What risks do Australian business leaders face as east coast lockdowns ease?

Sam MacPherson, Head of Treasury at Earlytrade, uses proprietary data from Australia’s largest working capital marketplace to support finance and procurement professionals preparing for the economy’s reopening.

Events that have caused global supply chains to be pushed to the brink have been well documented by media and commentators. Worldwide timber shortages, fuel and energy scarcity in the UK and China, major issues with semiconductor supplies and of course here in Australia we had the run on toilet paper.

These issues boil down to three key drivers. First, global lockdowns have forced factories to close or operate at reduced capacity. Second, global demand patterns shifted from services to goods. Finally, a shortage of shipping containers has been exacerbated by a mismatch in the location of existing containers, preventing supply from physically meeting demand.

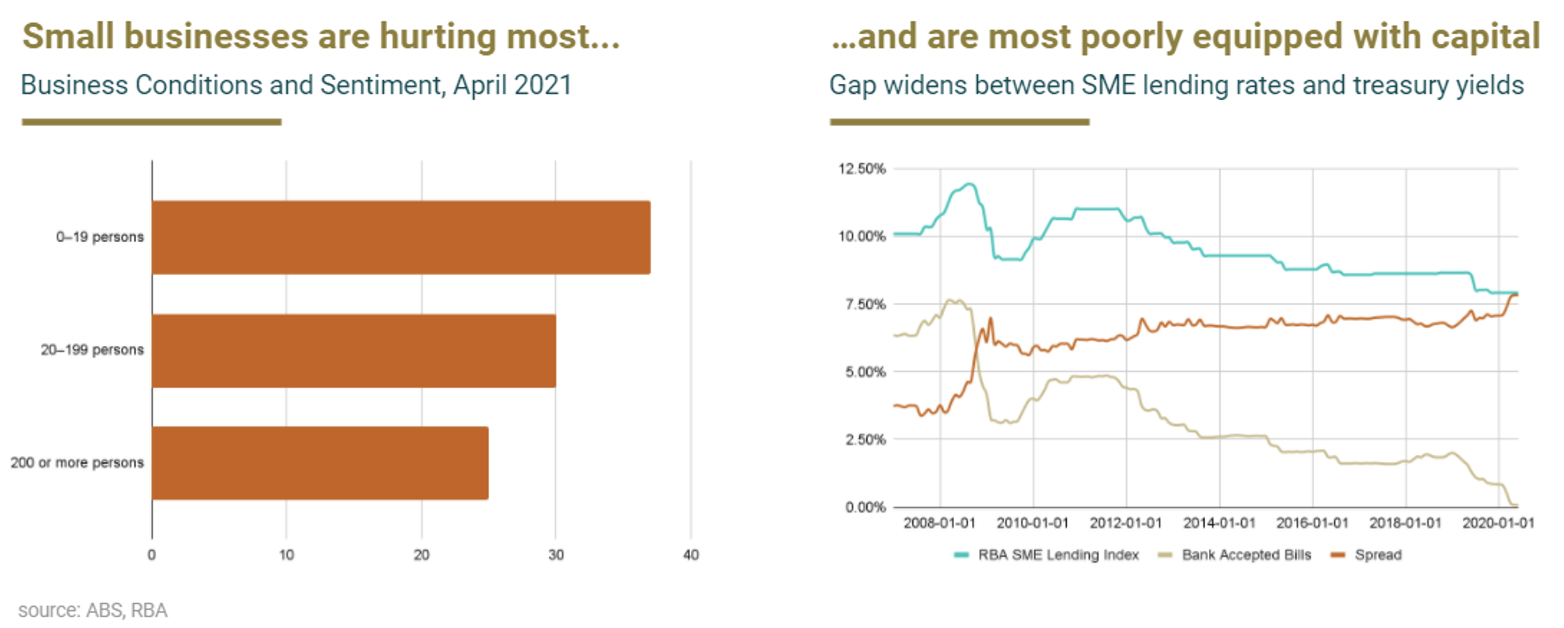

In Australia, 40 per cent of businesses say supply chain issues have greatly impacted their operations. Unfortunately, our economy’s small and medium-sized businesses bear the brunt of that pain disproportionately.

This trend is driven by small businesses’ inability to pass on rapid price increases to consumers, lack of warehouse storage to house increases in orders and their reduced ability to pivot to online or digital. Crucially, a lack of access to capital underpins all these issues for those small and medium business owners.

Despite the government’s massive economic stimulus, initiatives like the Term Funding Facility haven’t necessarily found a home with businesses that need it the most. Many SMEs still pay over seven per cent to get the cash they need to run their business.

What we see in the Earlytrade platform validates this. Demand from SMEs for early payments have gone up by a multiple of four in 2021 compared to 2020. That is business owners trying to bring in enough capital to stay afloat and reduce risk in their own supply chains. Many suppliers have reported exactly that to us – that costs have risen but those price increases cannot be passed onto customers. They’re trading on zero margin, or even losing money.

For many corporate buyers that we talk to, it’s becoming a trade-off between supply chain risk and costs. The majority are now finding that they simply need to pay more to shore up their supply chains.

Awaiting the Grand Reopening

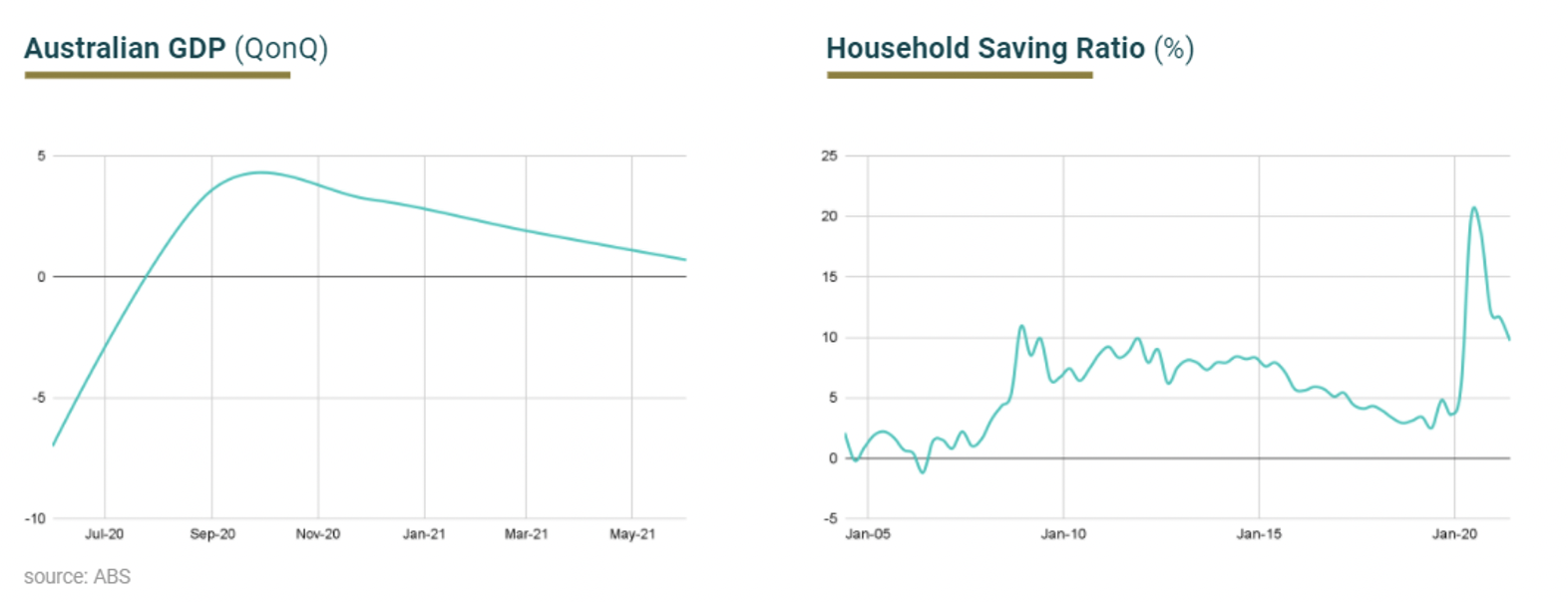

Looking at the demand side of the economy, we’re at a pivotal point with lockdowns easing and economies reopening. After the initial lockdown in 2020, GDP rebounded strongly – increasing more than three per cent in each of the September and December quarters.

This surge in consumption was, as we’d expect, well aligned with a reduction in the household saving ratio, which had increased to a record-high 20 per cent during the initial lockdown. In the December quarter that saving rate plunged to 12.2 per cent. But in the March quarter it barely fell, inching down from 12.2 to 11.6 per cent, perhaps reflecting the imminent end of JobSeeker and the coronavirus supplement. With COVID disaster payments ending, what happens to consumption?

It’s fair to assume that those considerable household savings (an extra $61bn), along with pent-up demand, will support a resurgence in economic activity when life gets back to ‘normal’. But even RBA Governor Philip Lowe says the recovery from these lockdowns will likely be slower than last year’s recovery.

Reopening again, but different?

So, what’s different? When we emerge, we won’t be emerging COVID-free. Delta and Omicron will be in the community. How does that influence attitudes towards doing ‘normal’ things? What happens to productivity when large portions of the workforce are stood down? There’s a transition period for us to get through as we adjust to ‘living with COVID’. Nobody knows quite how long that will be.

We did a lot of our spending last time. Many of us bought big items; TVs, laptops, home office equipment, cars, furniture etc. We don’t need to buy those again just yet, so it really requires a shift back to service based spending – which is contingent on people’s risk appetite and service providers’ ability, given they have capacity restrictions in place.

The third major difference is increased fear of future lockdowns. As long as they are a possibility, confidence will continue to be an issue. Certainly, the Federal Cabinet’s favoured Doherty Institute model says lockdowns in some form are an ongoing policy mechanism.

All these elements combine to keep consumer confidence muted, well below the long-term average. We’ve partially recovered from the initial hit in 2020, but the extended lockdowns are denting confidence and reducing people’s propensity to spend in the future.

Stimulus no more

Government stimulus will also be severely reduced or eliminated this time around. Fiscal stimulus totalled $6.5 billion in August. During the 2020 lockdowns, that figure was around $27 billion.

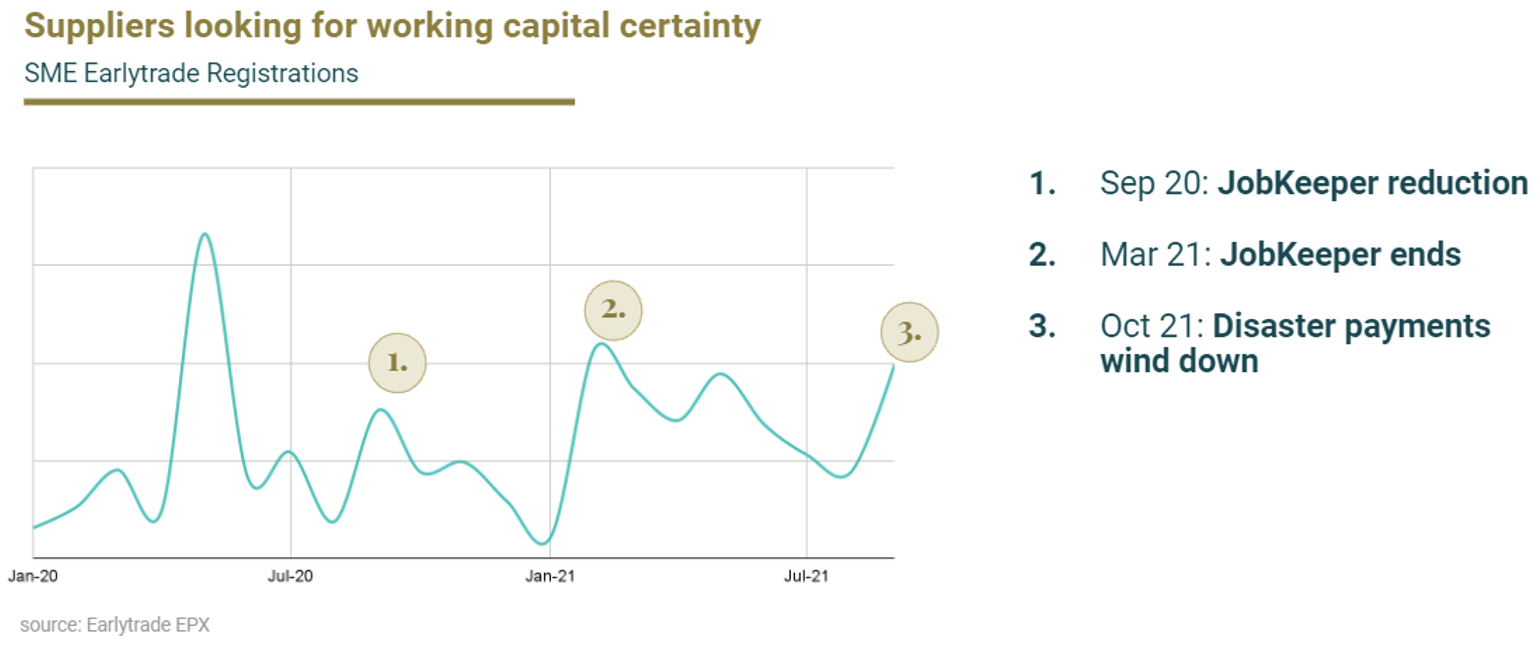

Ultimately households will be relying on their savings buffers to support spending. This is important because it means the rebound activity could be a lot more modest. This increases uncertainty for all businesses, but especially small ones. Earlytrade consistently sees a spike in new SMEs registering around the end or reduction of stimulus packages.

SME registrations doubled when JobKeeper was reduced in September last year and quadrupled when it ended in March this year. With the end of COVID disaster payments in October, we’ve seen a similar spike in September. These companies need certainty and control over their cash flow.

In Australia, over 2.5 million small businesses employ roughly 40 per cent of the workforce. Uncertainty for them has huge ramifications for consumption. From that perspective, the Australian economy has never needed dynamic on-demand payments to accelerate cash flow more.

With Governor Lowe acknowledging that the anticipated rebound will likely be less pronounced than last year, it’s intriguing that the RBA still forecasts four per cent GDP growth in December, compared to 3.2 per cent last December.

On the other hand, if spending surges, it puts additional strain on supply chains, which are already vulnerable. Small businesses may go out of business due to cash flow issues, reducing competition and increasing prices, again leading to further price inflation.

Whichever way it goes, you will likely have to pick your poison.

Dynamic in uncertainty

Overall, business leaders should be alert but not alarmed. Uncertainty will be the theme for the foreseeable future which only reinforces the case for business leaders to be looking at technology to prepare your supply chains for the reopening. As the economy reopens, operations must be dynamic and flexible, and able to quickly react to opportunities and risks as they arise.

Business leaders should be considering what technology is available and appropriate for their supply chains to manage their working capital and inventories and support their suppliers and subcontractors while navigating the reopening.