The RBA has maintained the cash rate at 4.10% at the October 2023 meeting. Continuing weak retail trade and consumer confidence data is giving the board the clear sign that their efforts to reduce demand in the economy have worked very well. While some items in the CPI ‘basket’ continue to record price rises, these rises are, by and large, not related to high consumer demand, and therefore not enough to convince the RBA to move again to cool demand further. All groups monthly CPI rose 5.2% over the year to August, up from 4.9% the month prior. While a higher figure is not welcome news for the RBA, the figure is heavily impacted by the higher cost of fuel this month. Excluding volatile items like fuel, holiday travel and fruit and vegetable items, monthly CPI increased 5.5%, down from 5.8% the month prior.

The unemployment rate is still very tight, at 3.7%, and almost 65,000 people gained employment over August. Business confidence in all sectors except retail trade is also relatively healthy. However, quarterly job vacancy data released in late September showed that job vacancies are now falling well off their post-COVID peaks, and this should result in the unemployment rate creeping up over the next few months.

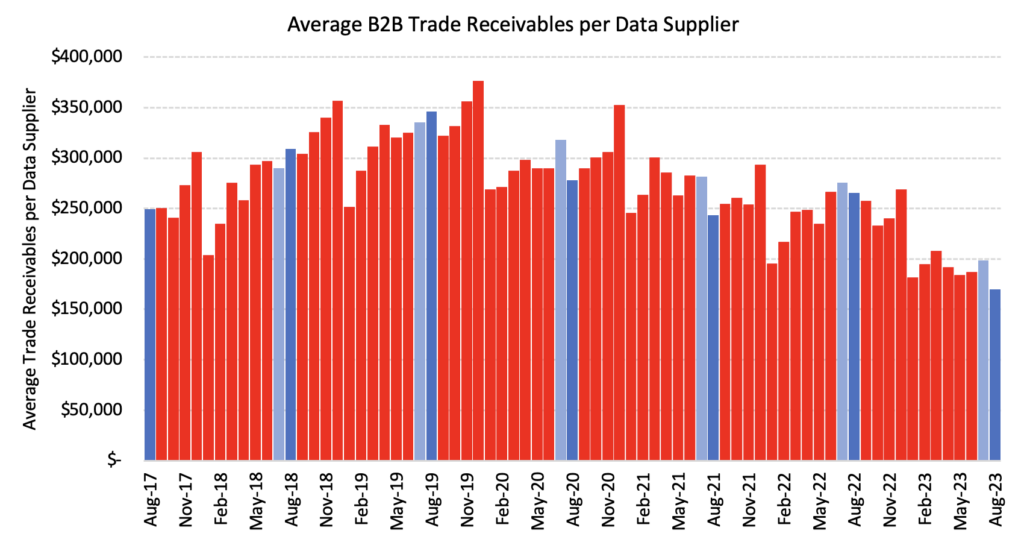

The economy appears to be maintaining a steady slowdown, and thus far business activity is not falling precipitously. However, CreditorWatch BRI data from August 2023 does show a significant fall in the average value of invoices since their peaks in late 2019. The slowdown has been more apparent since the start of 2023, and does indicate that monetary policy tightening is impacting the SME sector already.

Get started with CreditorWatch today

Take your credit management to the next level with a 14-day free trial.