In some positive news this month, June 2023 CPI data showed that inflation in Australia is on a steady downward trajectory, mirroring what is happening in most major economies around the world. The jobs market, however, is still very strong, and the unemployment rate remains near historic lows.

The RBA will be closely watching forward labour force indicators, such as job vacancies and applicants per role, to get some comfort that we can expect easing in conditions later in the year. Fortunately, forward looking job vacancy data suggests there are far fewer jobs available now that this time last year, however, still more jobs than were available pre-COVID.

The June 2023 inflation rate came in at below market expectations, with particular progress made in the slowing rate of goods inflation, which dropped from 7.6% over the year to March 2023 to 5.8% over the year to June. Goods inflation is far more responsive to monetary policy changes than services inflation, and this shows that consumers have well and truly responded to the RBA’s tightening measures.

Services inflation is still increasing and, at 6.3% over the year to June, is at the highest rate since the introduction of the GST. Inflation in the services sector was largely driven by steep increases in the costs of insurance and rent. Further increases to the cash rate are going to have limited impact on price growth in these areas, and it is likely that the RBA board will take this into consideration at its meeting in August.

Trimmed mean inflation came in at 5.9%, a significant decrease from 6.6% over the year to March. This result has reduced the chance of a further cash rate rise at the August meeting.

The unemployment remained unchanged in July 2023, at 3.5%, however we expect that weakness will emerge in the labour sector as we move through the second half of 2023. Major firms such as Telstra, Lend Lease and Westpac have announced redundancies as part of restructuring. We expect that as business conditions continue to weaken and profit margins fall, headcounts will get a lot of attention, particularly given the very strong headcount growth since the pandemic.

Retail trade fell in June 2023, as consumers showed far less willingness to spend in the mid-year sales compared to previous years. In a sign of just how much pressure consumers are under, retail spending fell in every category except food retailing, which only increased by 0.1% in dollar terms. Given inflation figures for food items are well above this figure, it is highly likely that volume figures, even in the non-discretionary category of food, will have gone backwards when quarterly trade volume data is released this Thursday.

Consumer sentiment remains at very low levels, with only minor adjustments being noted month-on-month. This sustained period of very low consumer sentiment is now well and truly ingrained in consumer behaviour and is unlikely to improve until cash rate decreases are on the horizon.

Business sentiment is still showing resilience. NAB’s June Monthly Business Survey showed that business conditions were steady over June, and business confidence rose slightly. Importantly, capacity utilisation fell to its lowest level since April 2022. This is a very good leading indicator of unemployment and indicates pressure may come off wages growth in the medium term.

While the unemployment rate is still lower than what the RBA would like, quarterly inflation and monthly retail trade data showed positive inroads are being made in the fight against inflation. While services inflation is still increasing, the main contributors to this – rents, insurance and utilities – are not at all responsive to increases in the cash rate, and it is unlikely continued inflation in these areas will convince the RBA to increase again.

Given capacity utilisation and job vacancies are falling, albeit slowly, and consumers and borrowers are showing signs of being under significant financial pressure, it is highly likely that the RBA will hold the cash rate steady at the August meeting, and wait for another month’s worth of data to come in. Quarterly retail sales volumes are released the day after the August decision, and this data will be factored into the September meeting results.

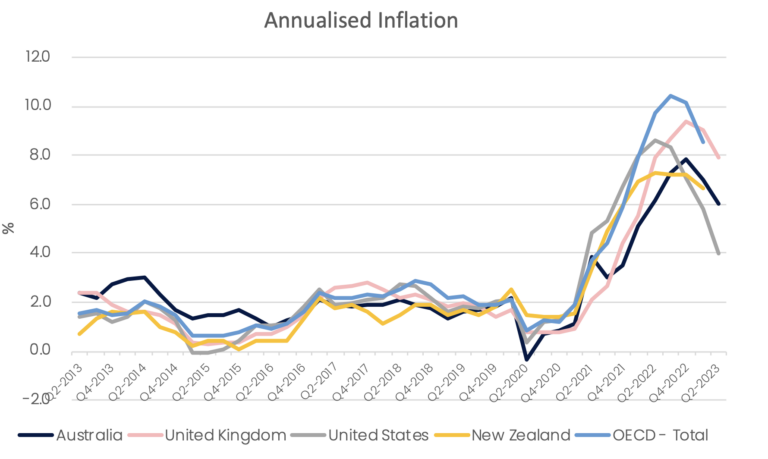

The fight against inflation is showing results around the world, with major economies well and truly past their inflation peaks. The USA peaked earliest, in June 2022, and gives us a good leading indicator of what Australia can expect over the next six months. The US economy grew faster than most expected over the June 2023 quarter, growing at a 2.4% annualised rate. While this is good news for US businesses, and has reduced the outlook for recession in US, it does mean that the relative ‘heat’ in the economy may mean higher interest rates for longer, even if the peak in interest rates is near or has been reached.

Get started with CreditorWatch today

Take your credit management to the next level with a 14-day free trial.