74% of Australian industries report a decrease in payment times

The CreditorWatch October Business Risk Review shows that 14 of 19 industry groups recorded a decrease in payment times in the month, with many industries reporting consecutive month-on-month falls. While this indicates that businesses are beginning to generate cash flow, payment times still remain 157 per cent higher, on average, than October 2019.

External administrations continue to fall

External administrations fell 26 per cent in October from September, cementing a long term trend that spells trouble for Australia’s economic recovery.

In the March 2020 quarter, the number of administrations was only four per cent lower than in the March quarter of 2019. In the June 2020 quarter that figure shot up to -35 per cent. By the September quarter it blew out to -50 per cent. This suggests that government stimulus is continuing to support thousands of businesses that are not viable in the long term.

CEO Patrick Coghlan says:

“Falling payment times and administration rates would ordinarily be considered encouraging signs because they indicate that Australian businesses are generating the revenue they need to survive.

However, the fact that payment times remain so high and above their 2019 levels, gives the game away while falling administration rates show that government stimulus packages have created a backlog of companies holding on to survival.

When this support is withdrawn next year, we expect many of these businesses to shed their camouflage and shut up shop because they do not have the cash flow to survive on their own two feet.”

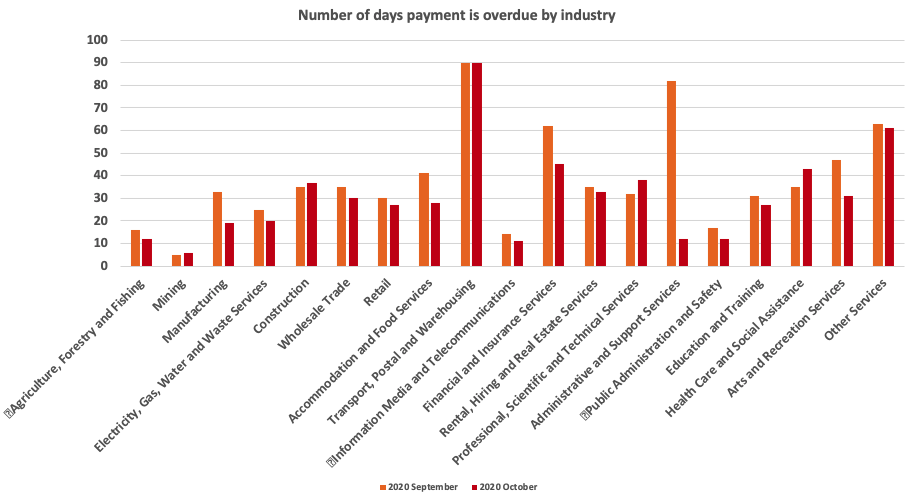

Which industries are paying their customers on time?

For a comprehensive investigation of the performance of Australian industries, read CreditorWatch Chief Economist Harley Dale’s blog.

Best performing industries

The below graph shows three months of consecutive declines in payment times

| Industry | Days overdue in July 2020 | Days overdue in October 2020 | Percentage change |

| Information Media and Telecommunications | 45 | 11

|

Down 75.6% |

| Rental, Hiring and Real Estate Services | 62 | 33 | Down 46.8% |

| Agriculture, Forestry and Fishing | 20 | 12 | Down 40.0% |

| Electricity, Gas, Water and Waste Services | 32 | 20 | Down 37.5% |

| Retail | 41 | 27 | Down 34.6% |

Worst performing industries

The below graph shows the industries that reported the biggest gains in payment times over three months

| Industry | Days overdue in July 2020 | Days overdue in October 2020 | Percentage change |

| Health Care and Social Assistance | 34 | 43

|

Up 26.5% |

| Arts and Recreation Services | 26 | 31 | Up 19.2% |

| Financial and Insurance Services | 42 | 45 | Up 7.1% |

| Wholesale Trade | 29 | 30 | Up 3.5% |

| Other Services | 59 | 61 | Up 3.4% |

State-by-state analysis

In October 2020, the majority of states recorded falls in external administrations when compared to September, in line with the national trend:

- New South Wales recorded a 36.7 per cent decrease in business administrations

- Victoria recorded a 14.8 per cent decrease in business administrations

- Queensland recorded a 15.0 per cent decrease in business administrations

Credit enquiries recorded by CreditorWatch customers, a live indicator of business activity, also fell by 4.7 per cent, the second consecutive month-on-month decline.

Chief Economist Harley Dale says:

“Although RBA Governor Lowe was able to state recently that the Australian economy grew in the September quarter, the October Business Risk Review results revealed just how finely balanced the outlook is.

One only has to look at the recent earnings from the Big Four banks to see how tough it is for large corporates, let alone SMEs that are perceived as the lifeblood of our economy. These companies are still struggling to collect cash and make payments quickly, indicating that they are still at the cliff edge and may well fall as soon as government support is withdrawn.

“Rather than handing out more money to keep failing companies afloat, policy makers should be encouraging them to wind down while creating a safety net to help those that lose their jobs.

Otherwise, a sudden wave of insolvencies could quickly derail any economic recovery and put us further away from consistent national growth.”

For an in-depth look at the performance of Australian states and industries, visit the CreditorWatch Business Risk Review website. It offers interactive graphs and charts you can toggle to find the data on payment defaults, external administrations and more.