Helping businesses navigate the Personal Property Securities Register

Does your business hire, rent or lease out goods? Do you sell goods on credit or Retention of Title terms? Do you operate in the construction or agriculture industry?

There’s a high chance you should be familiar with and using the Personal Property Securities Register, or PPSR.

We’ve teamed up with the Australian Financial Security Authority (AFSA) and Ledlin Lawyers to give you the must-have information, links and resources to ensure you understand the PPSR and how to register correctly.

How can you protect your business?

The PPSR (or register) is a single, national online database that shows you whether someone is claiming an interest in goods or assets.

Using the register can protect you in two main ways:

- When buying goods or acquiring personal property

Searching the register helps you make an informed decision because you can check whether the valuable goods or personal property you want to buy are free from existing financed debt and so safe from possible repossession.

- When selling on retention of title terms or consignment, or hiring or leasing out goods

Registering correctly can help protect your security interest should any of your customers not pay or go broke. And if that happens, being registered can mean you’re first in line to get your goods or money back, instead of at the back of the queue (and possibly getting little or nothing back after a lengthy insolvency process).

Industry checklist

These are some of the industries that are most likely to find the PPSR relevant to their business.

Industry |

Transactions |

| Agriculture | ● Selling or buying livestock, wool, timber, feed or fertiliser, crops, nursery trees.

● Leasing or other hiring out of stud or breeding cattle, horses or other animals. ● Selling, leasing out or purchasing farm machinery or equipment. |

| Automotive | ● Selling, leasing out or financing cars, trucks, trailers, or caravans.

● Leasing vehicles to employees; buying second-hand vehicles. |

| Construction and mining | ● Selling or buying materials.

● Selling, leasing or hiring out construction or mining plant and machinery, either separately or as part of works contracts. |

| Financial services | ● Selling or buying shares and other investment products whether for your business or for third parties.

● Dealing in or lending on debts (e.g. book debts, invoices, or receivables). ● Lending on security over any type of goods or assets — except for land, buildings and fixtures. |

| Retail | ● Buying goods from wholesalers and selling goods on credit. |

| Wholesale and manufacturing | ● Selling goods on terms (other than cash on delivery) to retailers for on-sale to the public or as materials for use or installation in manufacturing, agriculture or any other process. |

Deciphering the lingo

PPSA: The Personal Property Securities Act (PPSA) is the federal legislation introduced in 2012 that replaced various state and territory laws with one national system.

PPSR: The Personal Property Securities Register (PPSR) is the online noticeboard that lists goods or assets that have been registered and that aren’t land, buildings or fixtures.

Security interest: The name given to the collateral that is registered on the PPSR.

Retention of title: A contractual provision stating that title to goods being sold remains with the seller until certain obligations (normally payment of the purchase price) are met by the buyer.

Grantor: The person who provides the secured party with a security interest (the customer, debtor, buyer, lessee).

Secured party: The person who holds the security interest (the supplier, seller, lender, lessor).

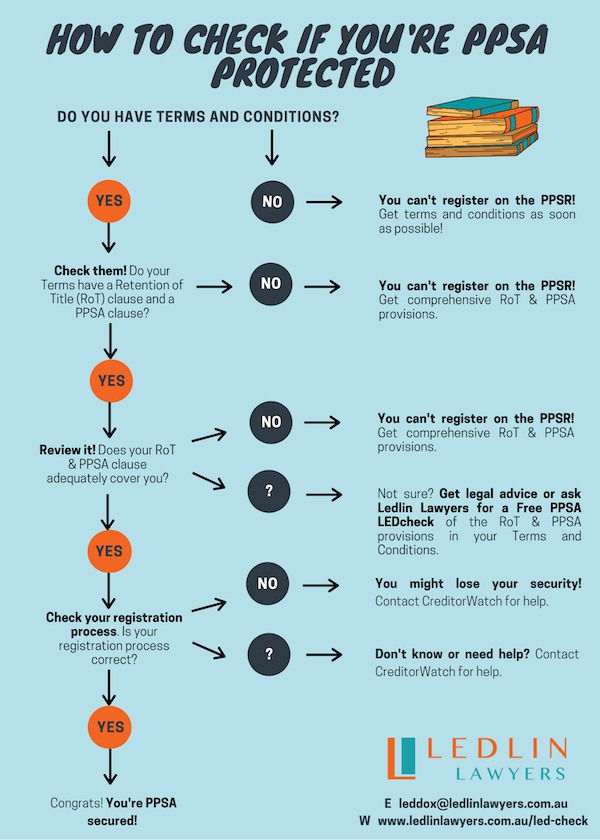

Check if you’re PPSA protected

Is your PPSA clause up to scratch? Check the below flowchart to see how you measure up or submit your PPSA clause to Ledlin Lawyers for a free LEDcheck.

A LEDcheck will help you identify the risks in your PPSA clause and offer you an assessment of where you can improve.

Creating and managing registrations with ease

Simplify the way you create, manage and renew PPS registrations with CreditorWatch’s award-winning portal, PPSRLogic. Hundreds of CreditorWatch customers use PPSRLogic to:

- Ensure registrations are accurate – incorrect information can void your protection.

- Register multiple security interests at once to save time.

- Monitor when their registrations are close to expirations.

- Create and customise templates for common registrations.

Watch the video below to learn more:

Get familiar with the PPSR in your industry

Case studies are a great way to see how the PPSR is used in the industry you operate in.

Whether you’re in agriculture and selling cattle feed or in construction and leasing excavators, learn more about your rights and how to protect your goods in these case studies.

Bookmark these links to learn more

- AFSA’s PPSR Business Guide: A comprehensive and engaging digital guide to the benefits of the PPSR, how to use the register and understanding the technical lingo.

- AFSA’s Resources: This is a business’s one-stop shop for easy-to-understand information on the PPSR. Access free PPSR booklets, industry-specific case studies, brochures, videos and more.

- PPSRLogic: Simplify the way you create, manage and renew PPS registrations with CreditorWatch’s award-winning portal. Hundreds of CreditorWatch customers use PPSRLogic to ensure their registrations are accurate and save time.

Speak to CreditorWatch about PPSRLogic Speak to Ledlin Lawyers about a PPSA LEDcheck