- Product SuiteDiscover Product Suite

Explore our suite of integrated products and all-in-one credit management platform

- SME

- Corporate

- Enterprise

Product Solutions

- Pricing

- News Hub

- Company

- Free Trial

- Login

Explore our suite of integrated products and all-in-one credit management platform

Better understand your trading partners and comply with complex legislation.

Understanding

Trading Partners

CreditorWatch’s Know Your Customer (KYC) procedure verifies the identities of your clients and assesses potential risks of doing business with them. This includes a variety of services including AML reports, UBO reports, Verification of Identity (VOI), Document Verification Service (DVS) and international reports. We help you easily comply with AUSTRAC’s Anti-Money Laundering/Counter-Terrorism Financing (AML/CTF) Act.

Protecting Your Business

AML Screening

Report

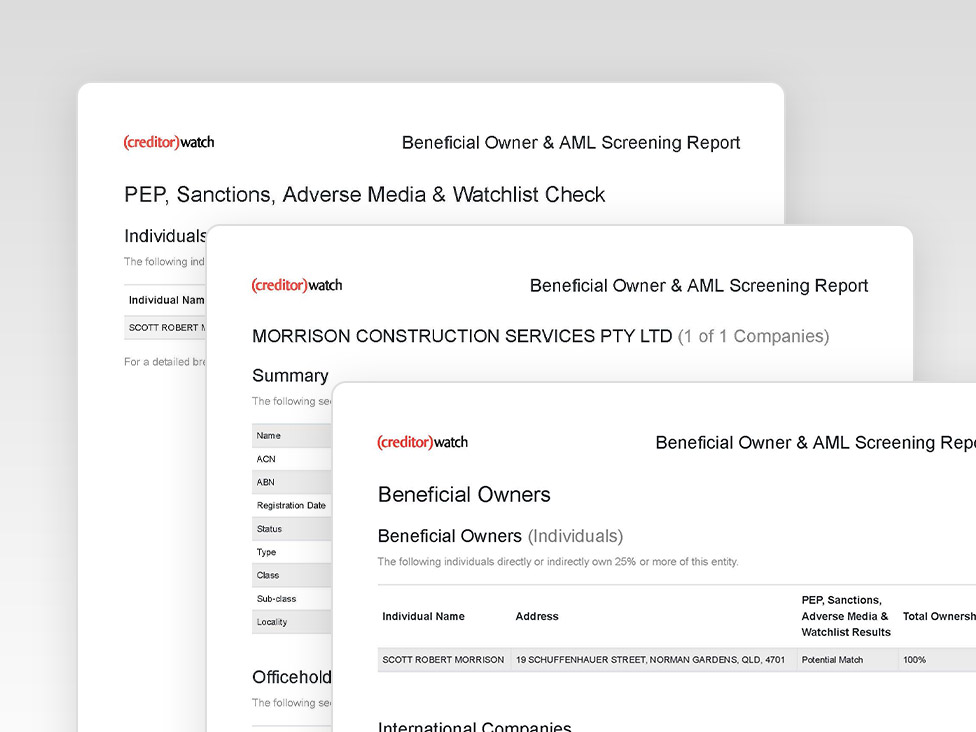

AUSTRAC’s AML/CTF laws prevent corruption, tax evasion, theft and other crimes. CreditorWatch offers two types of Anti-Money Laundering reports to help you meet your reporting obligations:

Identifying the beneficial owner of a business is integral to complying with the AML/CTF Act. CreditorWatch’s UBO report reveals the beneficial owners of an entity with a single click, helping you avoid the complicated process of digging through ASIC reports and manually calculating ownership percentages of entities with complex structures. Identify risks associated with the beneficial owners of your customers and suppliers.

Sophisticated Reporting Results

Make An Enquiry