- Product SuiteDiscover Product Suite

Explore our suite of integrated products and all-in-one credit management platform

- SME

- Corporate

- Enterprise

Product Solutions

- Pricing

- News Hub

- Company

- Free Trial

- Login

Explore our suite of integrated products and all-in-one credit management platform

Streamline your debt recovery process with our suite of tools and get paid faster.

Streamline Your

Debt Recovery

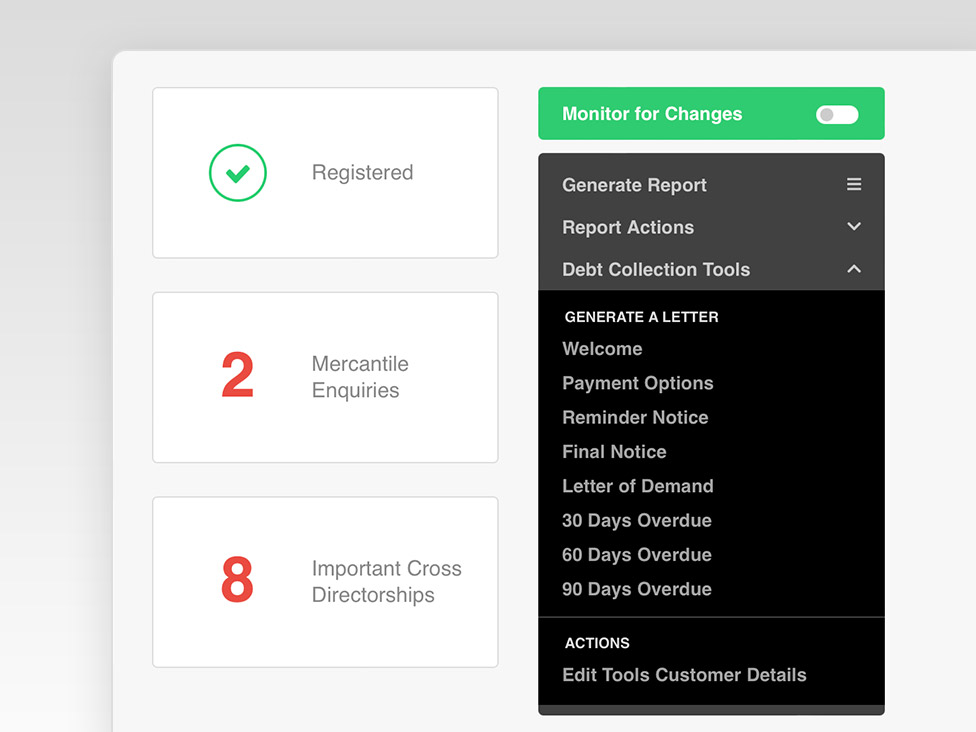

CreditorWatch’s debt collection tools help you get paid faster, eliminating the need to manually chase outstanding accounts. Our debtor management solutions enable you to gain visibility across all your debtors, identify risk indicators and prioritise collections. Strengthen your recovery procedures and utilise our debt collection letter templates for every stage of the collections process.

Getting Paid Faster

Receive Payments

By 53%

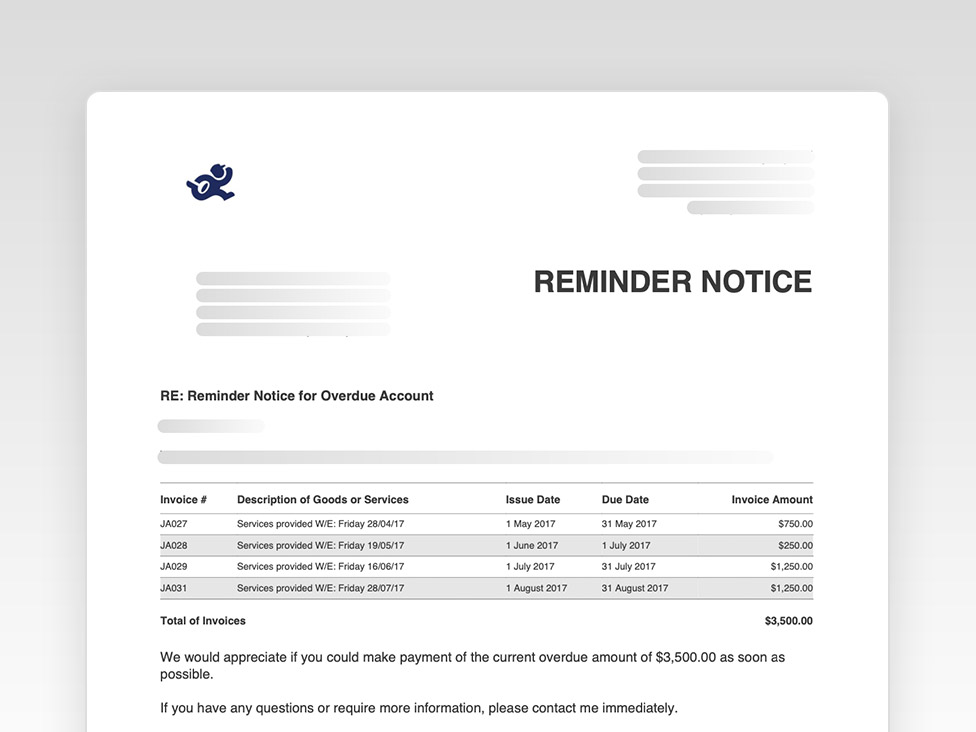

Our branded templates include welcome letters with payment terms; payment overdue notices; final notices; letters of demand; 30, 60 and 90-day reminder notices. Attach a CreditorWatch membership logo to all your invoices and statements. Our powerful third-party endorsement has been proven to expedite payments – using our logo increases your chance of receiving payment by 53%.

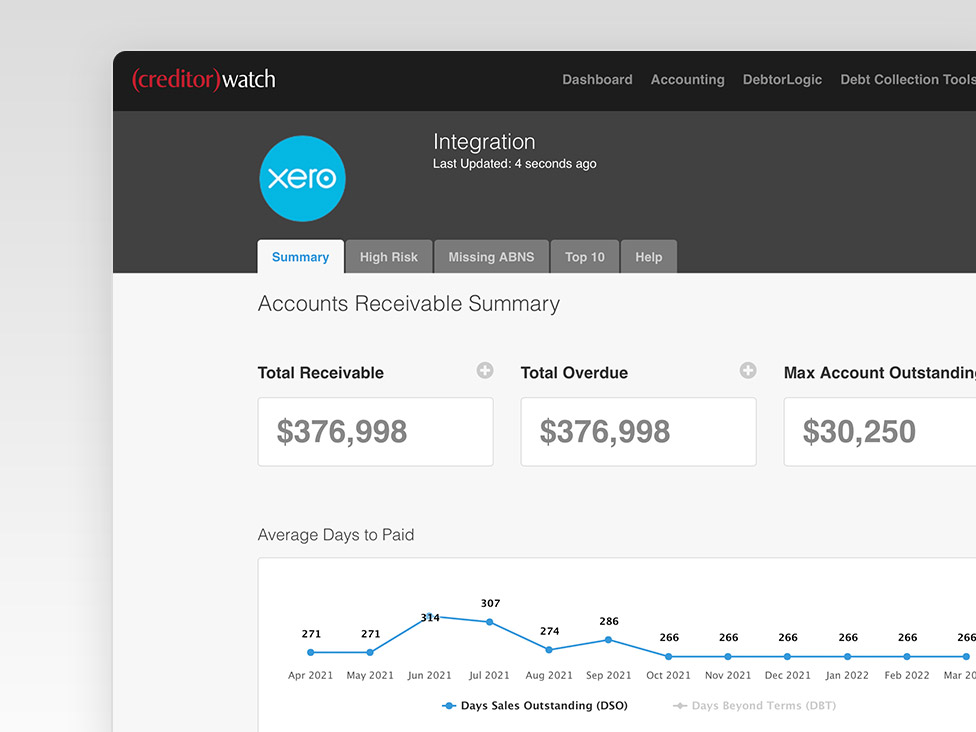

CreditorWatch integrates seamlessly with Xero and MYOB to streamline your accounts receivables process and highlight risky debtors directly in your accounting dashboard. Once integrated CreditorWatch can:

Accounting

Integration

Recover Debts

Easier

Payment defaults are unique to CreditorWatch and remain on a company’s credit report for up to five years. It is a powerful way to encourage your debtors to pay you faster. 91% of customers will not engage with a company with a default. Registering a payment default operates as a deterrent for slow or non-paying customers.

Find out more about how our debt collection tools can help you get paid faster.

Take a proactive approach to debtor management and debt collection with a 14-day free trial.