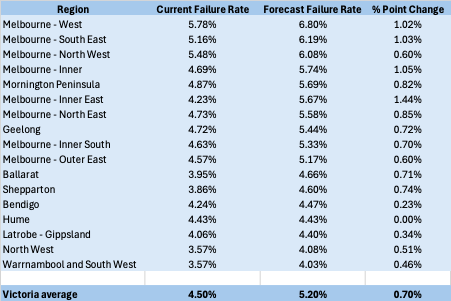

Outer suburban areas of Melbourne top the list of current and forecast business failure rates for Victoria, according to CreditorWatch’s Business Risk Index (BRI) data for July 2024. The region of Melbourne–West, which encompasses Brimbank, Melton–Bacchus Marsh, Wyndham, Hobsons Bay and Maribyrnong, currently has a failure rate of 5.78 per cent, which is forecast to rise to 6.80 per cent by this time next year. If this forecast plays out, this area will record failure rates 150 percentage points higher than the Victorian average.

Melbourne–North West and South East currently have the second and third highest failure rates, although CreditorWatch forecasts that failure rates in the South East will record a greater deterioration over the next year, and will move into second place in the rankings.

Interestingly, the area that is predicted to record the biggest increase in its business failure rate is Melbourne–Inner East. This includes the relatively affluent areas of Booroondara, Manningham–West and Whitehorse–West. Currently, the Inner East area is ranked 12th on a list of 17 areas in Victoria for business failure rates. By this time next year, the Inner East will have the sixth highest rate of failures in the state.

Overall, the areas with the highest rates of failures are predominately in Metro Melbourne, while regional areas record much lower rates of business failures and are forecast to stay that way.

The areas at the top of the business failure rate rankings tend to have lower median incomes, lower median ages of the population, higher levels of debt, and more businesses in the high-risk categories of food and beverage, retail trade and construction. The Inner East is forecast to see the biggest increase in biggest failure rates due to the high-cost nature of doing business in the area, particularly the high cost of rents, which is a big impost on business revenue.

Conversely, businesses in regional areas benefit from far lower commercial rent levels, older populations with lower debt levels, and lean towards lower risk industries such as agriculture and healthcare.

Business Failure Rates, Victoria, as at July 2024 (ranked by Forecast Failure Rate)

Source: CreditorWatch Business Risk Index (BRI), July 2024; regions defined by ABS SA4 categorisation.

Get started with CreditorWatch today

Take your credit management to the next level with a 14-day free trial.