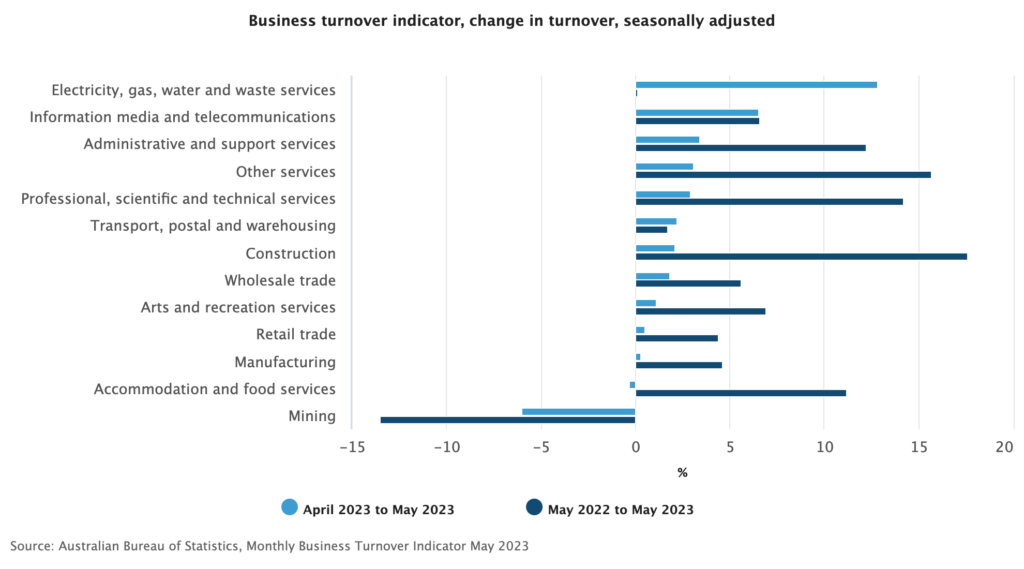

The latest Monthly Business Indicator data released by the ABS indicates that momentum in the Construction and Food and Accommodation sectors continues to slow. On an annual basis, change in business turnover is strong in both sectors, however, on a monthly turnover basis both sectors are weakening. In particular, turnover in the Food and Accommodation sector went backwards over May 2023, compared to the month prior.

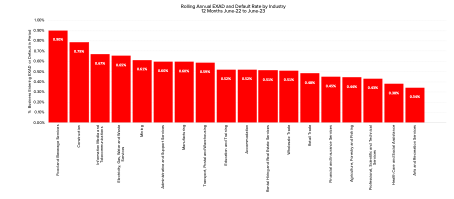

While not mirroring ABS data exactly, the slow down in trade in these industries does support our view that the riskiest industries are currently Food and Beverage and Construction sectors. Interestingly, Mining turnover has slowed dramatically, and this industy ranks quite high in terms of probability of default. However, the slowdown in Mining probably reflects a slowdown in capital investment rather than extraction and exports.

Transport, Postal and Warehousing turnover has slowed quite substantially on an annual basis, as the demands for logistic services has waned after a full year of consumers being able to shop in store.

Sectors that are dominated by white collar jobs – Information Media and Telecommunications, Administrative and Support Services and Professional, Scientific and Technical Services – are showing the most stability over the short and longer term. Areas around the country that have a higher proportion of workers in white collar sectors generally have a lower probability of default.

This is because income of white collar workers at this point in the economic cycle is more steady, and these workers are better able to increase hours/workload without greatly increasing their cost of doing business. We may see some change in this dynamic over the next six to 12 months when company profits start getting negatively impacted and employee headcounts either flatline or reduce.

Data Source: CreditorWatch Business Risk Index

Get started with CreditorWatch today

Take your credit management to the next level with a 14-day free trial.