Bad business debt – every business owner’s nightmare

How can you avoid bad business debt? When business transactions are conducted on credit, there’s always the risk that the debtor won’t pay their debt on time or won’t be able to pay it at all if they face liquidation or insolvency.

When customers won’t or can’t pay their debt, the creditor experiences a detrimental flow-on effect:

- First, the customer defaults on the payment

- This causes the creditor to accumulate unpaid debt which could lead to bad debt

- This hurts their cash flow; the bigger the financial loss, the longer it takes to recover; businesses that deal with large single transactions are especially vulnerable

- As a result, the business has to fund credit sales, thus reducing profitability and threatening financial stability

As a business, it’s your responsibility to conduct due diligence to mitigate this risk. This article addresses how to reduce the risk of bad debt by using effective debtor management strategies.

Most debt collection approaches lack effective data-driven processes

The problem with debt collection is that it might sometimes feel like you’re not in control of the situation; as if you’re just crossing your fingers and hoping that your debtor will pay you.

Many SMEs tend to follow collection practices based on arbitrary factors – for instance, prioritising collection from the highest to lowest amount, or oldest to newest debt.

Outsourcing the process to legal firms or debt collection agencies might not always be the most appropriate solution either. Needless to say, the collections process is often frustrating, inefficient and time-consuming.

An effective collections process would rank debtors according to their probability of success. This can be statistically derived from past payment behaviours.

Compared to larger corporations, SMEs have a higher chance of defaulting on their payments. Yet, it is more difficult to predict how or when they will make payments due to the lack of available and accurate data on their payment history and behaviours.

Businesses that understand their customers’ payment patterns have a significant advantage as they will be able to rank them according to the highest to lowest chance of success. By using this method to prioritise collections, you can maximise cash inflow.

Debtor management

Debtor management requires the implementation of clear processes, detailed documentation, access to accurate insights on payment behaviour, and intelligent data analysis.

It should be both proactive and reactive, and is critical to ensuring your business has sufficient working capital to maintain profitability.

Dealing with unpaid debt is a challenging process for most business owners. What are the best collection practices to maximise debt recovery? Is it possible to prevent debt in the first place?

In the following section, we address these questions and more.

Debtor management best practices

-

Establish credit policies and terms of trade

These should cover areas like pre-payments, down payments, discounts for early payments and so on. Credit policies should be clearly documented and reviewed regularly. Terms of trade should be reviewed by solicitors to ensure they are legally compliant.

-

Document and record all payment arrangements

All documentation like quotes, invoices, contracts and purchase orders should contain precise information on the products supplied and their delivery timelines. To reduce the likelihood of overdue payments becoming bad debts, credit terms and payment methods need to be clearly established. Also, be punctual in sending out your invoices and ensure your invoice formats meet your customers’ requirements.

-

Establish clear accounts receivable processes

Ensure all parties are fully aware of the accounts receivable process. For instance, there shouldn’t be any confusion about the collections process or when to outsource debt collection. These processes should work to maintain cash flow under all circumstances – for example:

- When a payment is overdue, contact the debtor promptly to confirm the invoice was received.

- When debtor disputes occur, ensure you continue to seek payment of the non-disputed amount.

-

Identify and mitigate risks

It is important that you assess the level of creditworthiness for new and existing customers. For existing customers, closely monitor your debtors’ ledgers and analyse your aged debtors report to effectively manage your expectations and collections. For prospective customers, make sure to investigate their financial history and understand their credit risk.

High-risk customers are those that are:

- Experiencing cash flow problems

- Deliberately withholding payments

- In financial difficulty and at risk of default, court action, liquidation or insolvency

- Demonstrating deteriorating payment behaviour

It’s possible to mitigate risks by:

- Monitoring your customers’ credit profiles and outstanding balances

- Getting insights into the payment patterns and risk scores of your debtors compared to the rest of the market

- Identifying adverse behaviour like ABN/ACN changes, mercantile enquiries, winding up notices and cross directorships

- Getting regular alerts about such changes in your customer base

-

Review credit terms

Regularly review each debtor’s credit limits to ensure they are still appropriate according to their payment patterns. Monitor their days sales outstanding (DSO) to identify adverse trends and take the necessary action to pre-empt and/or rectify this. For instance, if a debtor has a history of paying late, you might reduce their credit limits or implement lower-risk payment options, such as upfront payment instead of 30-day credit.

-

Systems and data management

Data integrity is essential for credit and debtor management. Accurate, complete and reliable information is required in order to understand and predict customer payment behaviour. Such information would include their credit scores, whether they are high or low risk, how they pay you compared to the rest of the market, and so on. This data can empower you to make important decisions and maximise your collection rate.

-

Collection services and financing solutions

When you face the inevitable process of collecting debt, evaluate whether credit insurance and debt recovery services are appropriate for the situation.

You might consider financing solutions such as debtor finance (invoice factoring and/or invoice discounting). This will give you working capital to address cash flow issues caused by overdue invoices. Although offering trade discounts may help accelerate your cash inflows and shorten the average collection period, the trade-off is the lost revenue that would impact your bottom-line profit. Thus, the costs of such solutions need to be weighed out against the expected improvement in cash flow.

-

Bad business debt estimation and provisioning

You can statistically estimate default probability using historical data from the business and general industry. Identify your best and worst customers according to who pays you and/or the market late. As the age of receivables increases, so does the risk of default. By measuring your expected losses, it is then possible to include provisions for bad debts in your ongoing budgeting processes. This will help to reduce the impact on your profitability.

In a nutshell, this is how to avoid bad debt from customers…

Debtor management is crucial in maintaining your organisation’s financial health and profitability.

Here are some ways you can stay ahead of bad business debt:

- Track customer payment behaviours and adjust credit terms accordingly

- Regularly assess debtor risk levels and creditworthiness

- Prioritise collections according to their statistical probability of success

- Manage expectations by identifying your best and worst customers

- Ensure all your data is accurate and regularly updated

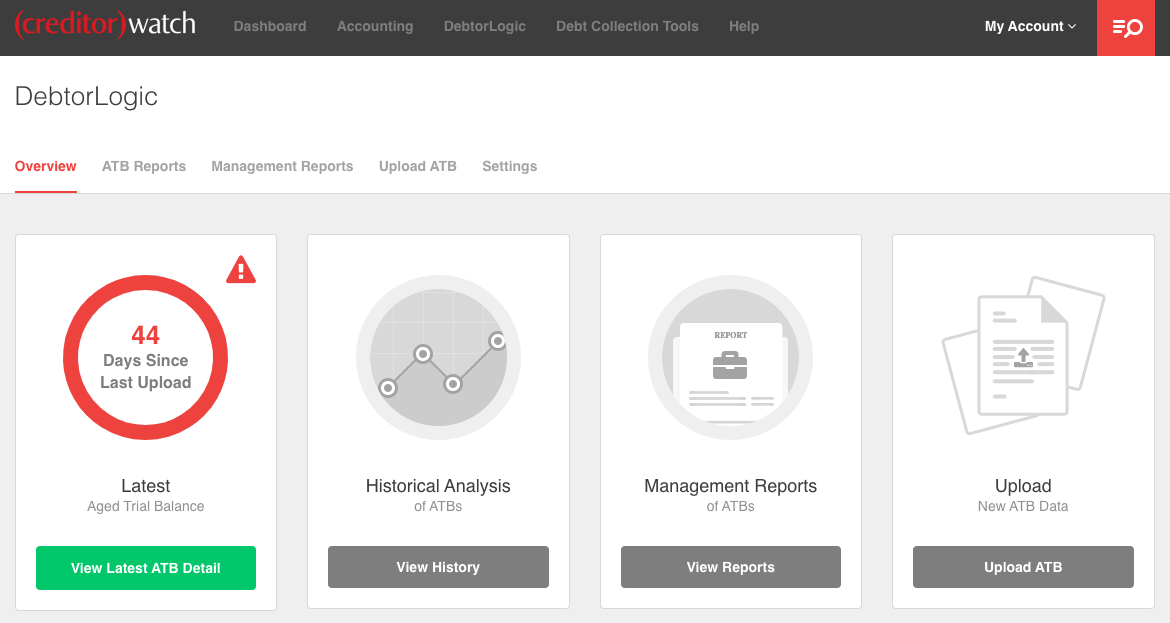

CreditorWatch offers a holistic credit management product suite, featuring the newly updated DebtorLogic, an all-in-one platform which minimises the risk of bad debt. DebtorLogic not only has access to unique data on SME payment trends, it also produces visually appealing reports via its user-friendly interface. Other features of CreditorWatch include credit reports, credit scores, datawashing, monitoring and alerts, payment predictors and debt collection tools.

To find out whether DebtorLogic is suitable for your business, get in touch today.

You might also find these articles interesting:

Our New DebtorLogic: More Features, More Data and How to Make a Debt Collection Call