For the first time since the start of this monetary policy tightening cycle, the Reserve Bank of Australia (RBA) was faced with a set of data that gave it no clear indication of which way to move and has left the cash rate on hold at 3.60%.

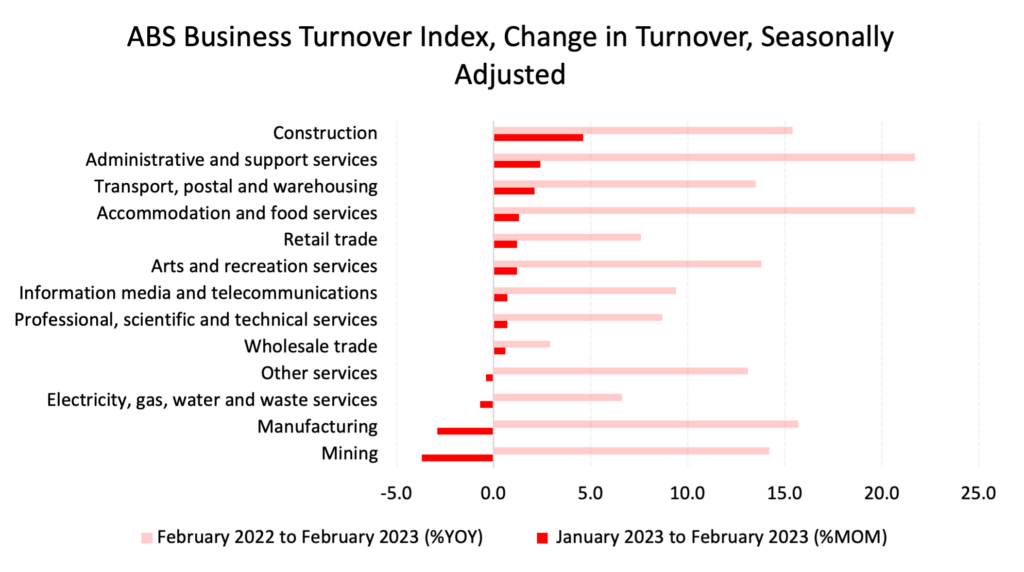

One the one hand, businesses are still reporting very strong conditions and the labour market is still very tight. On the other hand, retail spending has flatlined since September (and must be falling on a per capita basis), and inflation is falling, though still high and well out of the target range. It is clear the economy is at an inflection point, the only question now is how hard will it fall.

Today’s decision will buy the RBA one more month to assess incoming data before inflicting any more pain on Australian borrowers. Overseas, European and US central banks continue to increase interest rates to fight inflation despite pressures in the banking sector in their jurisdictions. The Australian economy is particularly sensitive to interest rate rises, more so than the US or Europe, due to the volume of borrowers on or soon moving to variable interest rates. This relatively unique factor is probably the main one allowing our central bank to pause, where others are still tightening.

It is highly likely that monetary policy is now in restrictive territory. That is, the economy cannot grow with the cash rate as it stands. This is, of course, intentional, and now the question is how long the RBA needs to keep the cash rate in restrictive territory before they can release the brakes, so to speak, and allow less restrictive credit conditions.

The RBA will be hoping that this latest move will put the economy deep into restrictive territory, and help to slow demand in the services space to ease price rises. However, both energy and rental costs are not responsive to interest rate moves, so it is likely inflation in these areas will prove very sticky.

We are now highly likely to be at the peak of the monetary policy tightening cycle, as the current settings will put enormous pressure on borrowers, particularly those that secured a home loan in the past two years.

Get started with CreditorWatch today

Take your credit management to the next level with a 14-day free trial.