February Retail Trade data indicates that Australian consumers are continuing to reduce their spending on discretionary goods. Spending on household goods was flat over February, while spending on ‘other retail’ declined by 0.4%.

However, spending in department stores rose by 1% over the month, and clothing, footwear & personal accessories by 0.6%. Spending on food and at cafes, restaurants and takeaway outlets also rose marginally at 0.2% and 0.5% respectively.

Overall, the 0.2% increase in spending over the month was very subdued and will give the Reserve Bank of Australia (RBA) board, at the very least, a discussion point in support of a pause to monetary policy tightening in April.

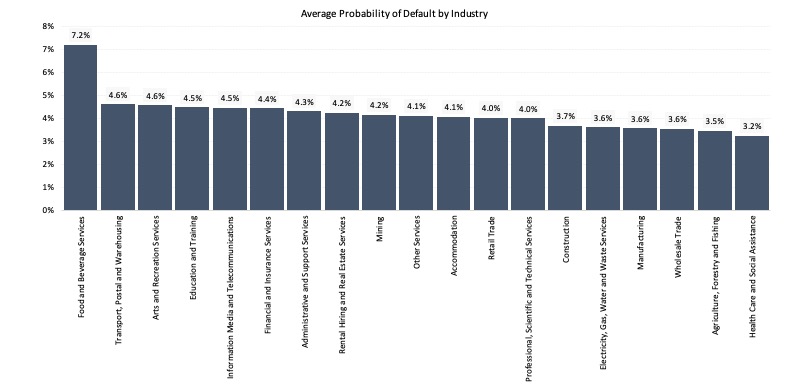

The data reflects CreditorWatch’s risk metrics, which continue to place those industries that rely on discretionary spending at the top of the table in terms of probability of default. While we are yet to see a marked downturn in spending at cafes and restaurants, the upcoming winter could tell a different story as more Australian borrowers come off fixed rate loans and many household budgets will see a dramatic fall in excess money available for eating out.

Data Source: CreditorWatch RiskScore Credit Rating average Probability of Default by Industry