Here’s a Fun Fact

Who would have thought that a line marked around the hull of merchant ships could be such a lifesaver? In the late 19th century, Samuel Plimsoll, a merchant and shipping reformer, became increasingly concerned about the loss of life caused by the overloading of ships. He devised the Plimsoll line, a marking on the hull indicating the limit that ships can hold cargo. If the water level of a loaded ship is above the line, then there is a risk of overloading and subsequent sinking of the ship.

What’s that got to do with business we hear you ask?

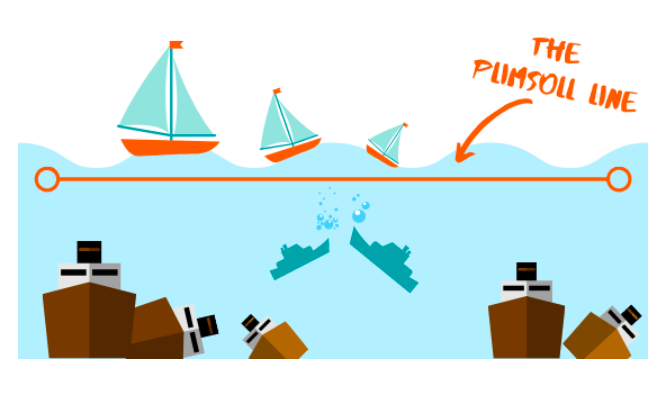

Imagine a line drawn across a page, something like this:

Let’s call that line our Plimsoll line, the line that represents (in nautical terms) when we are getting close to our ideal and maximum loading. In business terms, it’s the line that represents our ideal financial performance.

Now, let’s mark where (in our experience) most businesses fall compared to this financial performance line:

In the example above, many businesses have fallen below the line of acceptable financial performance. Based on our experience, the reason is that most businesses are more than likely technically insolvent, namely, they cannot meet their debts as and when they fall due.

Just hold that thought……most businesses are more than likely technically insolvent. Your business could be one of them. So could your Customers. (Stop reading now and have a stiff drink).

If we look again at our Plimsoll line to see what all these businesses are doing, they are doing 2 things;

- Either trying desperately to get up to the Plimsoll line; or

- Trying desperately to stop falling way beneath

Why should I care about this?

It’s called “empathy”- the ability to see things from someone else’s perspective. If you are ruthlessly honest about the state of your business, then you know where you fit in relation to our Plimsoll line. You are either:

- meeting or exceeding that acceptable financial performance line,

- insolvent,

- trying desperately to get to that Plimsoll line.

Good luck wherever you are. The point is, having recognised it in your own business, can you recognise it in your Customer’s business?

If you don’t recognise any of this in your Customer’s business, then you could be at risk of sinking below the Plimsol line yourself.

How do I stop my business falling below the Plimsoll line?

Start now to take steps to protect your business by ensuring your Customers’ failures do not cause you to fail. Try to look at your Customers differently – yes they are valued, yes you get along well, yes they have integrity, but how do they conduct their own business? If they fail, will it cause you to fail? Can you withstand a bad debt, a successful preference claim, an unexpected event like a fire or other misfortune?

What else can I do?

If you accept that many of your Customers might be insolvent, you should be paying extra special attention to them – onboard them correctly, know who you are dealing with, secure your debts by using the PPSA or personal guarantees and charging clauses, monitor their accounts, get updated credit and ASIC alerts regularly, establish close relationships with those that can hurt you the most, watch for warning signs that all is not well like payment arrangements or broken promises.

Conclusion

Riding the wave, not drowning under it, is where you and your Customers need to be. You are exposed to your Customer’s soft financial underbelly so use technology and your gut instinct to keep your business on the right side of the Plimsoll line.

Still uncertain what to do? Just make contact If you need any assistance, we are used to manning the lifeboats and rescuing ships that may be lost in the night.

More articles like this: Giving Credit Where Credit is Due

About the authors

Terry Ledlin is Special Counsel of Ledlin Lawyers, a boutique CBD law firm with 50-years of experience specialising in Credit Management and Collections, Commercial Litigation, Insolvency and Commercial Documentation. Terry is a practical and experienced lawyer who has worked with government agencies, private and publicly listed national and multinational companies across many industries. His speciality is helping to solve complex commercial issues.

Terry Ledlin is Special Counsel of Ledlin Lawyers, a boutique CBD law firm with 50-years of experience specialising in Credit Management and Collections, Commercial Litigation, Insolvency and Commercial Documentation. Terry is a practical and experienced lawyer who has worked with government agencies, private and publicly listed national and multinational companies across many industries. His speciality is helping to solve complex commercial issues.

Holly is a Lawyer at Ledlin Lawyers. At 6ft2 tall, the number one question Holly gets asked is, “Do you play basketball?” The good thing is, she’s a better lawyer than she ever was a basketball player. Holly takes advantage of her height in commercial litigation and dispute resolution, where a certain presence can often be key on and off the court (room). With her commercial approach, “slam dunks” are something Holly truly enjoys striving for in credit management and insolvency. Even on the bench, Holly is well-versed in great letter writing, drafting commercial contracts, and providing valued advice with the team at Ledlin Lawyers.

Holly is a Lawyer at Ledlin Lawyers. At 6ft2 tall, the number one question Holly gets asked is, “Do you play basketball?” The good thing is, she’s a better lawyer than she ever was a basketball player. Holly takes advantage of her height in commercial litigation and dispute resolution, where a certain presence can often be key on and off the court (room). With her commercial approach, “slam dunks” are something Holly truly enjoys striving for in credit management and insolvency. Even on the bench, Holly is well-versed in great letter writing, drafting commercial contracts, and providing valued advice with the team at Ledlin Lawyers.