- Product SuiteDiscover Product Suite

Explore our suite of integrated products and all-in-one credit management platform

- SME

- Corporate

- Enterprise

Product Solutions

- Pricing

- News Hub

- Company

- Free Trial

- Login

Explore our suite of integrated products and all-in-one credit management platform

Protect your business by taking a proactive approach to debtor management.

Reduce

Debtor Risk

Gain a competitive edge with CreditorWatch’s exclusive insights. Our exclusive trade payment data provides the most accurate picture of how a market is being paid. Use Payment Predictor to view an entity’s payment history, including the average number of days it takes to pay its bills. Compare this to the industry average to identify and avoid slow paying businesses. Make accurate credit decisions to secure cash flow and stay ahead of bad debt.

Data Driven

Analysis

Unique Data

& Insights

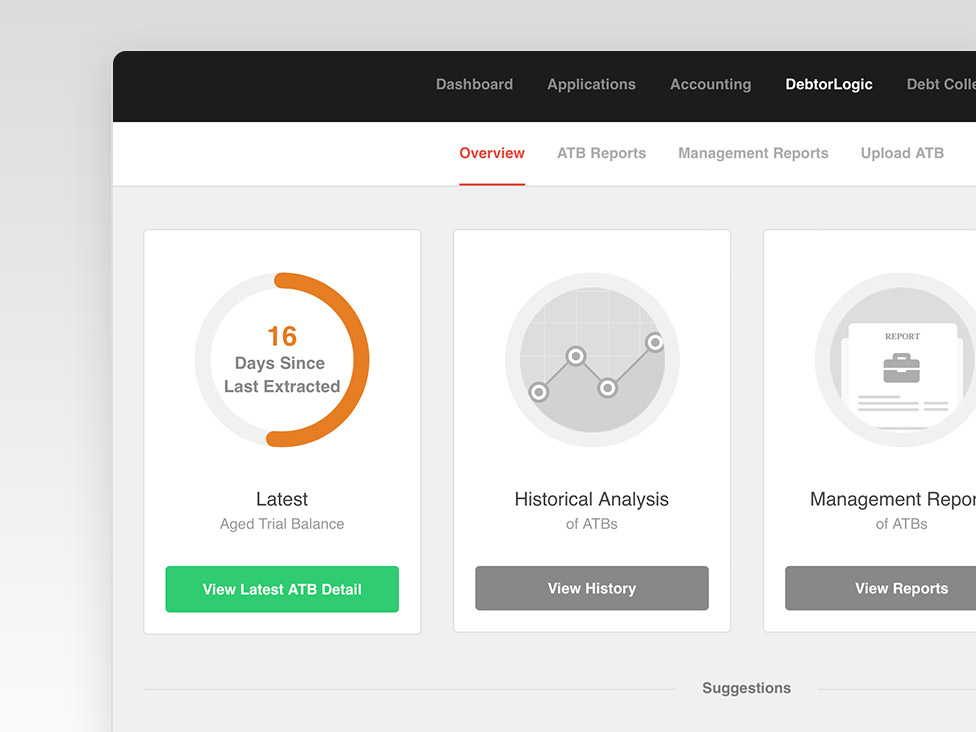

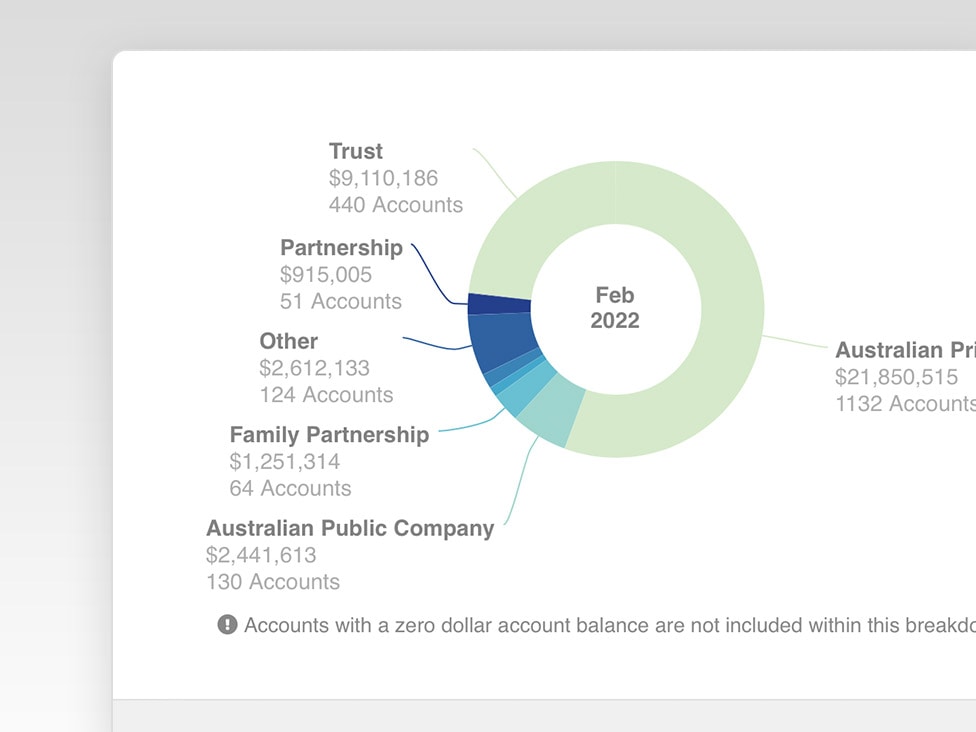

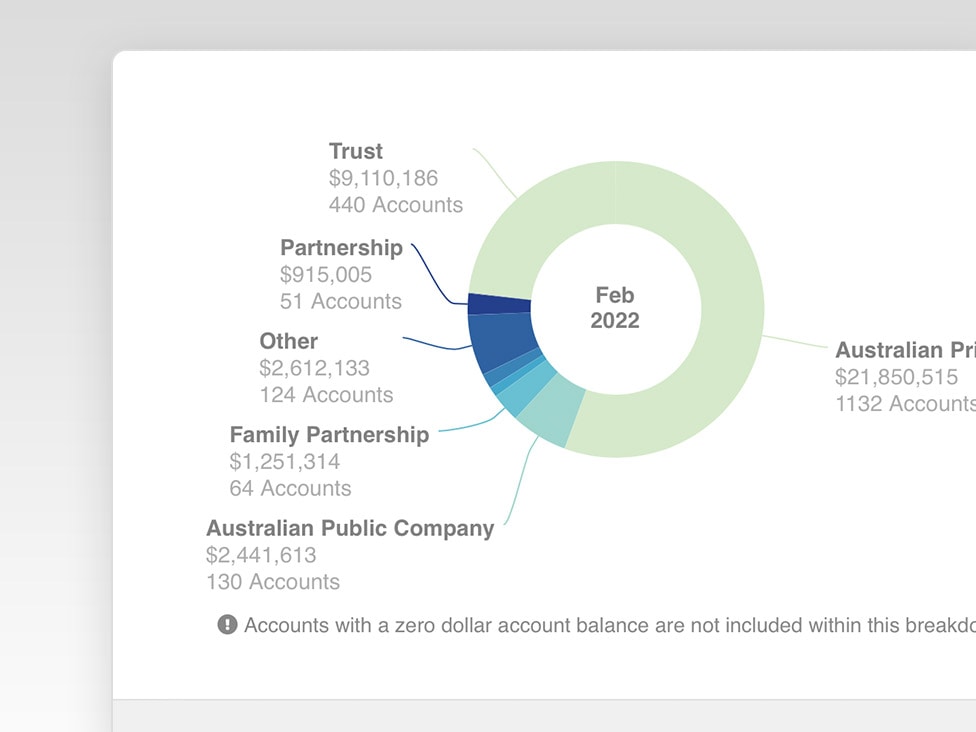

DebtorLogic is our interactive trade program that provides a data-driven analysis of your aged trial balance (ATB). Analyse your entire customer portfolio to uncover warning signs of credit risk. Reveal deteriorating payment behaviour and determine a debtor’s propensity to pay an outstanding amount. Easily identify high-risk debtors and prioritise your collections.

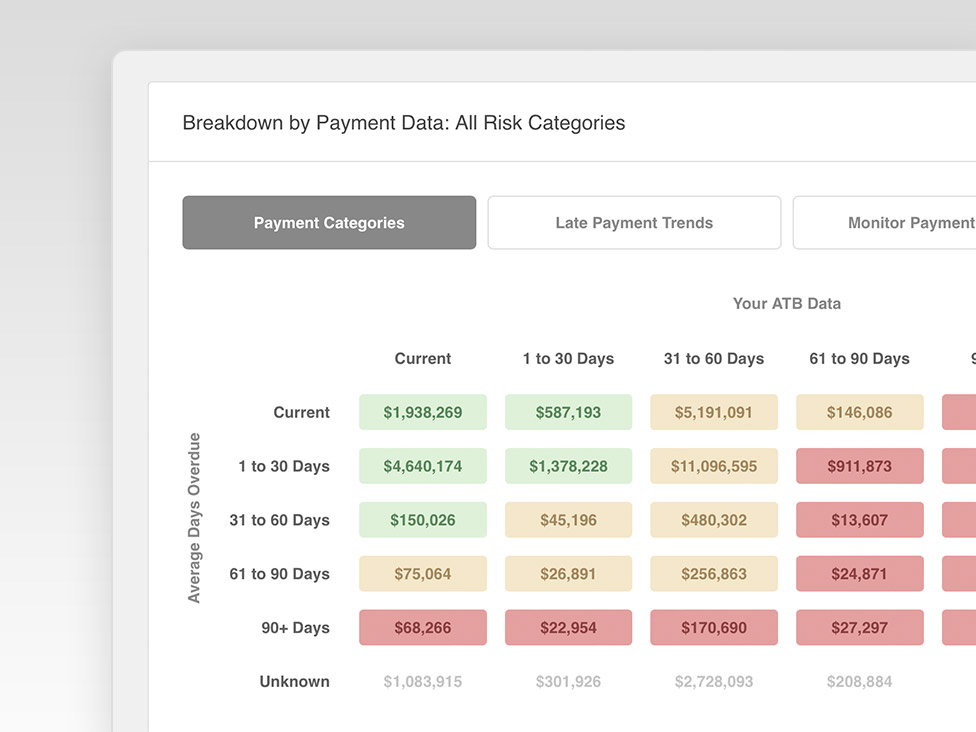

Analyse payment trends, predict payment behaviour, adjust payment terms, prioritise collections, avoid slow paying businesses and get paid faster.

Get real-time alerts about risk indicators like deteriorating payment behaviour, outstanding balances, cash flow issues and payment defaults.

Discover how you’re being paid in comparison to the market. See which customers are deliberately withholding payments and experiencing cash flow problems.

Gain deeper insights about your debtors, understand payment risks and analyse an entity’s likelihood of paying based on their past behaviour.

Prioritise collections to reduce days sales outstanding (DSO) and use our debt collection tools to improve the overall collection rate of your portfolio.

Unique Data

& Insights

Automate debt recovery with our debt collection tools. Our letter templates help you build a professional rapport and communicate trading terms. Strengthen payment requests and reduce payment times. Use the CreditorWatch membership logo on your invoices and statements — this third-party endorsement has been proven to increase chances of receiving payment.

Make An Enquiry

Take a proactive approach to debtor management and improve your cash flow with a 14-day free trial.