In good news for the economy, September quarter inflation data released today by the ABS shows that services inflation has moderated since June 2023. While still high, at 5.8%, it is down from the June 2023 peak of 6.3% and is also the first decrease in the rate of services inflation since December 2021.

The main categories of services inflation that continue to rise include rents (up 7.6% year on year), insurance (14.7%) and dental services (4.9%). Holiday travel inflation slowed dramatically, from 12.2% in June 2023 to 6.8% in September. Utilities, while trending down, is still showing strong price growth, at 12.6%, and automotive fuel (up 7.2%) recorded the highest quarterly increase since March 2022, which will come as little surprise to Australian car owners.

When reading into the breakdown of the inflation components, the data suggests that monetary policy continues to work as it should on Australian consumers. Key discretionary items, such as furnishings, household equipment and services (up 2.5%), clothing & footwear (up 0.9%) are showing very limited price growth in the face of weak consumer demand. Non-discretionary items such as food rose 4.8% over the year, but this was mostly driven by meals out, which rose 6.9% and where pricing continues to be impacted by high operating costs.

And it is these high operating costs that continue to be the biggest risk for Australian businesses, particularly small businesses. While fuel, insurance and utilities prices are still rising, demand is now falling in many areas, such as retail trade, dining out and construction, and these businesses are now finding it increasingly difficult to pass on these costs to already financially strained consumers.

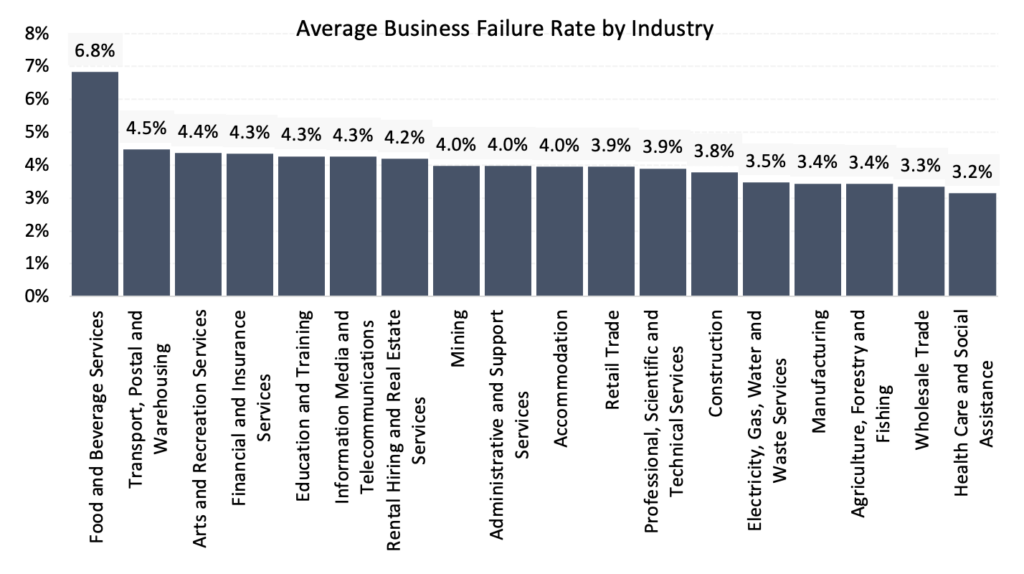

This is why we expect the business failure rate for those businesses sensitive to cost rises to be the highest. In the transport sector, higher fuel prices will be eating into margins, but customers will be unwilling to take on any higher cost of delivery in the current economic climate.

Source: CreditorWatch Business Risk Index

In terms of the cash rate, today’s inflation data will give the RBA some cause for concern, as the pace of inflation falls has slowed. However, the RBA will be looking closely at the contributors to this and asking itself what a higher cash rate can actually do to slow these price rises. In some key categories, such as rents, utilities, insurance and fuel, a cash rate increase will have little to no impact on any future pricing. This will be taken into careful consideration by the central bank.

Get started with CreditorWatch today

Take your credit management to the next level with a 14-day free trial.