Reinvent the way you collect your debts

On November 12 2019, CreditorWatch’s team of developers revamped and relaunched DebtorLogic – a data-driven tool that analyses your Aged Trial Balance (ATB) and helps you better understand the risk a debtor presents to your business.

What is DebtorLogic?

DebtorLogic helps you stay ahead of bad debt by revealing how your customers pay you in comparison to the rest of the market.

Assess the payment behaviour of your customers, prioritise your collections and identify high-risk debtors with an easy-to-use interface. Every time you upload your ATB, DebtorLogic generates an extensive management report and delivers the most relevant data.

DebtorLogic is the only trade program to combine both small business and corporate trade data. Traditional trade data programs only collect data from corporate customers (the best paid companies in Australia). By adding SME trade payment information, you’ll receive a much clearer picture of how a market actually gets paid.

The best bit? It’s delivered with simple, interactive and colour-coded graphs and tables that anyone can understand. Click on any graph segments and table groupings for a more detailed look at the data and find hyperlinks to your customers’ online credit profiles throughout. You’ll also be given a walkthrough of the tool to highlight all the need-to-knows before you use it for the first time.

A faster, simpler and cleaner experience

That’s the vision we wanted for our new DebtorLogic.

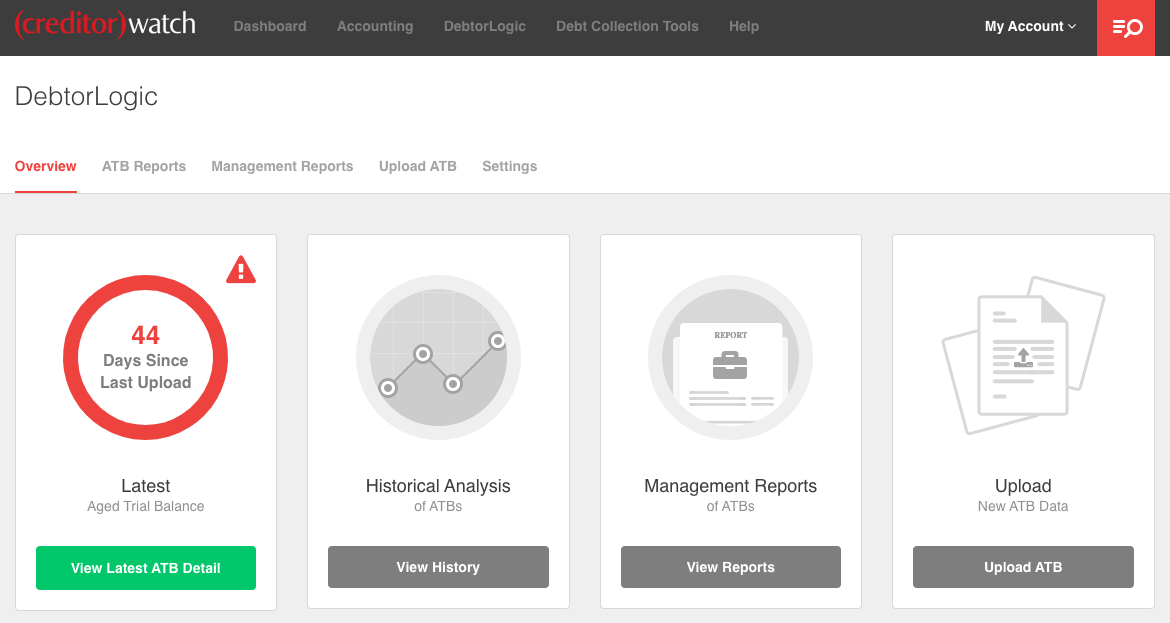

We know your time is valuable, so we’ve improved the backend to deliver you faster page loading and data crunching. Uploading an ATB is easier than ever before. Once you upload the data, we’ll send you an email to let you know when it’s ready so you can browse the site freely while you wait.

We’ve also recreated the platform’s overall layout to cut down on the clutter and provide a more enjoyable and intuitive experience.

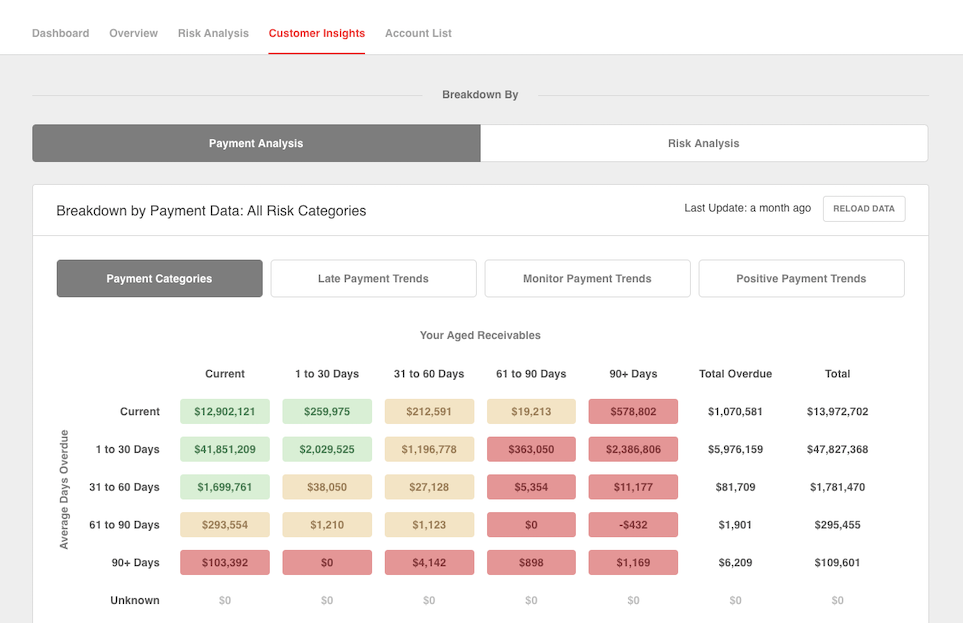

Access valuable customer insights

We’ve taken customer feedback on board and transformed our Customer Insights page to make it easier to understand. Interact with the charts to breakdown the data even further and review a list of your customers and how much they owe you.

Access the Payment Analysis page to see how your customers are paying you compared to others, including risk levels and collection priority. Toggle to the Risk Analysis page to review how your customers are paying you compared to the entity’s credit score.

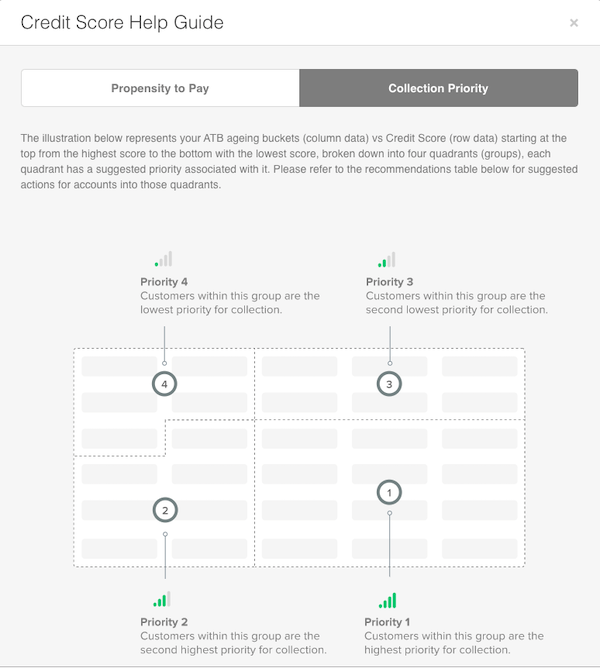

If you need recommendations on which of your customers you should collect from first, click on the ‘How To Guide’ (displayed below) for help deciphering the data.

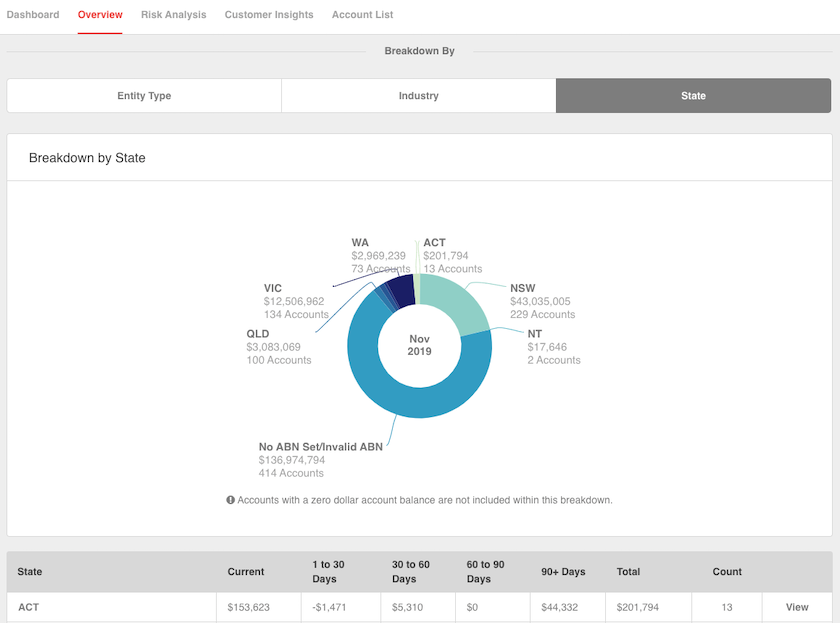

Compare your customers across state and industry

For the first time, the ATB detail overview page includes state and industry analysis so you can see exactly where your best (and worst) customers are.

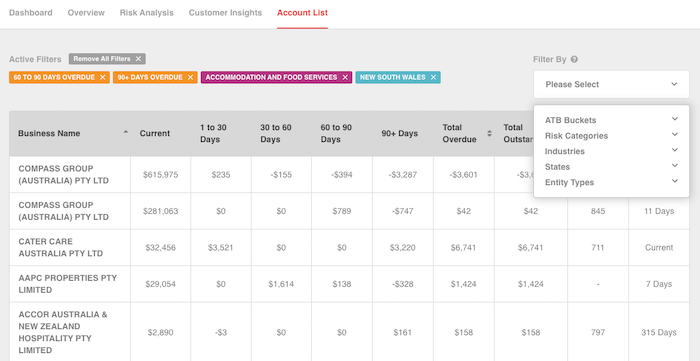

Customise your account list – drill down on the top-line data

Choose from a range of filters, including industry, state and risk category to display specific accounts. It’s never been easier to focus on the areas that are important to you and get familiar with even more data.

For example, the screenshot below displays all accounts in the accommodation and food services industry in NSW with an invoice that’s at least 60 days overdue.

For more information on the new and improved DebtorLogic or how your business can benefit, contact your account manager or send an enquiry to CreditorWatch here.