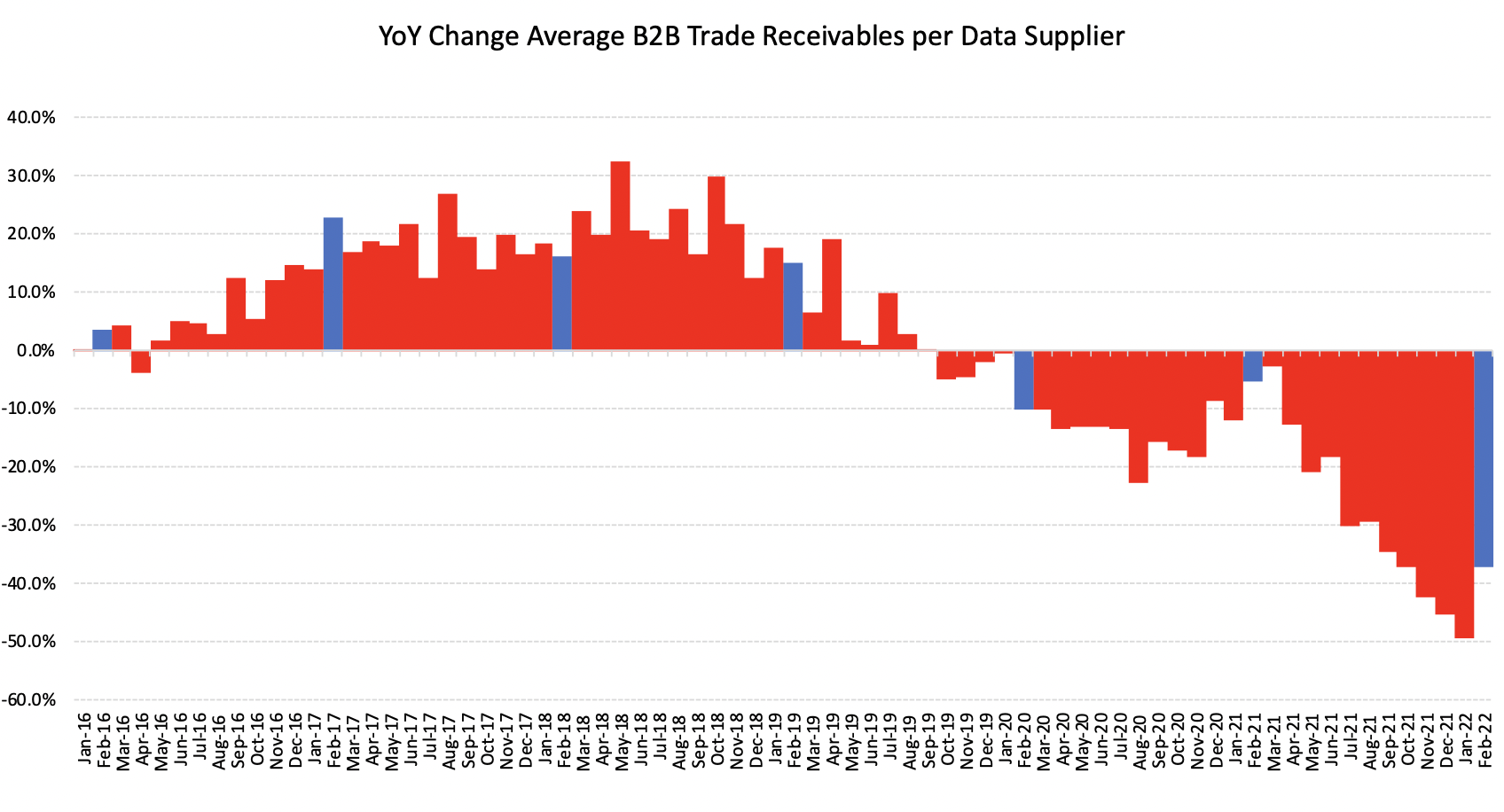

SYDNEY, Wednesday 9 March – The February 2022 CreditorWatch Business Risk Index (BRI) reveals that the Australian economy is still in a holding pattern as it emerges from the impacts of the Omicron variant. Trade receivables reversed their recent decline in February, but it is too early to see the effects of the disastrous floods on the east coast in the data. This will undoubtedly begin suppressing the positive trade data from next month.

Also on the plus side, credit enquiries were up 55 per cent from January to February, indicating that business confidence is returning and companies are ready to invest in growth.

Key Business Risk Index insights for February:

- There was a small increase in trade activity for February – an encouraging sign but it is too early to tell if it is the beginning of a sustainable pick up in trade activity. The impact of the east coast floods is yet to be seen in CreditorWatch’s data, but it will undoubtedly drag down trade activity.

- Credit enquiries were at 211,357 for February – the highest monthly number since November 2021 and second highest since July.

- Court actions have seen a significant increase in the last quarter when compared to the corresponding period last year. We are seeing early signs of enforcements and collections activities returning to normal.

- External administrations increased 29 per cent from January to February.

- Trade payment defaults jumped 35 per cent from January to February.

- The net result of the CreditorWatch Business Risk Index and our broader credit indicators is that trade activity remains subdued with the impending economic impacts of the east-coast floods expected to exacerbate this.

CreditorWatch expects insolvencies to dip as the support packages for flood-affected areas are delivered and banks offer ‘loan-payment-holidays’ to affected businesses. However, over time, as rejected insurance claims, losses from uninsured businesses and loss of income begin to be felt, this will unfortunately see insolvencies rise in those regions as well as the rest of Australia. There will be benefits to some industries such as construction as the rebuilding phase commences.

CreditorWatch CEO Patrick Coghlan says that while the small pick up in trade receivables is an encouraging sign, the effect of the east coast floods will decrease trade activity.

“The devastation of the floods in southern Queensland and northern New South Wales is yet to come through in our data, and it could take up to 12 months for us to see the full impact, but it will have a dramatic adverse effect on trade activity.

“The extent of the destruction throughout towns and cities along the coast, as well as agricultural areas, will be felt deeply.”

CreditorWatch’s data showed that trade receivables rose in February but is still down 37 per cent on the February 2021 figure and significantly below pre-COVID levels.

CreditorWatch’s data indicates that banks are well and truly back into their regular cycle of collections. Court actions continue to rise, sitting at 1,828 for February, the most in a month since March 2020 and a 70 per cent increase on February 2021. External administrations jumped 29 per cent from January to February and trade payment defaults were up 35 per cent. It remains to be seen what level of hardship measures the banks will implement for flood victims and whether this will have a significant impact on court actions.

CreditorWatch’s data indicates that banks are well and truly back into their regular cycle of collections. Court actions continue to rise, sitting at 1,828 for February, the most in a month since March 2020 and a 70 per cent increase on February 2021. External administrations jumped 29 per cent from January to February and trade payment defaults were up 35 per cent. It remains to be seen what level of hardship measures the banks will implement for flood victims and whether this will have a significant impact on court actions.

Credit enquiries also jumped significantly from January to February indicating that businesses are seeking credit and looking to invest, however for some business this is a result of cash reserves built up throughout the pandemic being exhausted, making them reliant on debt funding to get back on their feet.

Meanwhile, CreditorWatch’s Business Risk Index results for February also reflect the inherent problems highlighted in the Australian construction industry last month with the collapse of construction giant, Probuild.

The national probability of default remains flat at 5.48 per cent, against the same result in in January.

The Probuild collapse and outlook for the wider construction industry

Those in the construction industry had been warning for some time that the supply chain disruptions, cost pressures, materials shortages and labour shortages were beginning to bite, increasing risk exposure and making large projects unviable.

In the wake of last month’s collapse of construction giant, Probuild, CreditorWatch expects other construction companies to follow suit, with a major flow on effect to sub-contractors and suppliers. The problem is exacerbated by the banks lowering their appetites for lending for large construction projects.

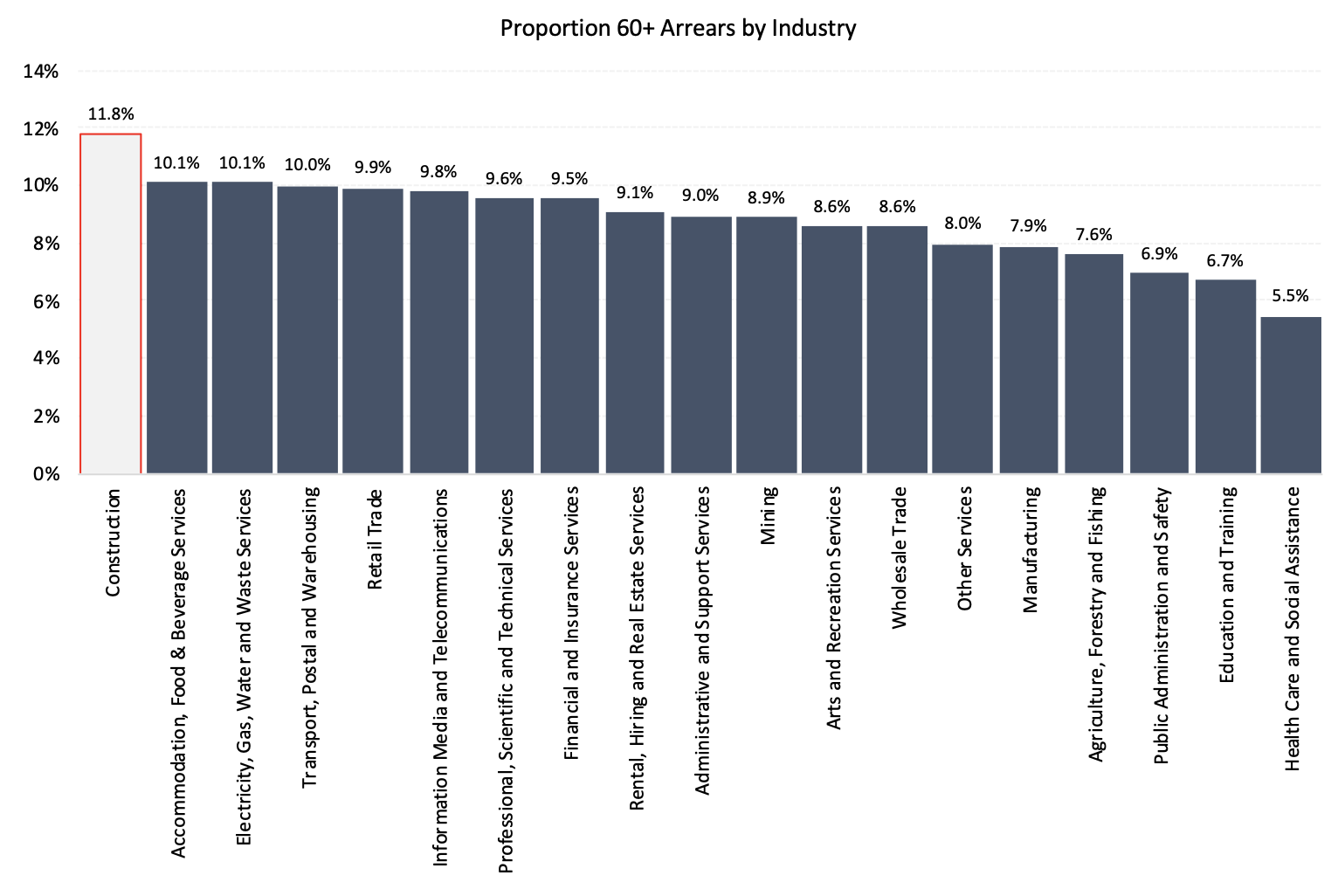

A tendency towards significant trade payments arrears is not a new development in the construction industry. The common practice of delayed payments to contractors and suppliers in the construction industry can make it challenging to detect genuine debtor insolvency risk compared to other industries where delayed payments are considered a red flag, prompting trade credit restrictions and other actions.

Despite this, CreditorWatch’s data revealed a blowout in Probuild’s payment times in late 2021 resulting in the company being designated a high-risk score of D1.

Source: CreditorWatch payment arrears data, proportion 60 days or more arrears by Industry

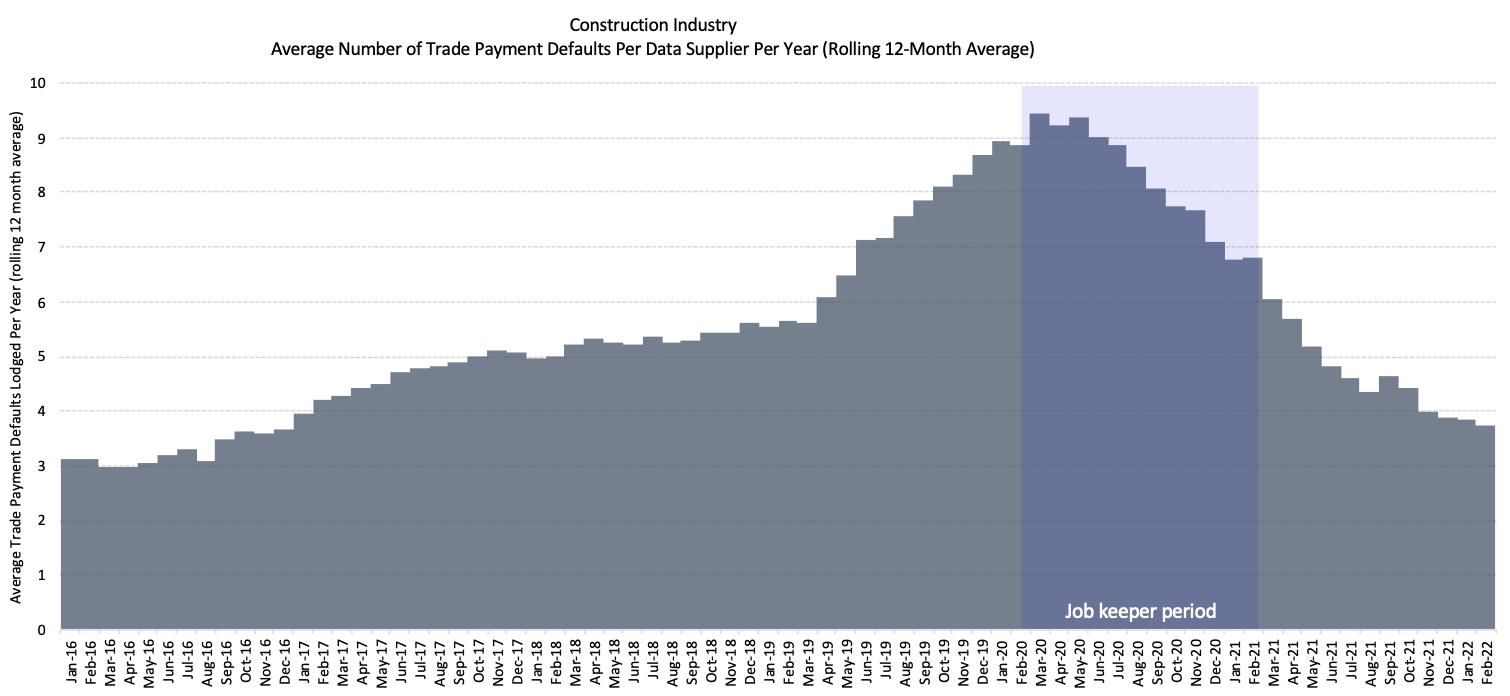

Construction trade payment defaults peaked prior to COVID and have steadily declined since then, despite consistent late payments over the same period.

Will suppliers and other creditors continue to be as hesitant to lodge defaults against poor payers in 2022?

Source: CreditorWatch trade defaults data, small to medium sized business data suppliers (accounting software integration)

Probability of default by region

The five regions at least risk of default over the next 12 months are:

| 1. Glenelg – Southern Grampians (SA): 3.44% |

| 2. Murray River – Swan Hill: 3.59% (VIC) |

| 3. Grampians: 3.62% (VIC) |

| 4. Lachlan Valley: 3.63% (NSW) |

| 5. Limestone Coast: 3.71% (SA) |

The five regions most at risk of default over the next 12 months are:

| 1. Merrylands – Guildford: 7.51% (NSW) |

| 2. Bringelly – Green Valley: 7.43% (NSW) |

| 3. Canterbury: 7.20% (NSW) |

| 4. Gold Coast – North: 7.10% (QLD) |

| 5. Bankstown: 7.00% (NSW) |

Probability of default by industry

The industries with the highest probability of default over the next 12 months are: –

- Accommodation and Food Services: 6.7 per cent, up from 5.7 per cent

- Information, Media & Telecommunications: 4.9 per cent, up from 4.6%

- Financial & Insurance Services: 4.7 per cent, up from 4.4%

The Probability of Default (PD) for Accommodation and Food Services is consistently higher than any other industry. Given all that has happened recently the metric sits at a probability of 6.7 per cent in February 2022, the highest in a very long time. That’s tough for business owners, many of whom leverage their family home to support their small business. You can’t have a Delta then Omicron variant of COVID followed by an illegal war abroad and a devasting flood situation at home without adverse consequences for frontline industries.

The industries with the lowest probability of default over the next 12 months are: –

- Health Care and Social Assistance: 3.3%

- Agriculture, Forestry and Fishing: 3.6%

- Wholesale Trade: 3.7%

Healthcare and Social Assistance is dominated by federal and state/territory funding but options for private elective surgery are increasing. Agriculture, Forestry and Fishing has a credit rating that reflects strong commodity prices, but those floods will have an impact.

Wholesale trade is the key leading indicator. The industry looked in such bad shape but seems to be turning around. If CreditorWatch data proves that improvement, that will be a very positive indicator for Australia’s economic recovery.

Payment arrears by industry

The industries with the highest percentage of businesses in arrears are:

| 1. Construction: 11.8% |

| 2. Accommodation and Food Services: 10.1% |

| 3. Electricity, Gas, Water and Waste Services: 10.4% |

The construction industry provides a crutch to the Australian economy because it has a huge multiplier impact through the rest of the economy. The monthly arrears payments figure is declining but there seems a long way to go.

Accommodation and Food and Beverage Services is a key economic barometer. When this industry sustainably bounces back, so will Australia.

Court actions

Monthly court cases have established an upward trend since late 2021 and are up by 23.1 per cent in the February ‘quarter’ (54.2 per cent annually). January 2021 was the low point. CreditorWatch data will provide a key leading indication as to how businesses are faring in a post lockdown environment.

External administrations

The number of monthly external administrations is still historically low, although they jumped in original terms in February as happens each year. Administrations are down by 7.0 per cent for February 2022 ‘quarter’ (-5.0 per cent annually).

While the number always drops in January, this year marked the second lowest level of the pandemic (January 2021 being the lowest). We can expect to see a stronger and more sustained increase over 2022 compared to last year as credit behaviour towards businesses normalises.

Credit enquiries

Credit enquiries are still trending down, although the jump in February is larger than normal for that month. Over the three months to February enquiries are down by 16.2 per cent, 3.7 per cent lower than the three months to February 2021. That is hardly a great start to the year and will be complicated by the natural disasters at home and the war in Ukraine.

Outlook

The war in Europe and the human and economic tragedy of the east-coast floods have changed the entire dynamic to Australia’s economic recovery. We will still experience a sustained period of economic growth in 2022, unlike what was widely anticipated but didn’t materialise last year. CreditorWatch has noted for some time that the recovery will be slower than initially anticipated and that many SMEs were at risk as they emerge from the shadow of credit leniency provided by financial institutions and the Australian Taxation Office (ATO) is progressively curtailed. The beast responsible for that outcome was called Omicron.

Now, we face the twin challenges of an exogenous war and an endogenous natural disaster on almost an unrivalled scale. Both events will further slow the pace of economic recovery and delay a first official interest rate rise from the Reserve Bank of Australia (RBA).

This situation may well have an adverse impact on consumer confidence, which has already been trending down for nearly 12 months. Watch for a possible hit to business confidence which would have an adverse impact on the key missing ingredient to a sustainable economic recovery for Australia – a lack of private business investment.

Contacts

Mitchy Koper

GM Communications and Marketing, CreditorWatch

mitchy.koper@creditorwatch.com.au

0417 771 778

Michael Pollack

Head of Content, CreditorWatch

michael.pollack@creditorwatch.com.au

0422 513 258

ABOUT THE BUSINESS RISK INDEX

The Business Risk Index is a predictive economic indicator to help guide businesses when making future growth plans and inform public policy. It is a new credit rating that ranks more than 300 Australian geographies by relative insolvency risk, providing unique insights into the health of Australian businesses by region.

Each region is ranked from best to worst in terms of the potential for businesses in it to become insolvent. The index can also measure the potential for insolvency risk at a national, state and individual business level.

Regions are ranked on a scale from zero to 100, where 100 represents the best credit quality regions, that is, the lowest risk of insolvency, and zero represents the weakest credit quality regions, that is, the highest insolvency risk.

The index is calibrated by data from approximately 1.1 million ASIC-registered, credit-active businesses. It combines these insights with CreditorWatch’s proprietary data, previously published as the monthly Business Risk Review.

Subscribe to the Business Risk Index to be the first to receive our monthly updates.