Learn how to get money from debtors in any scenario

The COVID-19 pandemic has been an overwhelming challenge for businesses of all sizes. It’s an uncertain time for everyone, including creditors who aren’t sure how to collect debts from customers who are suffering as much as they are.

Here’s how to navigate the most common payment scenarios during COVID-19 and get debtors to pay you first.

Keep your lines of communication open

This is the key to understanding how to collect money from debtors in the current economic climate.

Never underestimate the importance of building a healthy debtor relationship based on mutual understanding and trust. If you enjoy clear communication with your customers, you’ll know if they usually pay on time and are honest about their cash flow issues.

CreditorWatch’s Payment Predictor and DebtorLogic are insightful tools to assess how a debtor treats you and the risk they pose to your business.

Scenario #1 – Your debtor has always been a prompt payer but is now struggling

If you can manage it, a little leniency goes a long way to ensuring your customer relationship remains solid. Pick up the phone and have an honest conversation about how you’re both faring in the pandemic.

Find out if your customer is legitimately struggling or if they’re only using COVID-19 as an excuse to be lax with their payments.

Your credit policy should already clearly document your trading terms, so gently remind your debtors of these and come to an agreement. You might not need to resort to debt collection tools just yet, but they’re readily available should you need them.

Scenario #2 – Your debtor has always been slow to pay and is even more so now

If you’re been monitoring businesses, you’ll have a good idea which of your debtors are slow and potentially using you as a bank. They might think they can get away with more by blaming their poor payment behaviour on the pandemic. This is a good opportunity to reassess your credit terms with your customers and move non-compliant debtors to cash on delivery.

If you’ve used CreditorWatch’s payment overdue notices without any luck, consider lodging a payment default. Registering a default is an effective way to prompt slow-paying debtors to pay out of fear of ruining their credit file and relationship with other suppliers.

Our top tip to get debtors to pay? Even just warning a debtor you will register a default against them is often enough to get paid, just like it was for this Western-Australian packaging company.

Scenario #3 – Your debtor owed you money before COVID-19 and still isn’t complying

Monitor the business for signs of insolvency and protect your own business by moving to cash on delivery and securing your assets. If the debtor has been upfront about their difficulties and you can establish a line of communication, work together to decide on a payment arrangement.

If they haven’t been in touch or aren’t answering your calls, registering a default can help recover your debts without the need for legal action, like it did for Cassaform, a major Australian formwork business.

The power of payment defaults

Reporting your debt to CreditorWatch’s 50,000+ strong community with a payment default is a great way to ensure other businesses also stay away from the non-compliant customer. And it could also be a sign of things to come: more than 50% of businesses that incur a payment default go into administration within 18 months.

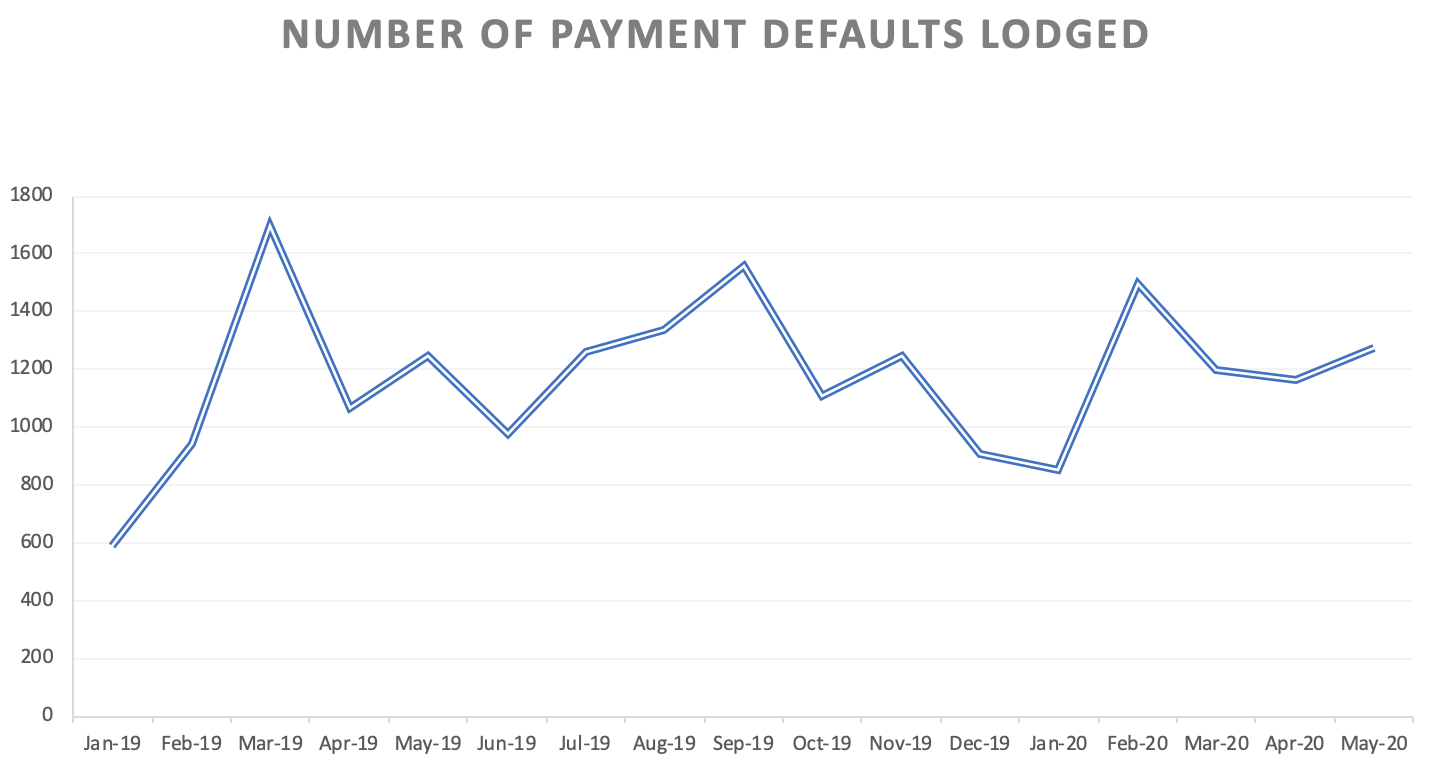

According to CreditorWatch data, 20% fewer payment defaults were lodged in March compared to February 2020. Creditors were showing leniency during the early days of the pandemic, but that seems to be waning now: from April to May 2020, there has been a 9.5% uptick.

Registering a payment default is often a last resort to get a debtor to pay before seeking legal action, which can be expensive but sometimes necessary. Escalating to a debt collector or the courts can seem like a daunting process, but it does have a place in any creditor’s late payment recovery game plan.

Remember, the government’s temporary relief measures that affect statutory demands only relate to debts incurred after 25 March 2020. If you have a debt from before this date, the usual $2,000 threshold and 21-day response time still applies. Learn more about your rights as a creditor during coronavirus here.

Scenario #4 – Your debtor is still trading but is on the brink of insolvency

According to CreditorWatch data, administrations fell by more than 37% from March to April 2020 as businesses took comfort from the government’s temporary relief measures. But, this doesn’t mean these businesses will last. Beware of zombie companies that are continuing to trade now but have no hope of financial viability when the measures cease on 24 September.

Protect your business’ assets by registering on the PPSR, review your credit application documentation, and it goes without saying, don’t continue to offer credit to companies on shaky ground. If you still have outstanding debts and are unsure how to resolve them during this time, professional advice is available to you.

Importance of proactive debtor management

If the pandemic has proved one thing, it’s how important it is to have effective debtor management processes in place before you run into trouble. It’s integral to maintaining your cash flow and staying ahead of bad debt.

And, it doesn’t need to be time-consuming or tricky. Read this blog post for CreditorWatch’s top 8 best debtor management practices you can implement in any economic climate.