Late Payment Recovery: The Five Steps to Get Paid Faster

Late payment recovery and bad debt cause more damage to the smooth operation of SMEs than any other business risk.

Whilst maintaining regular cash payments and low aged debtors are crucial to the success of any business, most SMEs are generally unable or unwilling to allocate enough resources into effectively managing these two key issues.

Businesses already struggle to deal with extensive payment terms, in addition to their high operational costs and limited cash flow. As such, SMEs often fail to escalate overdue accounts due to:

- The time and resources required to independently pursue customers for unpaid accounts;

- The complexity of debt recovery, and a lack of knowledge as to where to begin, or how to maximise their chances of recovery; and

- The cost and stress which may accompany independent recovery action.

The process is daunting, and so, it is common for the unpaid debt to be absorbed in the costs of doing business.

Businesses ask:

Does it have to be this way?

When does enough become enough?

Where would I even begin?

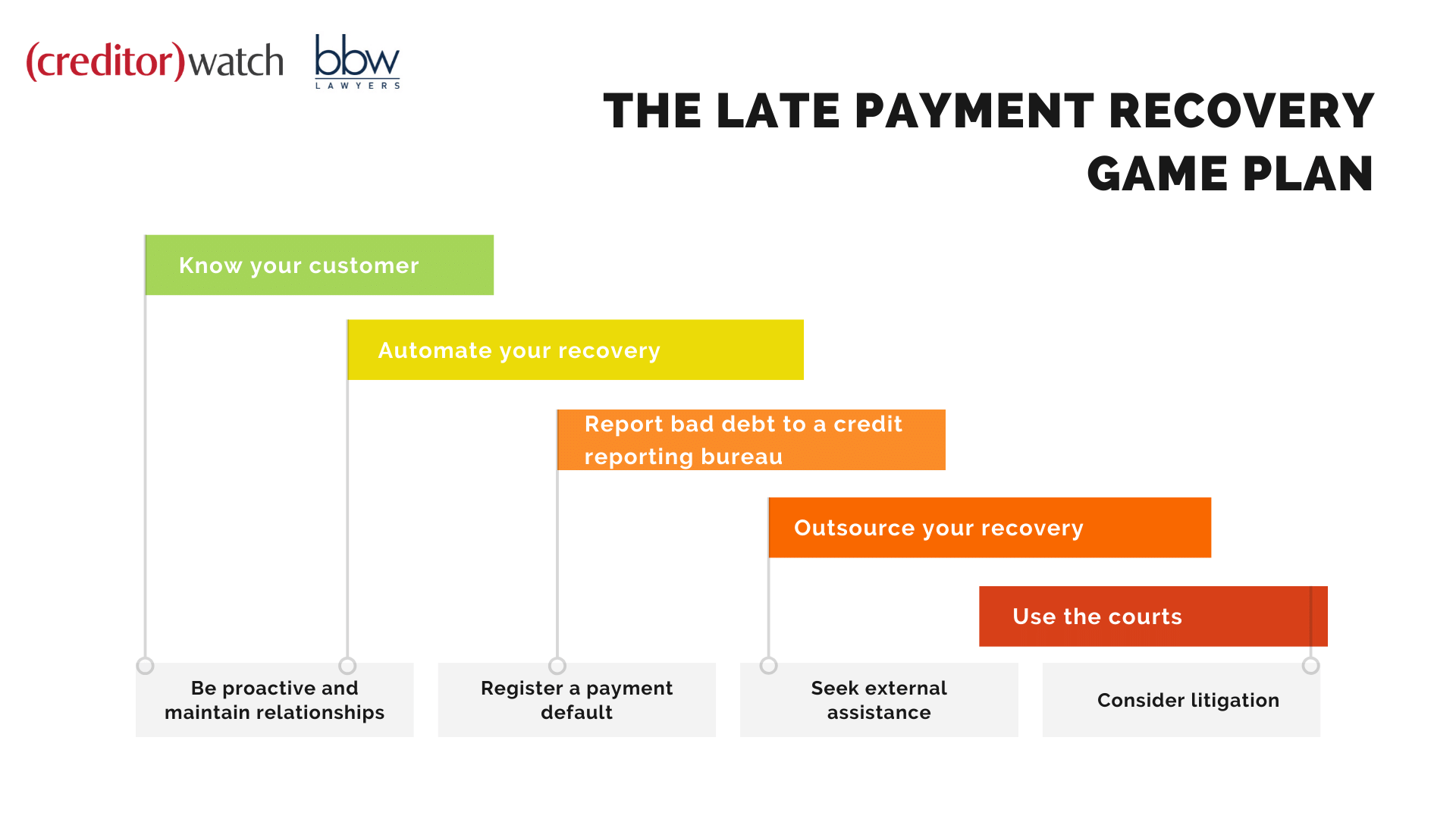

CreditorWatch, in collaboration with BBW Lawyers, have prepared a commercial game plan, strategically designed to recover late payments and bad debts for SMEs: a Late Payment Recovery Game Plan.

Implemented correctly, the Late Payment Recovery Game Plan means SMEs are able to maximise their ability to:

- Identify which debt should be recovered;

- Devise a bespoke collection process for optimising recoveries; and

- Comprehend the do’s and the don’ts of successful debt recovery.

1. Know your customer

The first rule of an SME’s Recovery Game Plan – know your customer. As frustrating as non-paying customers are, it is important that SMEs do not act impulsively and allow emotions to take hold, ruining what may have been (and may continue to be) a long-term client.

SMEs must understand their customers, and look behind the debt.

Are there factors are at play which may be affecting a customer’s ability to make payments on time?

Is the customer well-funded, communicable, honest, and otherwise a promising prospect for future business?

Are there external factors contributing to their late payments (eg. COVID-19)?

If Yes: a commercially strategic phone call or email may be the gentle nudge required to receive payment, and may earn the customer’s appreciation and respect. Try these tips to retrain your debtors.

If No: ensure that the debtor is trading, solvent, has the assets to pay the debt, and follow the next step in the Recovery Game Plan.

2. Automate your late payment recovery

Any good recovery process requires persistence and consistency.

Coordination of internal recovery procedures are often determinative of an SME’s ability to successfully recover from bad debtors.

There are companies, like CreditorWatch, who provide automated processes, which ensure the timely and reliable delivery of debt collection tools such as:

- Welcome letter with payment details and terms;

- Payment overdue notices;

- 30, 60 and 90 day reminder notices; and

- Final payment notices.

Inconsistent recovery procedures fail to facilitate the efficient process of bad debt recovery. SMEs must automate their recoveries, and stay on the front foot.

3. Report bad debt to a credit agency

With CreditorWatch, an SME can register a payment default against bad debtors, allowing other businesses to be alerted to the debtor’s behaviour.

Registering a payment default is a punitive tactic and also operates as a deterrent. It is a robust measure, which:

- Negatively impacts the credit record of a customer which has not paid its invoices;

- ‘Names and shames’ the customer as owing the debt; and

- Warns fellow SMEs of the non-paying habits of the customer.

Learn more about payment defaults

4. Outsource your late payment recovery

Often at times, it pays to rely on professionals to make contact with bad debtors and expedite the recovery of unpaid invoices and debt.

Bad debt management is not a simple issue, and attempting to recover late payments internally can often turn into a fruitless exercise.

When necessary, outsourcing the recovery of bad debt to external agencies, such as law firms, provides the benefit of:

- Speeding up the recovery process of bad debt collection;

- Ensures the debtor knows that late payments will be treated seriously;

- Provides an SME with peace of mind that the collection of the debt is being handled by professionals;

- Allowing an SME to focus on the successful operation of their own business; and

- Signposting to debtors and customers that an SME has a principled approach to debt collection, and that bad debt will not be tolerated.

5. Use the courts

The final remedy available to SMEs with respect to bad debt is litigation. What was once a daunting option, is now a more streamlined, cost-effective and efficient strategy to recover debts.

SMEs, with debts under $100,000, are able to take advantage of the Local Court system in New South Wales, which has evolved over recent years to accommodate cost-conscious and busy business owners seeking a just, quick and cheap resolution to their outstanding debts.

In 2019, the New South Wales Local Court increased the cap of its ‘Small Claims’ Division from $10,000 to $20,000, allowing individuals, small businesses and SMEs to benefit from the litigation process, without it being a significant cost to the business.

For debts over $100,000, other Court jurisdictions are available to SMEs to pursue bad debt through litigation.

SMEs who engage experienced legal practitioners are often rewarded with a successful outcome, at minimal cost.

The Do’s and Don’ts

Do | Don’t |

· Remain commercial. · Assess your customer’s bad debt, and the implications of recovery action. · Have a Recovery Game Plan. · Know the capabilities of your team and internal resources. · Automate your payment notices, final notices, and demands for payment. · Outsource your recovery action. · Report late payments and bad debt. · Register payment defaults. · Utilise the litigation process to your advantage. | · Act impulsively. · Be emotionally attached to the debt. · Ignore bad debt in the hope it will be eventually paid. · Internalise your entire recovery system. · Be hesitant to invest in your Recovery Game Plan. · Ignore the benefits of litigation to maximise your recoveries.

|

Good business practices and procedures will lead to organisational longevity and success.

That is why a well thought out and implemented Late Payment Recovery Game Plan is most effective before a debt goes bad.

For further information or should you require any assistance, please contact John Fairgray (Partner) jfairgray@bbwlaw.com.au, Luis Ormazabal (Senior Associate) lormazabal@bbwlaw.com.au, Balveen Saini (Associate) bsaini@bbwlaw.com.au, or Nicholas O’Connor (Solicitor) noconnor@bbwlaw.com.au.

About BBW Lawyers

BBW Lawyers’ commercial, insolvency and debt recovery team works closely with a number of prominent NSW and Australian companies and organisations in providing strategic advice and dedicated legal services. The team comprises of industry specialists who are active members of, and contributors to, the Australian Institute of Credit Management (NSW Divisional President – Balveen Saini, 2019 Legal Representative of the Year – Luis Ormazabal), as well as having extensive experience in all Courts and Tribunals.

© BBW Lawyers 2020. This is general commentary and should not be relied upon as if it were legal advice be reproduced by any process without written permission from BBW Lawyers.