The monthly CPI data continues to show an easing of price rises in most categories in the CPI basket. The exceptions, however, are rents, which rose by 7.6% over the year to July, up from 7.3% in June. Electricity prices also rose by a substantial 15.7% over the year to July. This substantial increase even takes into account the Energy Bill Relief Fund. If this had not been included, the monthly increase in electricity bills would have been 19.2%, instead of 6.0%.

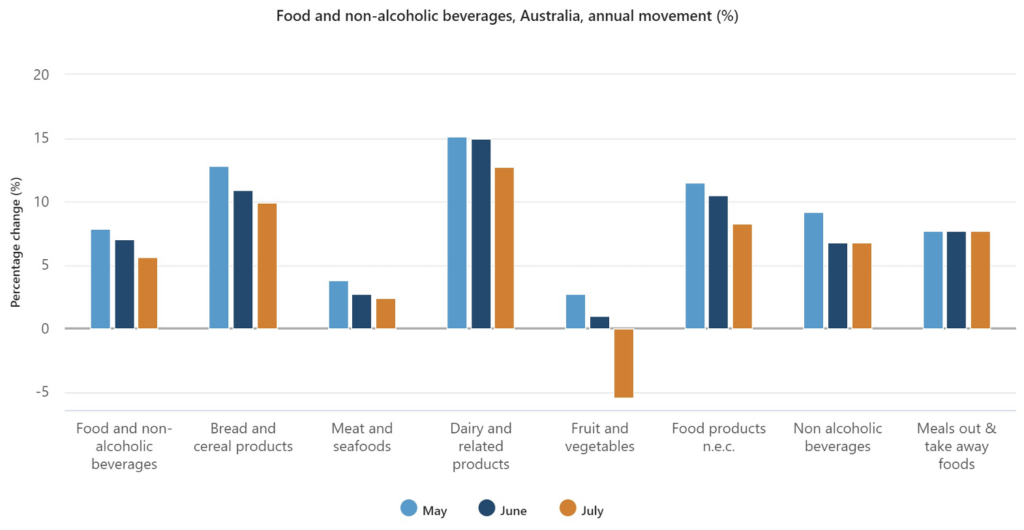

Food and beverage prices continue to ease, thanks to better growing conditions. There was even a fall of 5.4% in the overall price of fresh food and vegetables. However, meals out and takeway food inflation remains steady, and largely reflects the needs of business owners to pass on higher utility and rent costs to their patrons. For now, Australian consumers, particularly those aged 65 and over, are continuing to eat out at restaurants and cafes, with spending in this category increasing by 1.3%, versus 0.5% overall.

However, with diminishing savings rates, particularly among younger people, and interest rates that will remain high for some time, we expect margins in the food and beverage sector to continue to be challenged at the same time as customer demand flattens, or even falls.

Data Source: Australian Bureau of Statistics, Monthly CPI indictor rose 4.9 per cent annually to July 2023 30/08/2023

ABS Monthly Building Approvals

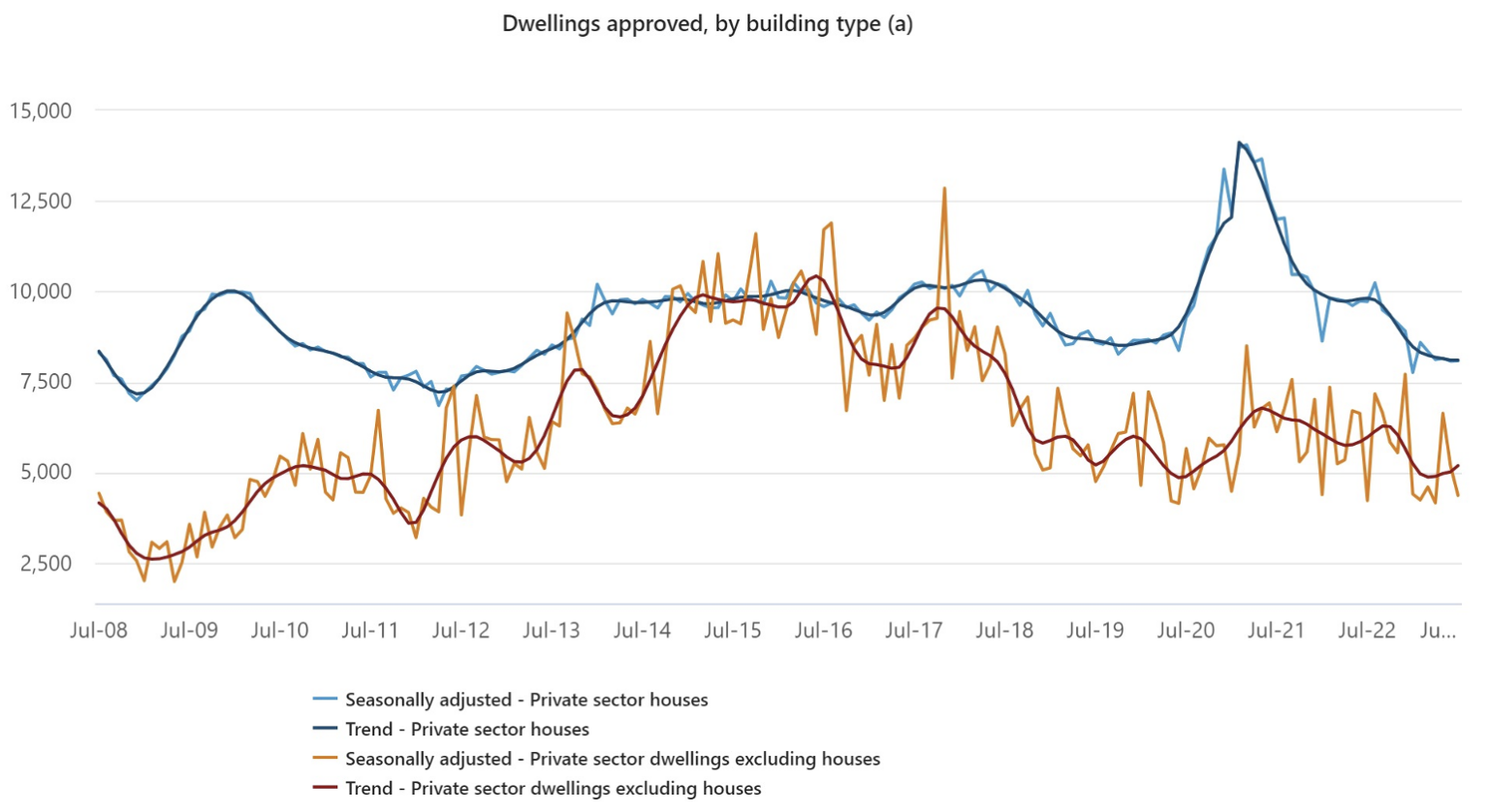

Dwelling approvals overall continue to fall in Australia and are now down to levels not seen since 2013. Total dwelling units approved are down 10.6% over the year to July 2023. Approvals of non-house dwellings (apartments/units) showed no sign of recovery, as very high building costs, a lack of building capacity (particularly in Queensland) and a lack of buyers being able to obtain finance weighs heavily on the sector. Building approvals today inform new housing supply roughly one year in advance, and with rents being one of the few areas where prices are still rising, this is a particularly worrying sign for housing affordability.

As renters will continue to spend a larger proportion of their weekly income on rent, consumer spending in the younger age categories, in particular, will be adversely impacted.

Data Source: Australian Bureau of Statistics, Building Approvals, Australia July 2023

Get started with CreditorWatch today

Take your credit management to the next level with a 14-day free trial.