Deteriorating payment times in construction threaten economic recovery

In a worrying sign, payment times are worsening in the construction sector, according to the CreditorWatch January Business Risk Review. This could have consequences for the broader economy and may indicate the fledgling economic recovery is under threat.

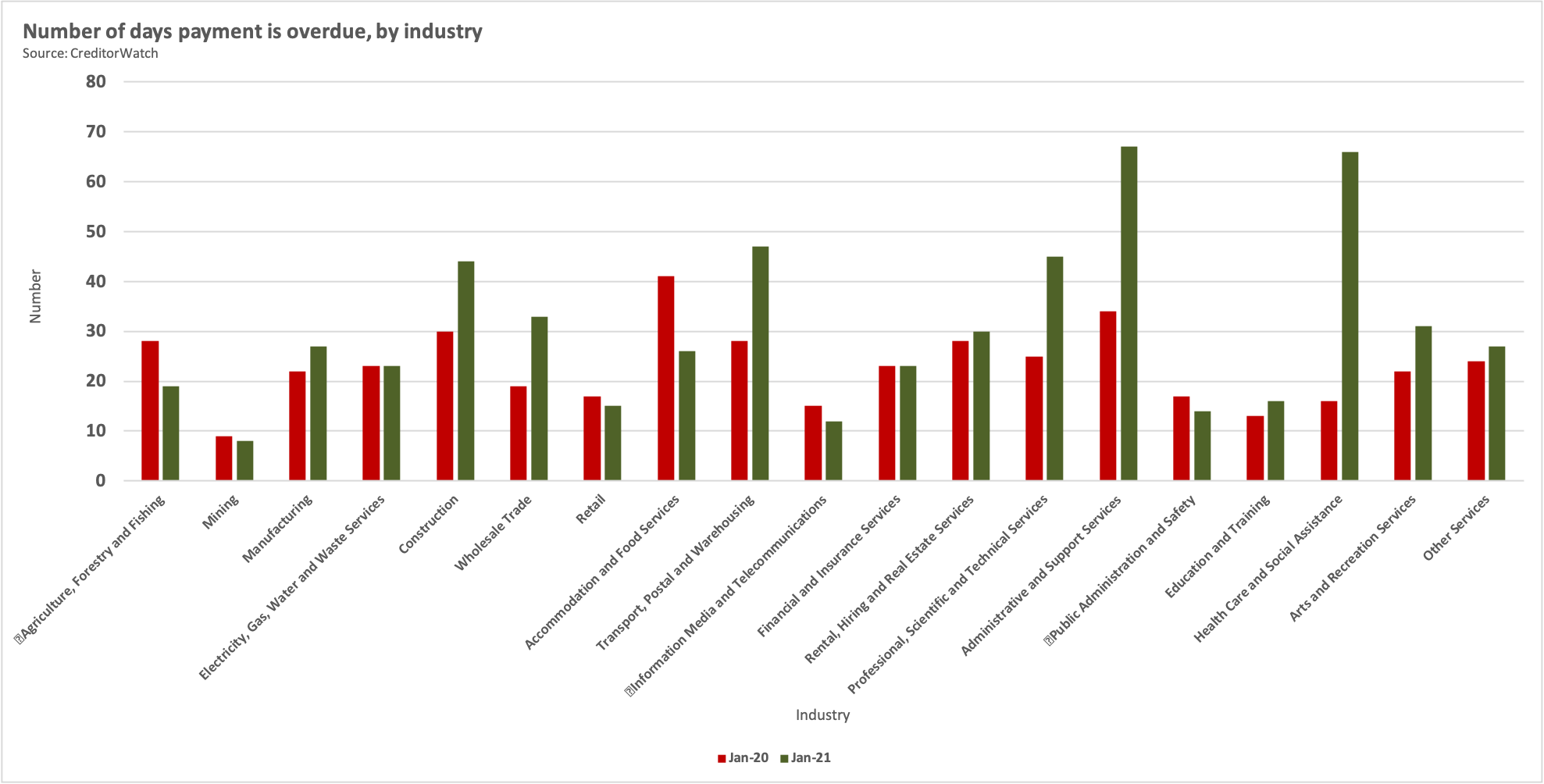

According to the latest CreditorWatch data, payment times in construction rose by 47 per cent year-on-year in January. On a monthly basis, construction firms are now on average 44 days late paying their bills, versus the December result of 35 days.

Patrick Coghlan, CreditorWatch CEO says:

“Due to the COVID-19 pandemic, the commercial building sector is suffering, which is one of the main factors behind rising payment times across the construction industry. However, increasing payment times in construction are partly seasonal and encouragingly residential construction is booming thanks to government stimulus and low interest rates driving demand in the housing market.”

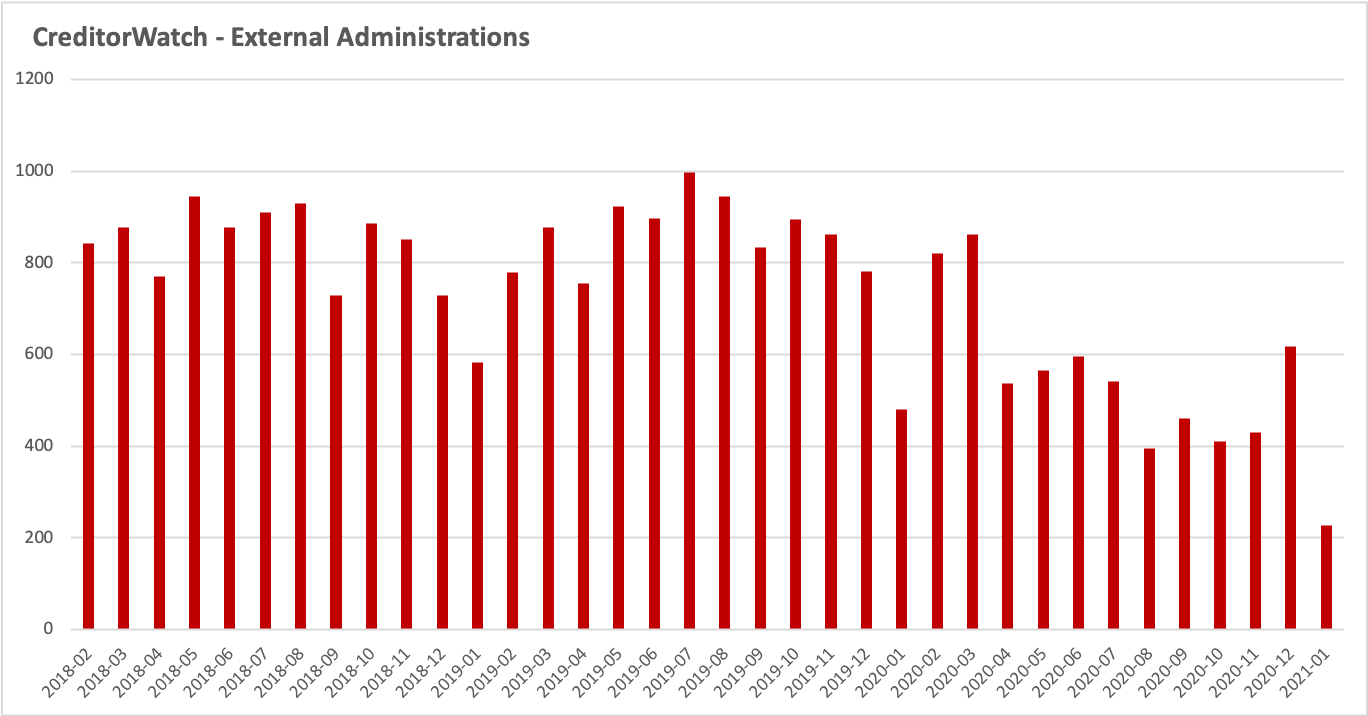

The January Business Risk Review also records 228 external administrations in January, which is the lowest the figure has been since 2018.

Harley Dale, CreditorWatch Chief Economist says:

“Seasonally, administrations are typically down in January. This result is also due to the concession available to small businesses with debts of less than $1 million that allows them to appoint a restructuring practitioner to help them put in place a plan to work through their debts, rather than go into administration. We expect a substantial turnaround in the number of companies going into administration and entering into court proceedings as the year progresses.”

The industries to watch

- Health care and social assistance: payment times are up by a whopping 313 per cent for the year to January 2021. It’s assumed this is largely due to the all-encompassing focus on addressing the COVID-19 pandemic to the detriment of many other health services. Payment times worsened between December, when health care businesses were on average 50 days late paying their bills, and January, when this figure rose to 66 days. By contrast, in January 2020 health businesses were only 16 days late paying their bills.

- Administrative and support services: year-on-year, payment times in this sector are up by 97 per cent. This reflects lack of demand for admin services as a result of the shift to working from home. However, there are signs this trend is reversing, with payment times consistently coming down over the last three month. Firms in this sector were 82 days late paying their bills in November, 72 days late in December and 67 days late in January. It’s hoped this trend will continue as businesses start to transition back to the office throughout 2021.

- Transport, postal and warehousing: payment times rose by 68 per cent for the year to January 2021. This reflects bottlenecks in the supply chain as a result of border closures and the severe contraction in the airline sector. On a monthly basis, payment times in this sector deteriorated between December (42 days late) and January (47 days late). This could be due to border closures being reinstated due to the COVID outbreak in Sydney in December. Payment times have substantially improved since this sector recorded six straight months from June until November when firms were on average 90 days late paying bills across this period.

- Wholesale trade: payment times are up by 74 per cent year-on-year for this sector. This is a reflection of COVID-induced disruptions to the supply chain having a flow-on effect for wholesale. This sector tends to follow trends in transport, so it’s no surprise payment times rose between December (businesses were 30 days late paying their bills on average) and January (businesses were 33 days late on average), although this could reflect the usual seasonal rise in January.

- Financial and insurance services: while there’s no change year-on-year in terms of payment trends in this sector, there has been a marked improvement since September 2020, with payment times coming down each month since then. On average, businesses were 35 days late paying bills in December and 23 days late in January. This improvement can be attributed to rising demand for financial services as consumers seek to take out home loans or refinance, to take advantage of the low interest rate environment. Federal government stimulus has also been beneficial for this sector.

- Accommodation and food services: payment times improved in this sector over the year to January 2021, falling by 37 per cent on average. There was a small deterioration between December (22 days) and January (26 days), which could be attributed to COVID-induced lockdowns and travel bans.

Emerging trends in external administrations and court actions

The number of external administrations collapsed not just in January, when there is always a seasonal decline, but across the year, with administrations falling by 52.6 per cent for the 12 months to January 2021. They were down month-on-month by 63 per cent.

This trend is also reflected across the major states:

- NSW: administrations down by 46 per cent year-on-year and by 55 per cent month-on-month.

- VIC: administrations down by 58 per cent year-on-year and by 59 per cent month-on-month.

- QLD: administrations down by 60 per cent year-on-year and by 68 per cent month-on-month.

These figures are being artificially supported by federal government measures to give relief to companies that are trading while insolvent due to the pandemic. It’s expected the number of companies entering administration will rise and then normalise throughout 2021.

Similarly, court actions have dwindled into insignificancy, dropping by 44 per cent year-on-year and by 24 per cent in January. The monthly figure also represents the usual drop in court cases in January.

Arrears rates also fell consistently from mid-2020, a sign government support for businesses last year paid dividends. What remains to be seen is how businesses fare as they are weaned off government support such as JobKeeper.

CreditorWatch data will provide an important insight into how small and medium-sized enterprises (SMEs) will perform subsequent to the end of government stimulus. Government support will still be there, but not to the same degree. What happens to SMEs from March onwards will provide an important barometer as to the health and recovery of the overall Australian economy.

*Data accurate as of 1 February 2021. ASIC data may be subject to change.

“There continues to be considerable variance in the number of overdue payment days across different Australian industries.

Key industries who entered 2021 still struggling under the weight of a much greater than usual number of days that payments were overdue are:

- Construction

- Wholesale trade

- Transport, Postal and Warehousing

- Professional, Scientific and Technical Services

- Administrative and Support Services

- Healthcare and Social Services

- Manufacturing

All these industries averaged higher overdue payment times over the three months to January 2021 when compared to the same period a year earlier and the August – October 2020 period.

It is encouraging to see the continuation of clearly improving overdue payment times in January 2021:

- Electricity, Gas, Water and Waste Services

- Accommodation and Food Services

- Information, Media and Telecommunications

- Public Administration and Safety

Payment times for the retail sector are also improving considerably.

There are a number of industries where it would be encouraging to see stronger signs of improving payment times in coming months:-

- Agriculture, Forestry and Fishing

- Financial and Insurance Services

- Education and Training

- Arts and Recreation

- Other Services

-Harley Dale, CreditorWatch Chief Economist