Retail trade fell 0.8% in June 2023, as consumers showed far less willingness to spend in the mid-year sales compared to previous years. In a sign of just how much pressure consumers are under, retail spending fell in every category except food retailing, which only increased by 0.1 per cent in dollar terms.

Given inflation figures for food items are well above this figure, it is highly likely that volume figures even in the non-discretionary category of food will have gone backwards when quarterly trade volume data is released next week.

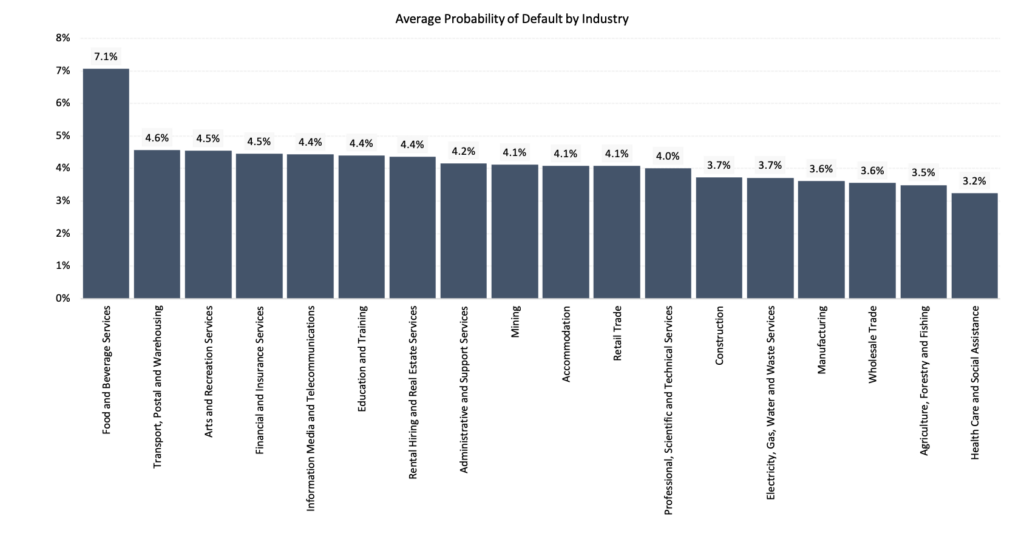

The food and beverage sector is under considerable pressure at the moment, as supply side cost pressures continue and demand falls. Unfortunately this will ultimately result in more wind up activity in the restaurant/café sectors.

Many non-food retail traders will now have stock overhang and inventory issues to deal with, which will likely result in further price discounting, and ultimately further pressure being taken off goods inflation. This is good news for borrowers, as the chance of further cash-rate increases has decreased on this data. However, for retail business owners, the outlook is for a very tough 12 months, as consumers cut back spending to deal with higher home loan, rent, utilities and insurance payments.

Data Sources: CreditorWatch RiskScore Credit Rating average Probability of Default by Industry

Get started with CreditorWatch today

Take your credit management to the next level with a 14-day free trial.