The combination of lockdowns and lack of stimulus from the government is leaving businesses cautious and recoiling from activity, which will have a devastating impact on the Australian economy.

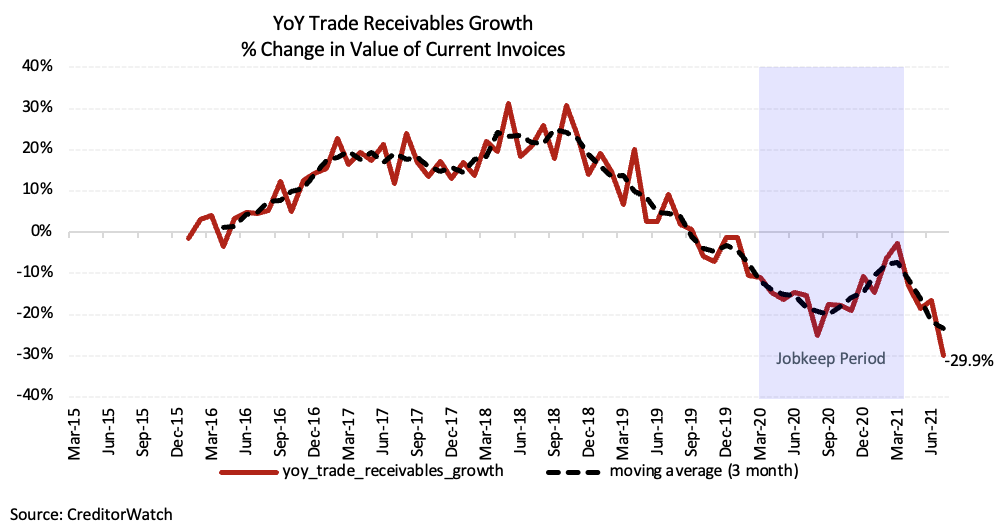

CreditorWatch’s B2B transactional data for July reveals a dramatic decrease in trade activity with trade receivables down a massive 30% compared to July 2020. The reduction of government stimulus and the uncertain end data to the lockdowns, specifically NSW and Victoria, has significantly hindered receivables growth.

As shown in the graph below, trade receivables growth is now lower than it ever was during the period of JobKeeper from March 2020 to March 2021.

“Put simply, lockdowns and lack of government stimulus compared to JobKeeper are the primary drivers of this lack of business activity,” CreditorWatch CEO Patrick Coghlan said.

“Business trade receivables are lower now than at the worst part of the 2020 lockdowns. Businesses are sitting on cash and simply not trading with each other because they don’t know how this will play out.”

He added that trade receivables growth won’t recover until there is more certainty around when lockdowns might end, and more financial assistance is provided by the government to support businesses and stimulate the Australian economy.

There was a significant increase in business activity between September 2020 and March 2021 as the economy began to recover from the lockdown earlier in 2020.

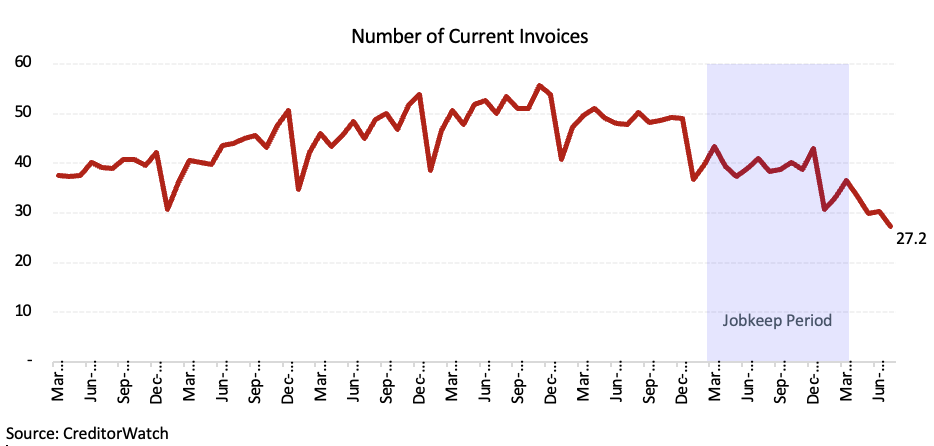

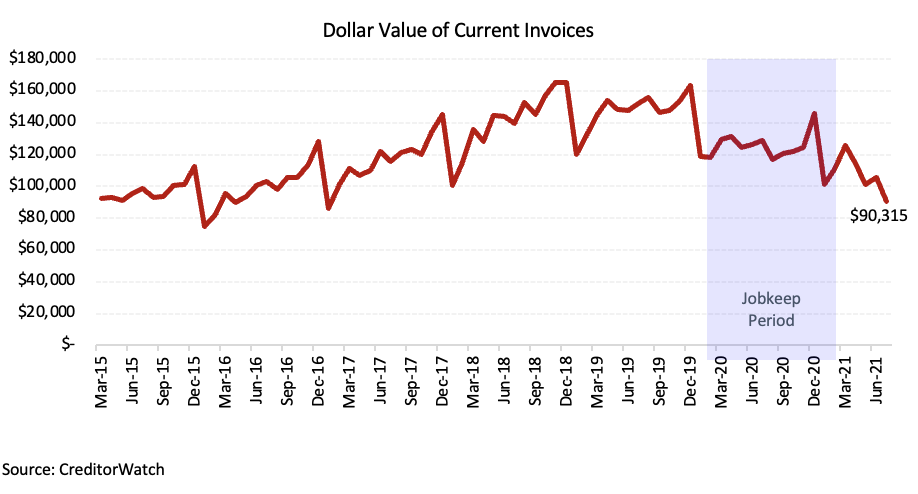

Mr Coghlan believes that the decrease in the number of invoices issued and the value of invoices being at multi-year lows will have a ripple effect in the economy. According to CreditorWatch data, June 2021 recorded a low of 27.2 current invoices and an average dollar value of $90,315 in current invoices.

Commenting on the road ahead, Mr Coghlan said, “trade turnover is correlated to insolvencies in the future, so basically the weaker levels of trading activity will manifest into insolvencies and businesses collapsing. We need more government assistance to help prevent this from happening.”

Click here to read the media release.