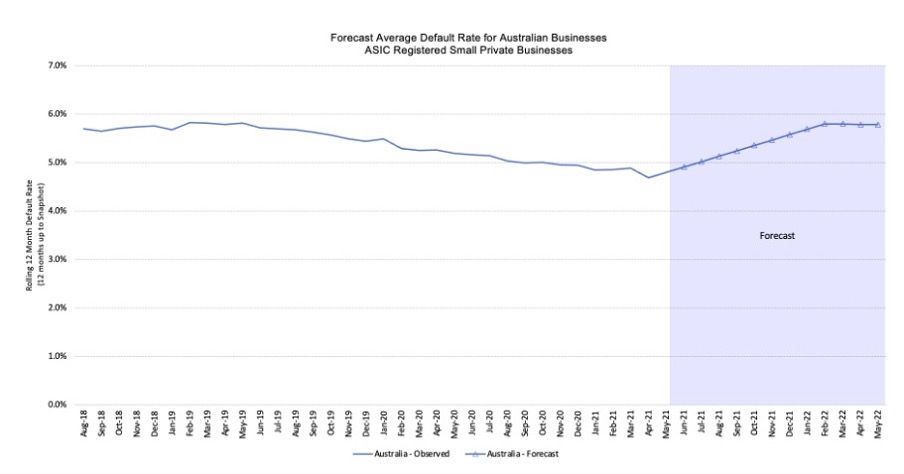

CreditorWatch has released its Industry Synopsis for June. Industry data, coupled with stats from its Business Risk Index (BRI)*, point to an increased probability of default for a number of industries, as the threat of rising interest rates finally eventuates.

Australia is currently experiencing a ‘perfect economic storm’ of increasing cost of debt, labour and supply shortages, the cessation of Covid-related government support and the ATO and many financiers removing any remaining periods of grace for clients in arrears. This means those businesses who have been trading unprofitably since 2020 will now have to face the reality of their situation.

Sector-specific insights for June:

- The highest level of trading risk continues to be found in the Food and Beverage, Transport, Postal and Warehousing and Arts and Recreation services

- Trade in these areas has started to suffer since early May and CreditorWatch data suggests these sectors will continue to be dramatically impacted by high inflation and higher interest rates.

- The lowest risk sectors include Health Care and Social Assistance, Agriculture and Manufacturing.

- CreditorWatch data suggests these low-risk industries tend to be dominated by larger operators and are therefore less exposed to any fluctuations in the Australian housing market.

- However, the Fair Work Commission’s 5.2 per cent increase to the national minimum wage means even these low-risk sectors will see an impact on their outgoing costs.

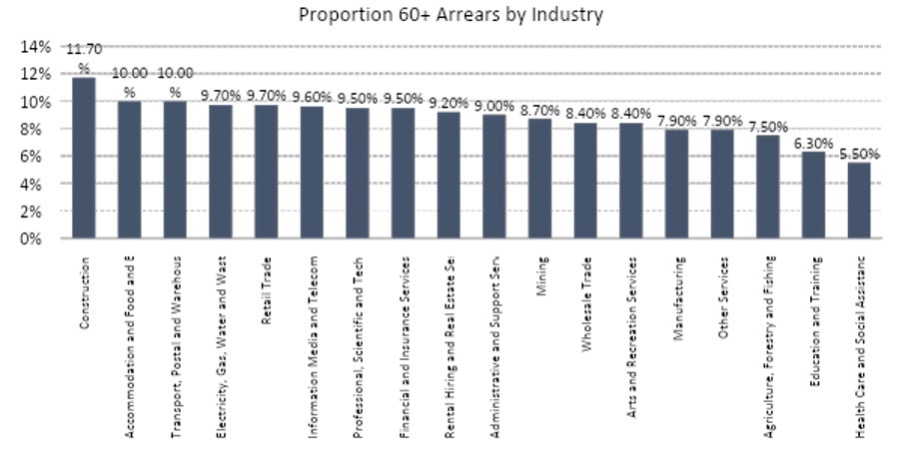

- Payment arrears remain relatively unchanged month to month, with the construction industry still easily the worst performer with 11.7 per cent of businesses in the sector in 60 days or more arrears.

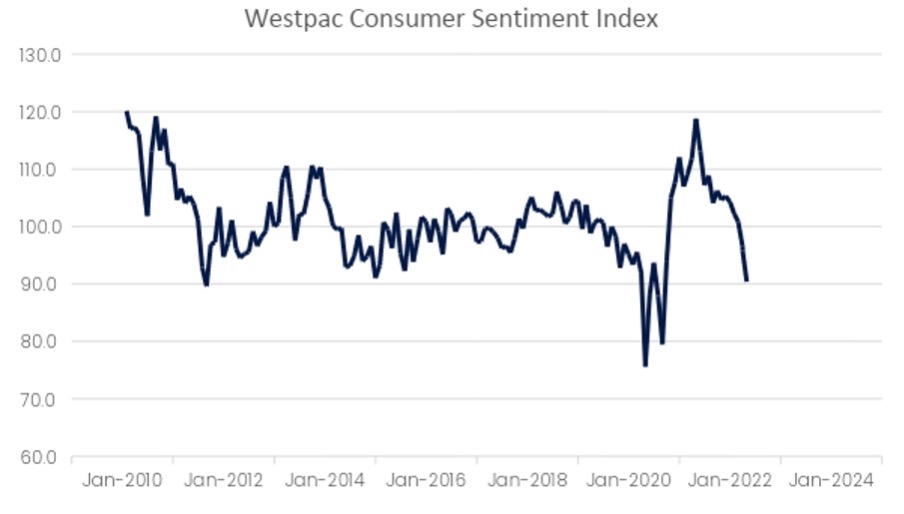

At a time when consumer confidence has sunk to levels not seen since the early stages of the COVID-19 pandemic, CreditorWatch Chief Economist, Anneke Thomson, says “Our nation is in quite the predicament. The Westpac Consumer Sentiment recorded the fourth lowest sentiment in recent memory in May 2022 and the latest ANZ-Roy Morgan consumer confidence index – a guide to future household spending – tumbled 7.6 per cent to 80.4 points, its lowest level since early April 2020.

“Given the 50bps increase in the cash rate at the June RBA Board Meeting, it is almost certain that the decline in consumer sentiment will continue. Coupled with an extremely cold and wet start to winter, and the rising cost of fuel and gas, it is likely that trading conditions in sectors dependent on discretionary spending will continue, and we expect the Probability of Default in these sectors to rise as the year progresses.”

Lowest and highest risk sectors

CreditorWatch’s May 2022 Business Risk Index shows that the three industries with the highest probability of payment default over the next 12 months are:

| 1. Food and Beverage Services: 7.1% (down from 7.2%) |

| 2. Arts and Recreation Services: 4.8% (down from 4.9%). |

| 3. Transport, Postal and Warehousing: 4.7% (down from 4.8%). |

While the risk of these sectors dropped slightly from the previous month, this data will continue to be impacted by high inflation and higher interest rates.

Another factor to consider is the decision by The Fair Work Commission to increase the minimum wage by 5.2% in response to the high March inflation figures. All of these sectors are big employers and will see their wage costs increase, both as a result of the Fair Work Commissions decision, and the strong competition for workers in the sector also forcing up wages.

Source: CreditorWatch BRI May 2022

The lowest risk sectors will also see an impact to their costs as a result of higher wages, although as already discussed, they are more able to pass on these costs to the end user. These low risk industries also tend to be dominated by larger operators, and will be less exposed to any fluctuations in the Australian housing market.

CreditorWatch’s May 2022 Business Risk Index shows that the three industries with the lowest probability of payment default over the next 12 months are:

| 1. Health Care and Social Assistance: 3.3% (steady at 3.3%) |

| 2. Agriculture, Forestry and Fishing: 3.5% (steady at 3.6%). |

| 3. Manufacturing: 3.6% (steady at 3.7%). |

Payment arrears data remains relatively unchanged month to month, with the construction industry, at 11.7 per cent of the sector in 60 days or more arrears, still easily the worst performer. We would expect that payment arrears may start to increase as credit becomes more expensive.

Source: CreditorWatch BRI May 2022

Inflation continues to rise overseas

While there was some hope that inflation had peaked in the US and UK, the latest data suggests this is not the case. US inflation rose to an annual rate of 8.6 per cent as at May 2022, and in the UK it has soared to 9.0 per cent as at April 2022. There are now significant calls around the globe, including here in Australia, for pay increases for public sector workers and those on industry awards. However, even with more generous than normal pay increases, real incomes for most workers continues to go backwards. Coupled with interest rate rises (the US Fed Funds and UK’s rate are both already 1.0 per cent) and large increases in energy costs in particular, it is hard to see how households are not going to have to cut back on consumer spending significantly.

What changes to spending are we already seeing in Australia?

While measurable changes to consumer spending take some time to come through, there are impacts that are already being felt across the economy. House prices have started to decline in Sydney and Melbourne (always the bellwether cities) and many agents are reporting that buyers are steering clear of properties that require an upgrade or renovation.

This means that longer-term we are likely to see some pressure come off the labour shortages in the construction sector, although this probably won’t eventuate until 2023 as so many current jobs have been slowed down due to supply shortages and delays.

The Buy Now Pay Later (BNPL) sector is also feeling the effects. Many BNPL operators have lost significant market valuation, as the sector is completely untested in an environment where capital isn’t easy to come by and consumers start spending less and bad debts are rising. Australian BNPL Zip was worth $10 billion in February 2021 and is now worth $420 million. According to consultancy firm McLean Roche, bad debts as a percentage of outstanding consumer loans were 13.9 per cent for Afterpay, 9.7 per cent for Zip, and 8.1 per cent for Klarna.

In comparison, CBA’s bad debt write off for credit cards 180 days in arrears is 0.31 per cent. In addition, Macquarie Group recorded a decline in year on year BNPL web traffic for the first time since they started recording the data. Declining BNPL customer numbers may be a portent for what is to come in the wider consumer market.

CreditorWatch CEO, Patrick Coghlan, explores what all of this means for business insolvencies: “Insolvency activity was well down from normal levels during the ‘lockdown phase’ of the Covid 19 pandemic. While the reasoning behind giving companies some repayment breathing space during the period of great uncertainty was sound, what this means is Australia now has a much larger than usual number of companies that are probably close to insolvency.

“The changes to monetary policy, prices and consumer behaviour will all combine to build a sense of urgency for many companies who are in this position. The ATO has been hot on sending out letters to businesses that are behind in repayments, underscoring the need to pay back debts that may have been deferred over 2020/21. The second half could well be a wash-out for many of these struggling businesses.

“A sector that knows that feeling all too well is the construction industry which still remains extremely problematic. Fixed-price contracts that are unique to the sector remain a serious drag on profitability, and insolvency activity will increase over 2022.”

You can find a more in-depth analysis of the construction sector in CreditorWatch’s ‘Cracks in the Foundation’ whitepaper here.

Note:

*The CreditorWatch Business Risk Index (BRI) is currently undergoing enhancements around its ASIC insolvency data collection.

Because of this, the next full Business Risk Index will be released on Wednesday 13 July.