Bad debt can be fatal to a business. CreditorWatch helps you avoid this by taking a proactive approach to debtor management. Our interactive trade payment program, DebtorLogic, reveals your debtors’ payment trends, enabling you to identify risks and prioritise your credit collection. Meanwhile, our suite of debt collection tools help you expedite debt recovery.

In this article, we reveal the power of CreditorWatch’s debt collection management tools. Learn how they strengthen your debt recovery procedures to help you get paid faster and improve cash flow.

Automate tedious processes

Collecting debts is notoriously frustrating, requiring endless time and persistence. CreditorWatch helps you streamline this process, so you can stop manually chasing outstanding accounts and start using your time more productively.

Strengthen payment requests with our letter templates

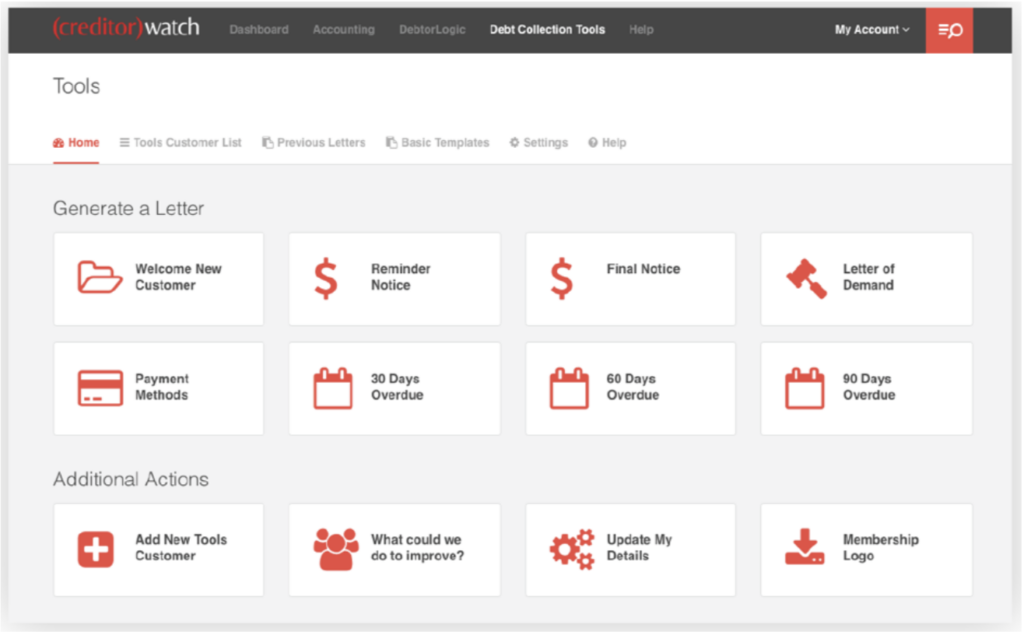

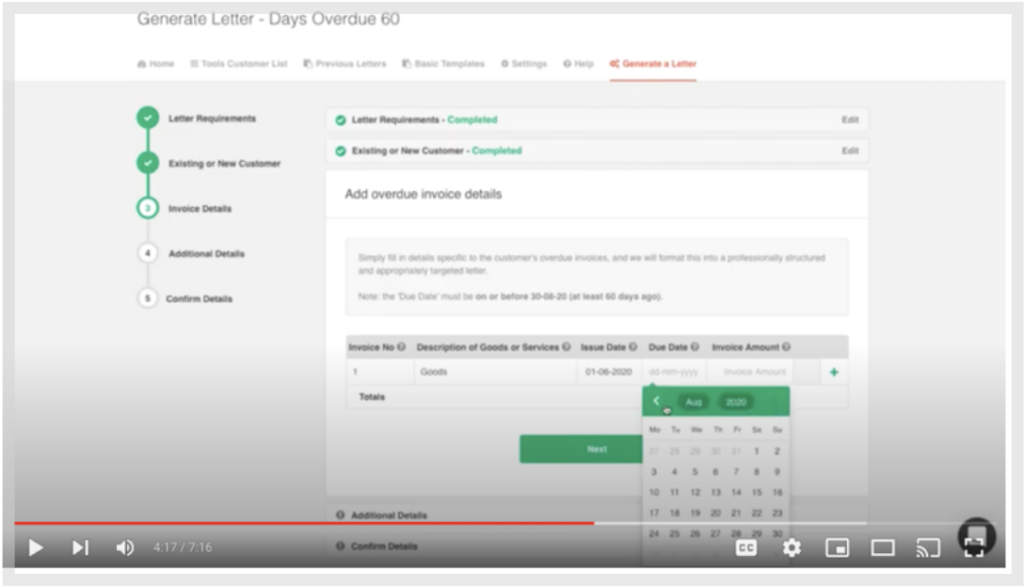

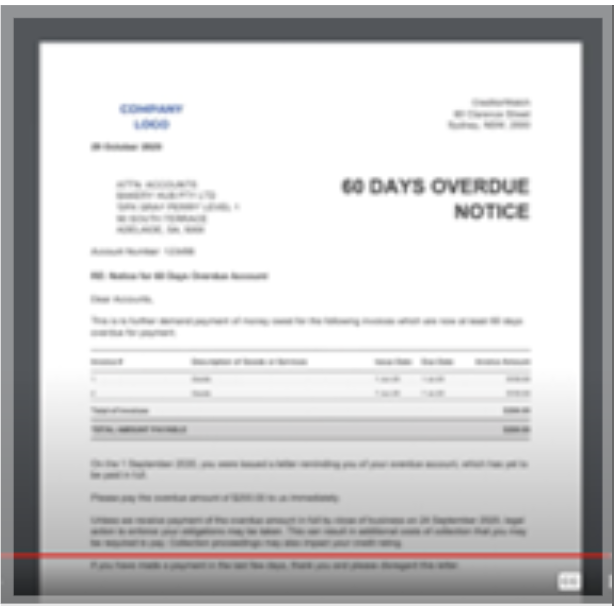

Get paid faster by using our custom letter templates for every stage of the credit collection process. Simply choose the type of letter for your needs, fill in your customer details and we’ll instantly generate a professional letter for you.

Types of letters:

- Welcome New Customer: Formally welcome a new customer and advise them of their credit terms.

- Payment Details: Inform a customer about the types of payment methods available.

- Reminder Notice: Remind a customer about an overdue invoice, outlining exactly what needs to be paid, when it is due, and how to make payments.

- 30 Days Overdue: Send this letter when your invoice is a minimum of 30 days past its due date.

- 60 Days Overdue: Send this letter when your invoice is a minimum of 60 days past its due date.

- 90 Days Overdue: Send this letter when your invoice is a minimum of 90 days past its due date.

- Letter of Demand: Reiterate the details of your overdue invoices if your customer refuses to pay.

- Final Notice: Send this to late-paying customers to claim overdue debt. This is a more forceful letter, which requests for full payment to be made by a specified date to avoid further action. It warns the debtor that you will be lodging a payment default against them and the ramifications of this. Often, after receiving one of these letters, debtors will make payment or at least respond to organise a payment plan.

Easy to use and navigate

Your user-friendly dashboard simplifies debtor management and communications.

- Tools Customer List: Easily view all customers you’ve generated letters for and quickly send them new letters.

- Previous Letters: See all the letters you’ve sent and organise this list based on letter type, date generated and entity name.

- Basic Templates: Download useful resources and common templates. Here, you’ll also get a best practices guide, providing tips on how to deal with debtors and recover bad debt.

Take advantage of CreditorWatch’s endorsements

Our powerful third-party endorsement has been proven to expedite debt recovery. Attach the CreditorWatch membership logo to your invoices, statements and final demand letters. This increases your chances of receiving payment by 53%!

Maintain customer relationships with professional communication

The risk of strained relationships is a significant issue when it comes to the debt collection process. Multiple calls chasing money can often lead to awkward and tense conversations, involving poor word choices and frustrated threats. It is often even more difficult to collect debt from long-time customers, as they may expect more flexibility based on ‘trust’. In this fraught process, businesses risk ruining relationships with their customers, old and new.

CreditorWatch helps you operate professionally and communicate clearly with your debtors, to ensure mutual understanding and maintain valuable relationships. We also help you monitor your customers so you stay informed about potential cash flow issues and whether they can pay on time.

Deal with delinquent debtors and recover bad debt

If you do not receive a response from your debtor after issuing their final notice letter, then register a payment default against them. Payment defaults are unique to CreditorWatch and remain on a company’s credit report for up to five years. 91% of customers will not engage with a company with a default. Lodging a default prompts non-paying debtors to settle outstanding debts to prevent ruining their credit file, reputation and business opportunities.

If, after lodging a default, if your debtor still does not pay, you may want to outsource this to a debt collector or lawyer. Beyond that, your final move would be to commence legal action and take your debtor to court.

Stay on top of your ledger with CreditorWatch

CreditorWatch integrates seamlessly with accounting packages, Xero and MYOB, to streamline your accounts receivables process. This also helps to ensure you lodge invoices on time to increase your chances of getting paid. Our debtor management solutions empower you to stay ahead of your debtors to prevent late payments and bad debt.

CreditorWatch’s debt collection tools and templates help businesses expedite recovery and secure cash flow. If you’re interested in using these solutions to protect and grow your business, get in touch with us today / get a 14-day free trial here.

Get started with CreditorWatch today

Take your credit management to the next level with a 14-day free trial.