By Anneke Thompson, CreditorWatch Chief Economist

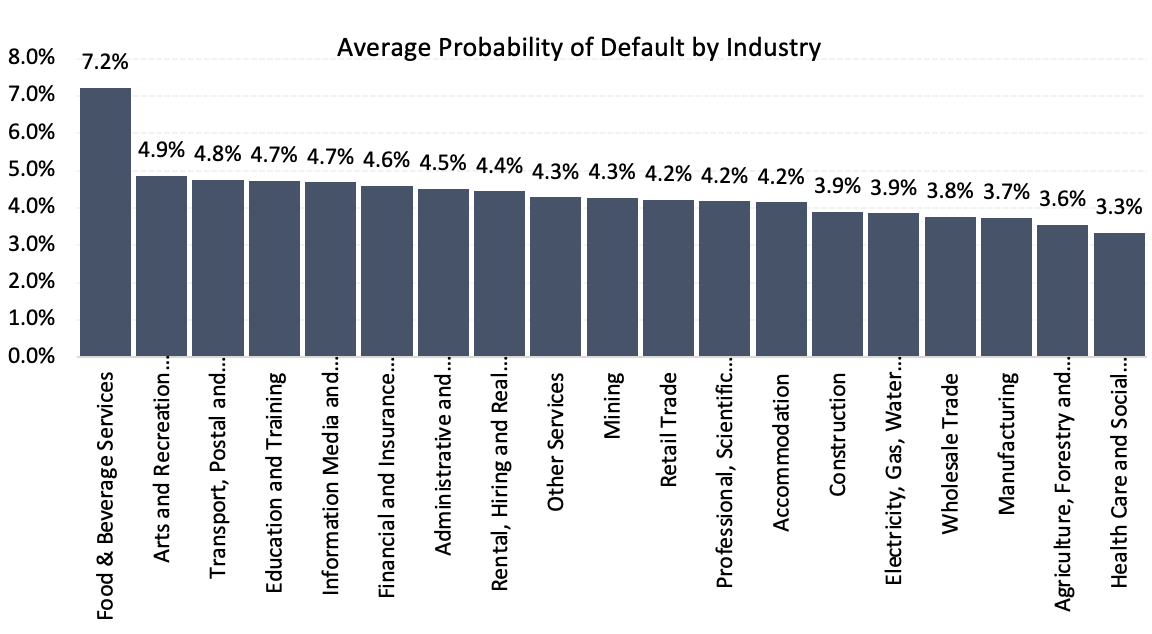

Reflecting their rising risk profiles due to Australia’s higher inflationary environment, the Food and Beverage Services, Arts and Recreation Services and Transport, Postal and Warehousing Industries all recorded an increase in their probability of default. As inflation works through the economy, it is expected that consumers will reduce spending on discretionary items. Cafés, restaurants and the arts and entertainment sectors are all typically areas where consumers choose to spend less as their discretionary income declines.

What is causing inflationary pressures, and what can we expect going forward?

High inflation is currently a global phenomenon, with various structural elements combining to create a perfect inflationary storm. High fuel costs as a result of the war in Ukraine is one major factor, impacting everything from shipping, trucking, air freight and manufacturing. Ongoing production and staffing issues associated with the Omicron wave are causing short term havoc. And global labour mobility has been severely impacted by COVID-19, with countries that typically import a lot of labour are reporting severe productivity constraints as they make do without these employees.

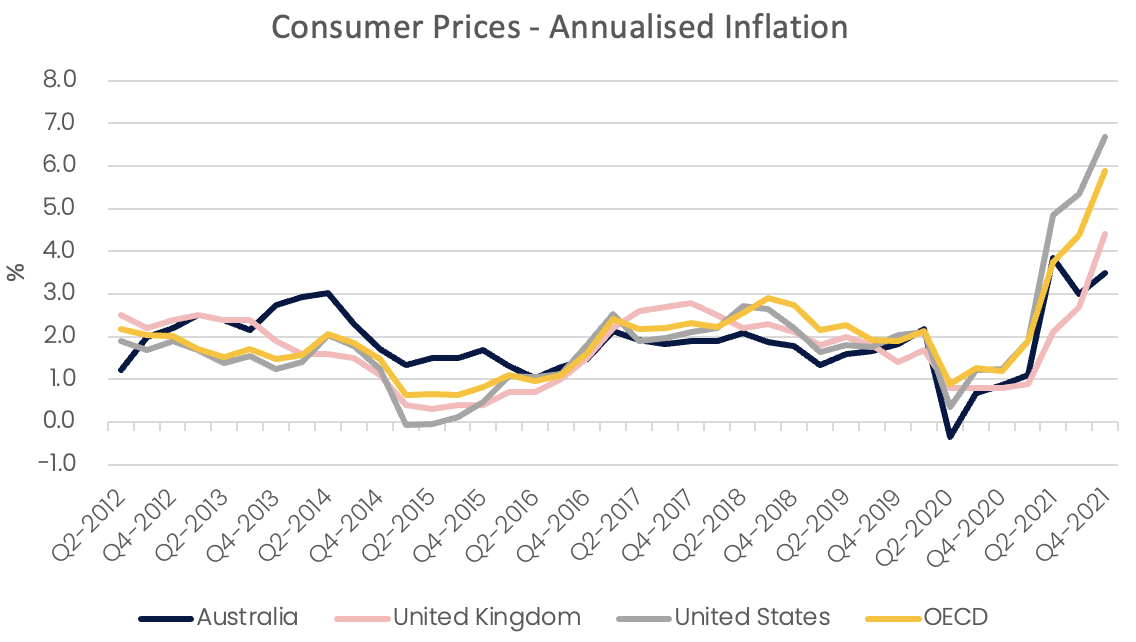

Compared to other OECD nations, Australia’s inflationary curve is still relatively modest. The USA and UK are recording inflation between four and seven per cent. Combined, the OECD nations reached an average inflation rate of almost five per cent by Q4 2021. The steepness of the curve is particularly worrying, and Australia will look to avoid replicating other OECD nations by tightening monetary policy, likely very soon.

What does inflation mean for Consumer confidence?

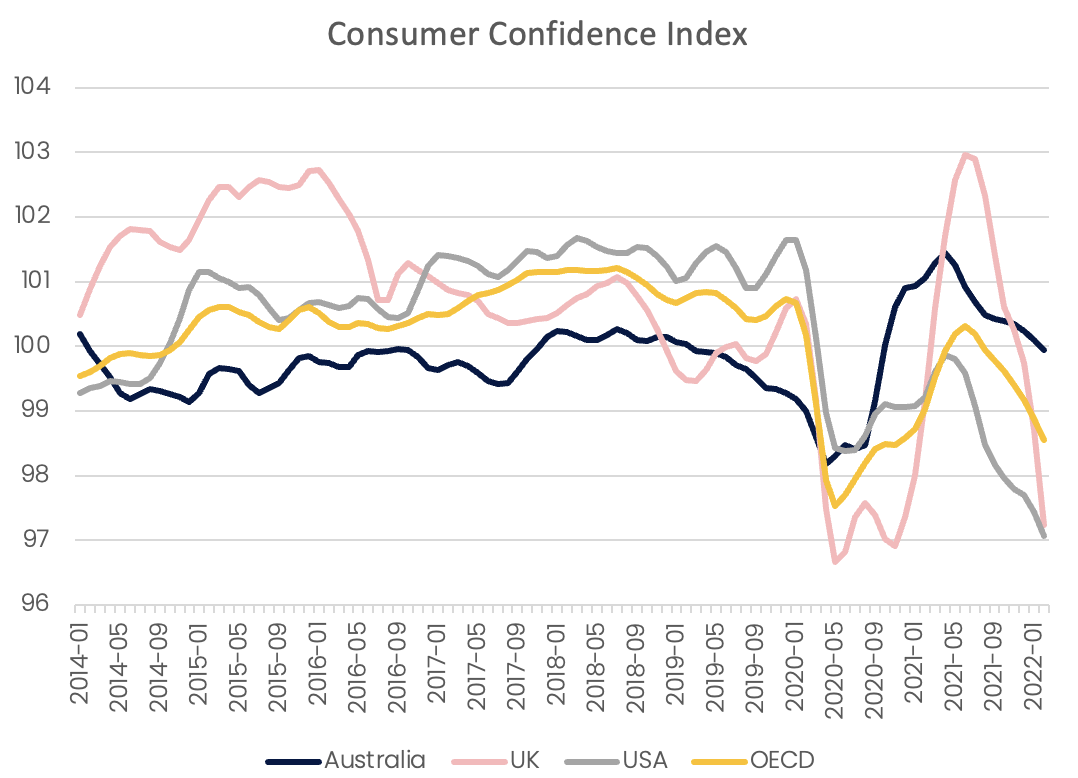

Rising prices and impending interest rate rises are weighing on consumers’ minds as much as COVID-19 did when it first went global in early 2020. In 2020, consumer confidence plummeted as the shock of the pandemic set in. However, massive amounts of government stimulus quickly reversed the trend, and, like it or not, most consumers settled into a life of online shopping, home renovations and lots of cooking!

In Australia and the OECD, consumer confidence peaked around mid 2021, before the Delta wave arrived, and we realised that COVID-19 was not going away any time soon. Since then, the trajectory has been progressively worsening, as rising prices, Omicron and war in the Ukraine all add up. Importantly, most consumers have no come to expect that their home and personal loans are about to get more expensive, and this will curtail discretionary spending going forward.

Consumer confidence in Australia is sitting above the USA, UK and OECD average, however, we are not as far into our inflationary cycle, and have yet to feel a cash rate increase. So, expect that this indicator will continue to worsen.

What does this mean for the credit outlook for Australia’s industry sectors?

Our February 2022 industry data recorded a significant rise in the probability of default for the Food and Beverage Services sectors, which rose from 5.7 per cent to 6.7 per cent over the month. This was the highest probability we had calculated in some time, and once again, probability of default for this sector has risen, now sitting at 7.2 per cent as at March 2022.

This figure sits well above all other industries, with the Arts and Recreation sector being the next most vulnerable at 4.9 per cent. The Food and Beverage Services sector is facing numerous headwinds, even though turnover will be well up after years of COVID disruption. Labour, food, utilities and borrowing costs are all rising for this sector, while at the same time consumers are easily able to substitute eating a meal out at a restaurant for eating at home. This means that demand is likely to wane, particularly after the cash rate does finally rise. In a similar vein, the Arts and Recreation sector will feel the burden of consumers reducing their discretionary spending as we move through 2022.

The March 2022 Business Risk Index shows that the three industries with the highest probability of payment default over the next 12 months are:

| 1. Food and Beverage Services: 7.2 per cent (up from 6.7 per cent) |

| 2. Arts and Recreation Services: 4.9 per cent (up from 4.6 per cent). |

| 3. Transport, Postal and Warehousing: 4.8 per cent (up from 4.5 per cent). |

At the other end of the spectrum, Health Care and Social Assistance maintained the lowest probability of default, at 3.3 per cent. Agriculture, Forestry and Fishing remains the sector with the second lowest probability of default, at 3.6 per cent. The challenges of moving goods around the globe means that the local manufacturing sector now comes in as the sector with the third lowest probability of default (3.7 per cent), overtaking Wholesale Trade.

The March 2022 Business Risk Index shows that the three industries with the lowest probability of payment default over the next 12 months are:

| 1. Health Care and Social Assistance: 3.3 per cent (steady at 3.3 per cent) |

| 2. Agriculture, Forestry and Fishing: 3.6 per cent (steady at 3.6 per cent). |

| 3. Manufacturing: 3.7 per cent (steady at 3.7 per cent). |

Payment arrears is still a particular problem for the construction industry, with 11.8 per cent of the sector in 60 days or more arrears. This proportion is by far and away above any other sector, and partially represents almost the normalisation of late payment in the industry. As such, even though arrears are a problem in the construction sector, the probability of default rate is still a relatively low 3.9 per cent.