Helping you stay ahead of the competition and onboard new customers faster

First impressions are important. That means approving applications from new customers in a timely manner is crucial.

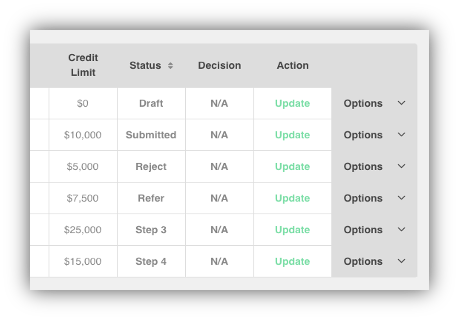

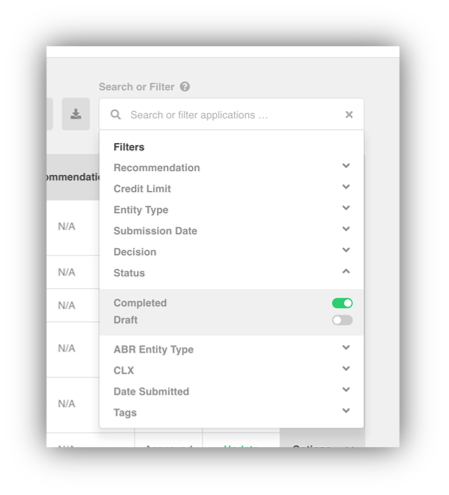

We’ve made it easier to track and manage applications by adding a ‘status’ field. You can customise your status names and create workflows using the application status – an improvement from using ‘labels’ to manage applications.

We’ve also enhanced a number of existing features including ApplyEasy application search functionality, auto-fill capabilities within application forms, and added more conditions and rules to improve credit decisioning.

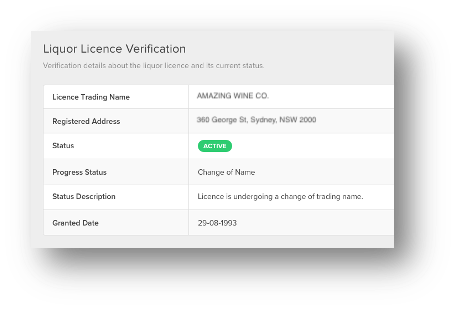

For liquor producers and wholesalers, ApplyEasy can now check the validity of liquor licenses captured in your onboarding form. This way, you can automatically approve or reject applications based on whether the customer has a valid liquor license, saving you valuable time.

Improve decision making and risk mitigation

We understand that each business is unique and has different risk appetites. Now, Monitoring & Alerts subscribers can choose what alert types they’ll be notified of using the ‘custom alerts’ option. The 3 pre-set alert levels will remain available to use.

To improve the quality and accuracy of CreditorWatch credit reports, we’ve added and updated thousands of ANZSIC codes within the bureau. ANZSIC codes are used to calculate credit risk by way of CreditorWatch’s proprietary RiskScore. Having more accurate data means that we can generate more accurate insights to help our customers make better informed decisions and mitigate risk.

Helping Dynamics 365 users automate their collections process

Saving time by automating repeatable manual tasks could mean the difference between having to hire an additional staff member or choosing to not complete a task. When it comes to chasing customers to pay overdue invoices, email and SMS reminders can be easily automated using CreditorWatch Collect.

Our new CreditorWatch Collect integration to Dynamics 365 means that CreditorWatch Collect can identify any customers that require follow up to send them automated reminders with details of any relevant overdue invoices. Manual effort is minimised, and your business can ensure that all late paying customers are followed up every time, increasing how much you collect.

We’re here to help!

If we can help you optimise your customer onboarding process, manage risk across your customer credit lifecycle, or improve your receivables, let us know.