Consumer confidence continues to bump along at near record low levels, falling by 0.4% in July 2023. Consumers are unlikely to report any improvement in confidence until inflation looks to be firmly in the rearview mirror. Unfortunately, NAB’s Business Survey for July 2023 indicates that cost pressures upon businesses remain elevated, with both price and cost growth rising sharply over the month.

Unsurprisingly, business confidence is weakest in the retail sector, at -12 index points. In trend terms, business confidence remains at below average levels, although it did rise slightly in the July 2023 figures released. The retail sector looks to be entering a period of increased business risk, and we are likely to hear more stories of insolvencies and business liquidations in that industry in the coming months.

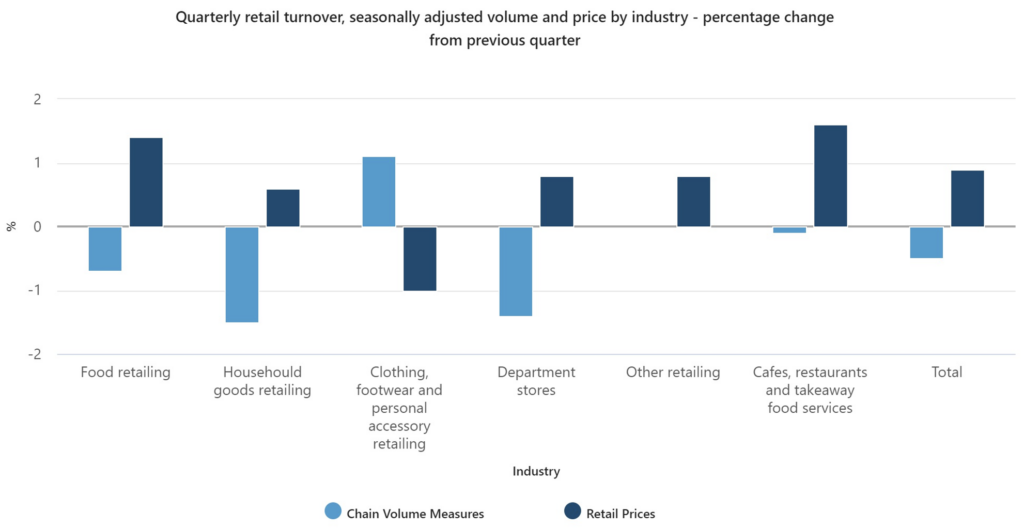

The continued price pressures coupled with anaemic consumer confidence are weighing heavily on profitability, particularly in the household goods and department store sectors. Both of these sectors are selling less product than they did the previous quarter, despite very strong population growth. For furniture, electrical and appliance retailers, as well as residential construction wholesalers, conditions are very challenging, as consumers can quite easily tighten spending in these areas, and also did a lot of their household goods spending during the lockdown periods. Low residential sales volumes and new dwelling completions also weigh heavily on these sectors.

Sources: Australian Bureau of Statistics, Retail volumes fall for third straight quarter 3/08/2023

Get started with CreditorWatch today

Take your credit management to the next level with a 14-day free trial.