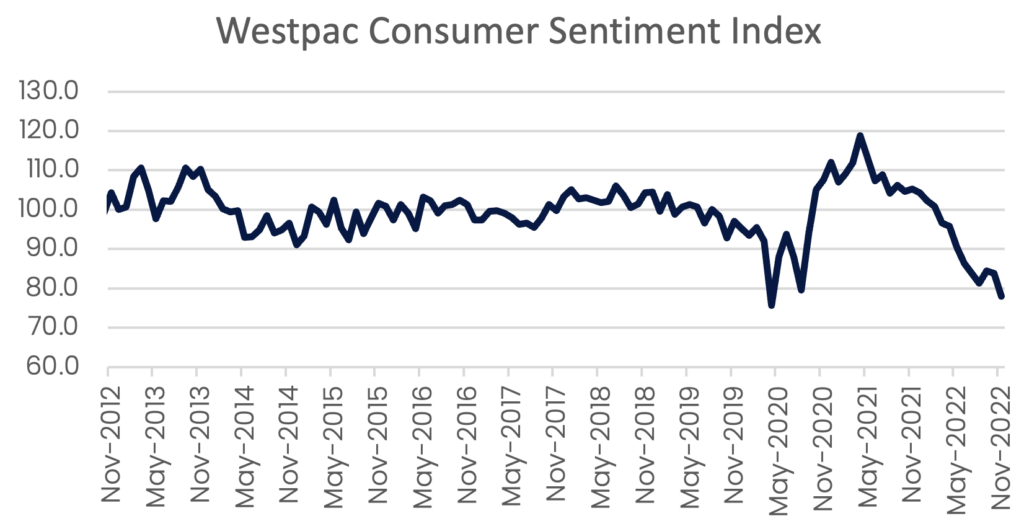

Westpac Consumer Confidence and NAB Business Confidence Conditions

Yesterday’s release of Westpac’s Consumer Confidence and NAB’s Business Conditions survey gave us the clearest signs yet that interest rate rises and inflation are really about to start impacting the performance of Australian economy. Consumer confidence was down 6.9 per cent month-on-month and 25.9 per cent year on year. This is at levels similar to the onset of the GFC and pandemic.

The Treasurer’s fairly bleak assessment of the economy in the October Budget report, as well as continued strong inflation and rising interest rates, are now firmly on the minds of Australian consumers. The weakening outlook is also finally resonating with Australian businesses, as business confidence reported in NAB’s October survey fell to below the long run average. While capacity utilisation is still very high (85.8) – and this bears a strong correlation to the unemployment rate – forward orders by businesses have weakened by 7points, and the employment outlook also weakened. This suggests that we can expect the labour market to weaken as fewer jobs are made available.

Source: Westpac, RBA

Source: NAB, RBA

Overall, it is expected that the Christmas shopping period is likely to be weaker, as consumers both have less money to spend, and feel less wealthy thanks to falling house values. It may be difficult to see this impact immediately as retail sales may hold up in dollar value, due to rising costs of goods. But it is highly likely that the quantity of retail sold will be subdued, and this will impact retailer profitability.

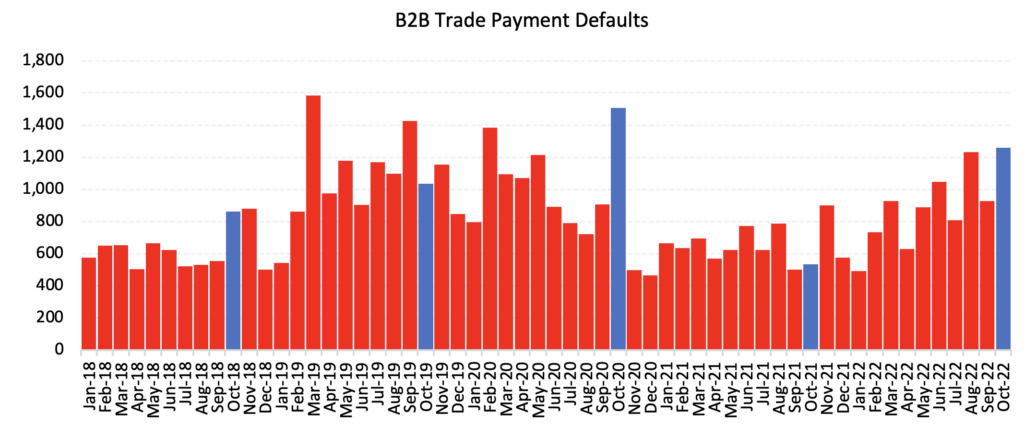

Overall, the weakening of both business and consumer confidence is reflective of CreditorWatch’s Business Risk Index October 2022 data. B2B Trade Defaults continue to rise on a trend basis, indicating that more small businesses are lodging defaults through non-payment. At the same time, growth in trade receivables since the end of the lockdown period has stagnated, suggesting that the weakening economic conditions are already hitting small business.

Source: CreditorWatch Business Risk Index

Get started with CreditorWatch today

Take your credit management to the next level with a 14-day free trial.

Subscribe to our newsletter

You’ll never miss our lat news, webinars, podcasts etc. Our newsletter is sent our regularly so don’t miss out.