Our latest release delivers a number of key performance upgrades across our range of credit risk management solutions.

Continue reading to explore how our latest updates are set to make protecting your customers’ sensitive information simpler than ever, streamline the onboarding of customers under a trust structure, enhance the detection of potential risks with new clients, and automate time-consuming collection processes without sacrificing your personal touch.

Onboarding a customer

We know customers prefer to trade with businesses who are easy and safe to work with. We also know that first impressions last. Your application and onboarding process is a reflection of that.

Protect your customers’ sensitive information from the start

We’ve enabled the encryption of sensitive information and attachments in online application forms for an added layer of security for you and your customers.

Have new customers under a trust structure? No worries!

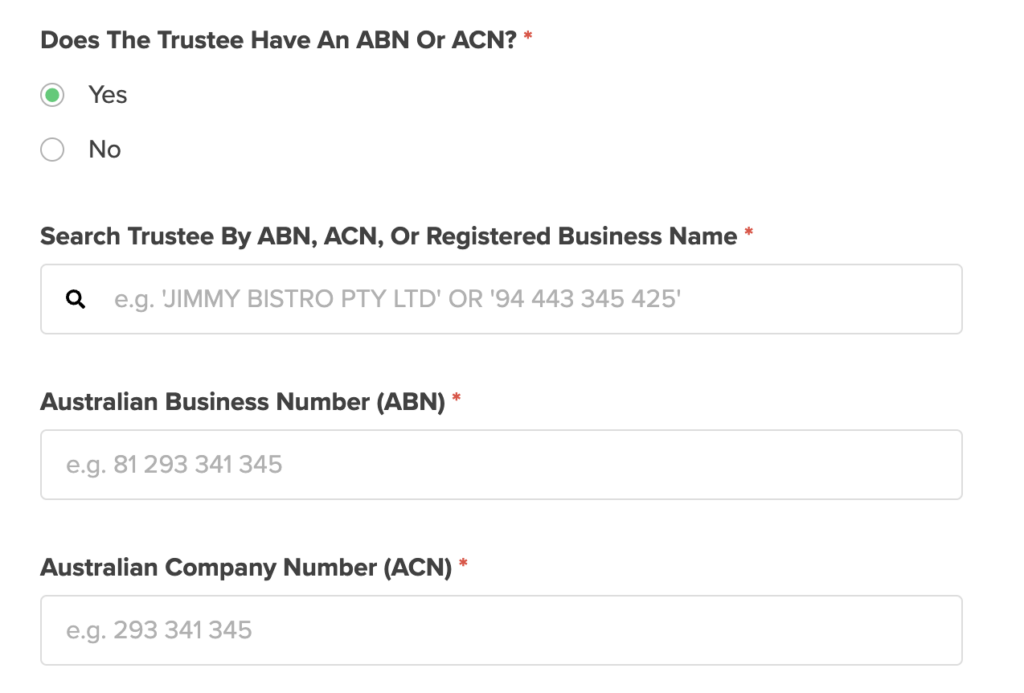

You can now onboard Trusts with business trustees using our online application and credit decisioning solution.

Your customer can simply fill in their trust and trustee information in the application form, and we’ll do the automated decisioning so you can approve their application within seconds.

Performing due diligence checks

Watch out for red flags for a new customer

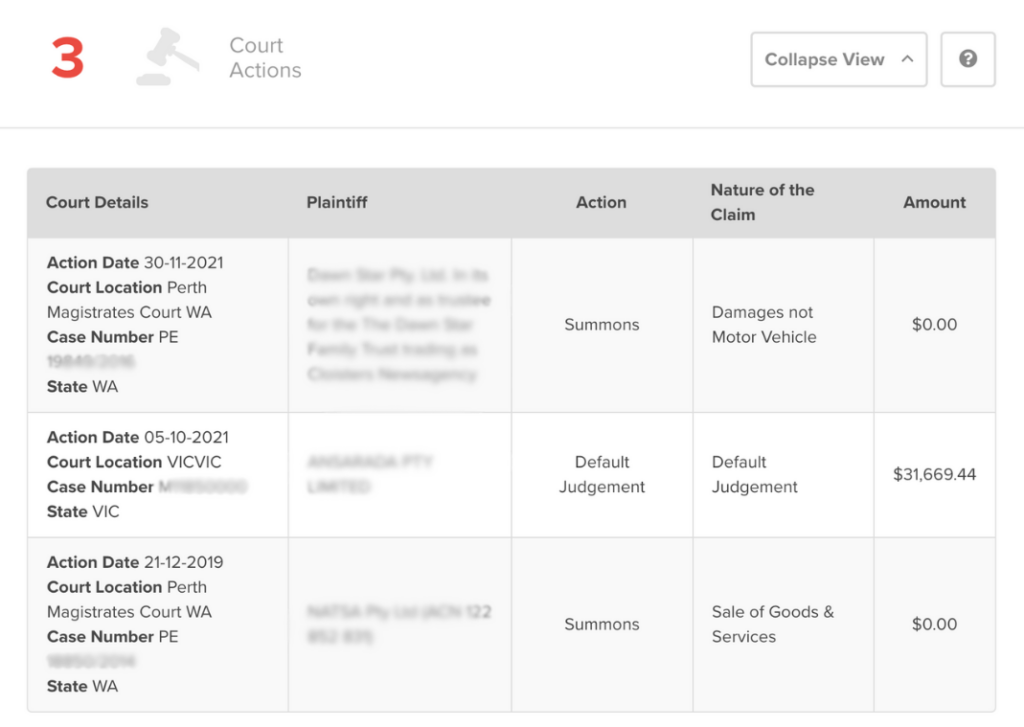

Stay vigilant with red flags. Court actions against your customers could be indicative of risks. With over 9,000 new court records from VIC and WA, you’ll get richer insight into your customers’ risk.

Getting your invoices paid

Important notice for anyone that wants their invoices paid faster!

Every Accounts Receivable team deserves a break from repetitive and labour-intensive collections processes without losing their unique touch. CreditorWatch Collect does just that.

Set up custom workflows to automate your team’s collection processes, leveraging your accounts information from your preferred accounting tool or ERP.

We’ve expanded our connectivity to include direct links to Oracle NetSuite and Microsoft Dynamics 365, in addition to Xero, MYOB, and QuickBooks. Connect your account in minutes and streamline your collections process.

Using a different platform? No worries! Our new public API let’s you to link CreditorWatch Collect to any ERP system.

We’re here to help!

If we can help you optimise your customer onboarding process, manage risk across your customer credit lifecycle, or improve your receivables, let us know.