Despite clear signs that the Australian economy is well and truly into its necessary slowdown, the Reserve Bank of Australia (RBA) today increased the cash rate by a further 25 basis points to 4.10%, in an effort to combat services side inflation. Monthly CPI data released in late May showed that April CPI rose by 6.8% on an annual basis. This higher than expected rate was driven by housing (+ 8.9%), food and non-alcoholic beverages (+7.9%) and transport (+7.1%). There were one off reasons for the high inflation figure, such as the fuel excise tax being halved in April 2022, that contributed, however, overall, it would appear that inflation is not falling fast enough for the RBA to be comfortable with.

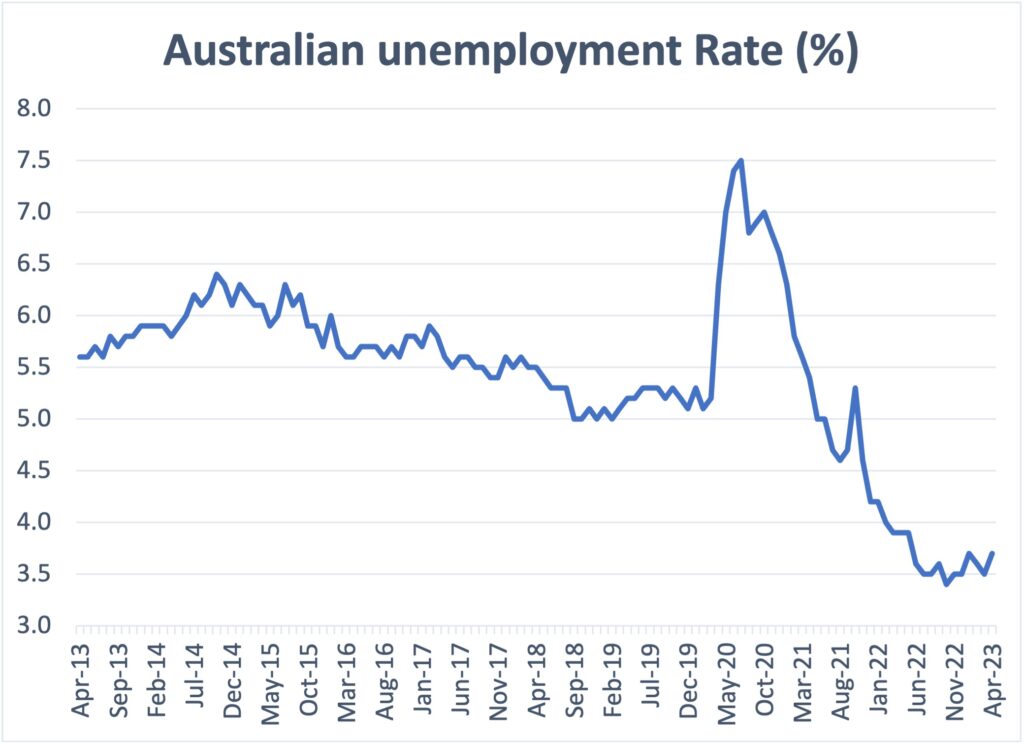

The slowdown in labour hiring appears to have started, and this will give the RBA some early indications that we should be able to avoid significant wages pressure going forward, despite last weeks increase to the minimum wage by 5.75% by the Fair Work Commission. The RBA is also concerned about productivity growth, or the lack thereof over the past three years, and a higher unemployment rate will hopefully help to improve productivity.

There is still pressure on inflation from the rental market, with housing being the single biggest contributor to the CPI basket. However, the RBA will be aware that a higher cash rate is not the answer to reducing rental increases. And while consumer demand is definitely dropping overall, non-mortgaged and non-renting households continue to spend up on services, particularly in the tourism, cafes and restaurants and health sectors, making inflation more sticky in these areas of the economy. It remains to be seen if further increases to the cash rate will make enough of a dent in services side inflation, given these consumers are not impacted by higher interest rates.

Get started with CreditorWatch today

Take your credit management to the next level with a 14-day free trial.