RBA increases official cash rate to 3.60%

Despite clear signs that the brakes are being slammed on the Australian economy, the Reserve Bank of Australia (RBA) increased the cash rate by 25 basis points to 3.60% – the 10th consecutive increase. This latest increase will take many borrowers – both personal and business – well past their lenders’ serviceability test and will be a serious drag on both consumer and business sentiment.

In February we learned that while the Australian economy continued to grow in the December quarter, the growth rate slowed substantially. Australian Gross Domestic Product (GDP) grew by 0.5 per cent over the Dec quarter, down from 0.7 per cent in September quarter and 0.9 per cent in the June quarter. Importantly, for both the inflation and cash rate outlook, growth in household spending rose by a moderate 0.3 per cent.

This will give the RBA comfort – among other important indicators like monthly retail trade and labour force – that its efforts to reduce inflation are working. Unfortunately, the flip side to this success is continued pain for the Australian consumer and, ultimately, businesses.

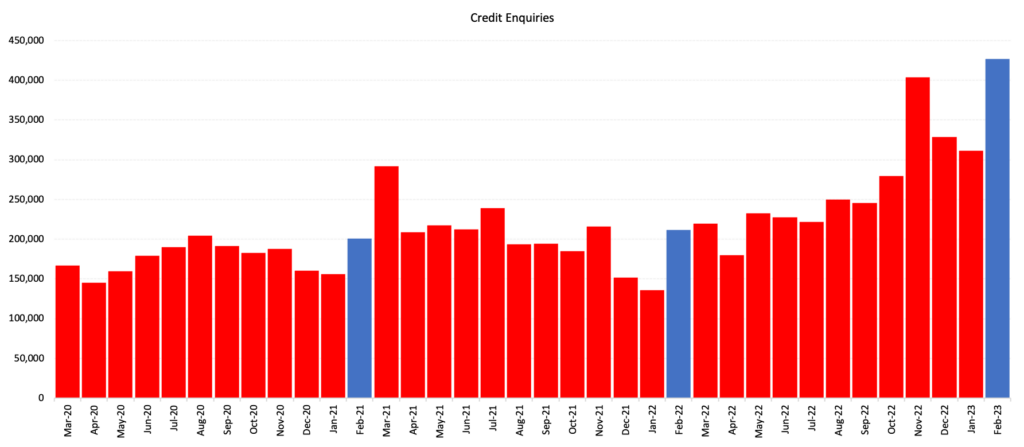

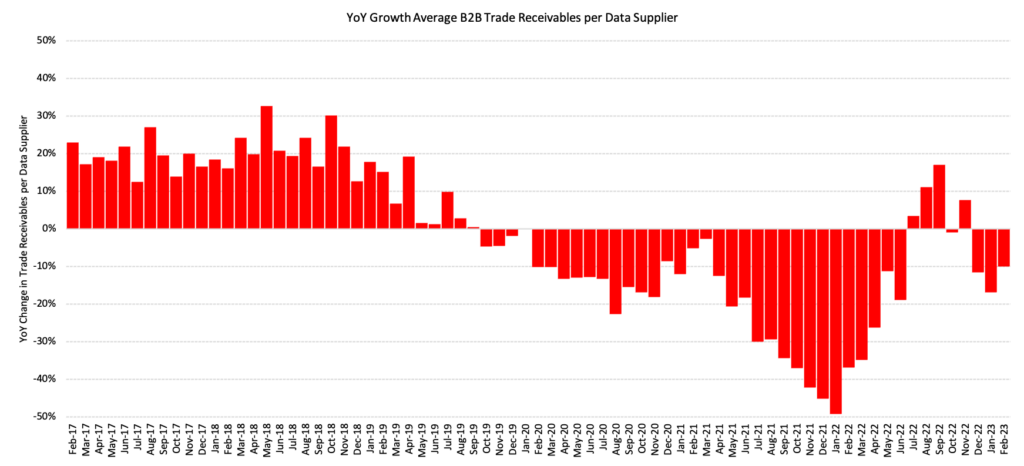

CreditorWatch’s Business Risk Index continues to point to businesses acting in an increasingly cautious manner. Data from February 2023 shows that credit enquiries in February 2023 were more than double those in February 2022. This is despite average trade receivables per data supplier decreasing by 10 per cent year-on-year in February 2023. Businesses are clearly more concerned about the financial stability of the businesses they are trading with, given the economic conditions and large decline in consumer sentiment.

Source: CreditorWatch credit enquiry data

Source: CreditorWatch trade receivables data (accounting software integrations)

Overall, the picture for Australian businesses is looking increasingly more complicated as we move through 2023. While the Australian economy is certainly one of the brighter spots when we think about the global economy, there is no doubt that businesses will find trading conditions far more challenging this year than last. On the bright side, it does appear that inflation has peaked. This gives us confidence that pricing data coming through this year should, based on sentiment levels, show continued moderation in growth levels of inflation.

Find more data insights at our Business Risk Index homepage.

Get started with CreditorWatch today

Take your credit management to the next level with a 14-day free trial.

Subscribe to our newsletter

You’ll never miss our lat news, webinars, podcasts etc. Our newsletter is sent our regularly so don’t miss out.