Are you making the most out of your CreditorWatch subscription? By now, you already know how CreditorWatch strengthens your credit risk management processes. Here’s a tip to improve this further – integrate your Xero or MYOB accounting package with CreditorWatch.

This integration enhances automation to increase speed and accuracy, empowering businesses to take a more proactive approach to credit management. It’s a free, quick and easy way to reap additional benefits from your CreditorWatch subscription.

Without a dedicated accounts receivable or credit risk team, many small and medium businesses manage their accounts on a weekly or monthly basis. This approach is a reactive one – it may be too late when they discover an overdue account, giving them little chance of recovering their debt.

When it comes to managing credit, proactivity enables you to stay on the front foot. Integrating your Xero or MYOB accounting package with CreditorWatch equips you with some of the tools, functionalities and proactive credit risk management capabilities of larger organisations.

Automation enables businesses to generate deeper insights, quickly identify risks, increase transparency and make better decisions. Linking your accounting package increases automation, giving you the advantage of speed and accuracy, both key factors in credit risk mitigation. When your customer starts heading towards delinquency or failure, you need to act quickly to be ahead of other creditors and recover your debt before they collapse.

Benefits of integrating your accounting package

Integrating your accounting package improves debtor analysis, ensuring that you don’t overlook anything or anyone. Gain a better understanding of your ledger and act proactively with speed and accuracy. Easily monitor all your debtors, compare them against their credit files and get a clear overview of the risks associated with each entity straight from your dashboard.

Check out these additional features you’ll get from the integration:

-

Automated credit checks for proactive due diligence on new customers

When you integrate your Xero or MYOB package, CreditorWatch will automatically email you a credit report for each new contact added. If you have forgotten to look them up or are not monitoring them, we will push a credit report to you via email.

This is a proactive way to get on top of your new customers. It helps you ensure that there is no adverse information against them and gain confidence that you’re dealing with a company that’s likely to pay their invoices. Our 24/7 monitoring function also gives you real-time email alerts about any red flags associated with your debtors, allowing you to take action before it’s too late.

-

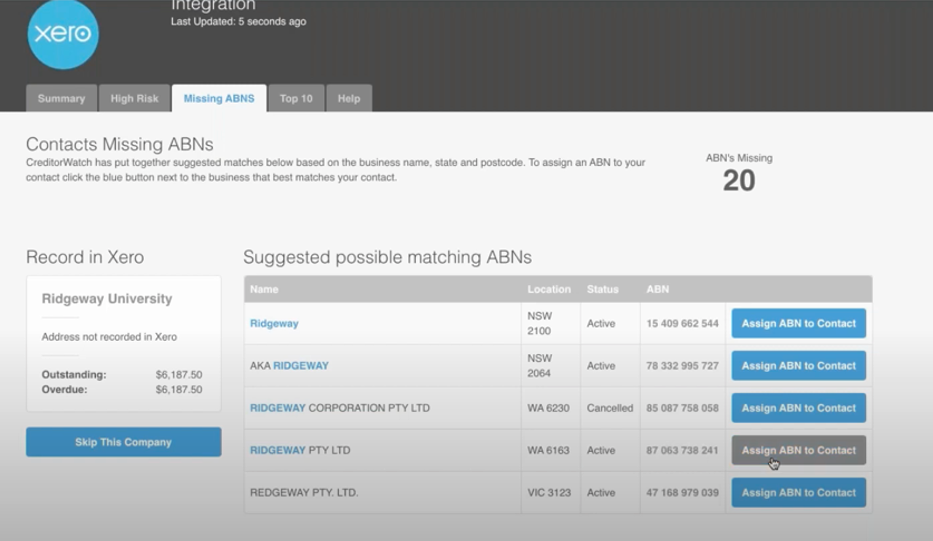

Identify and verify your customers’ ABNs to know exactly who you’re working with

Do you have the ABNs of all your customers on file? Many businesses do not record their customers’ ABNs and fail to understand the risks associated with this. The ABN is the official identifier of every commercial entity. It is essential to identify and verify your customers’ ABNs because it reveals exactly who you’re dealing with.

Our Name Match function uses a proprietary algorithm to match the information you have on a particular company to an actual ABN. It takes the name and/or address in your Xero or MYOB records and suggests possible matching ABNs, enabling you to quickly and easily assign ABNs to your existing records.

All reporting and monitoring at CreditorWatch are based on ABNs. With your customer’s ABN, you can verify that it is a legal entity, see who its directors are, run credit checks and receive alerts on high-risk issues. Without this, you would have to manually search for each business name in the CreditorWatch platform on a case-by-case basis. Furthermore, if you ever get to the collections stage, the ABN will be the first thing your debt collector or lawyer will ask for. Filling in missing ABNs is an important aspect of protecting your business.

-

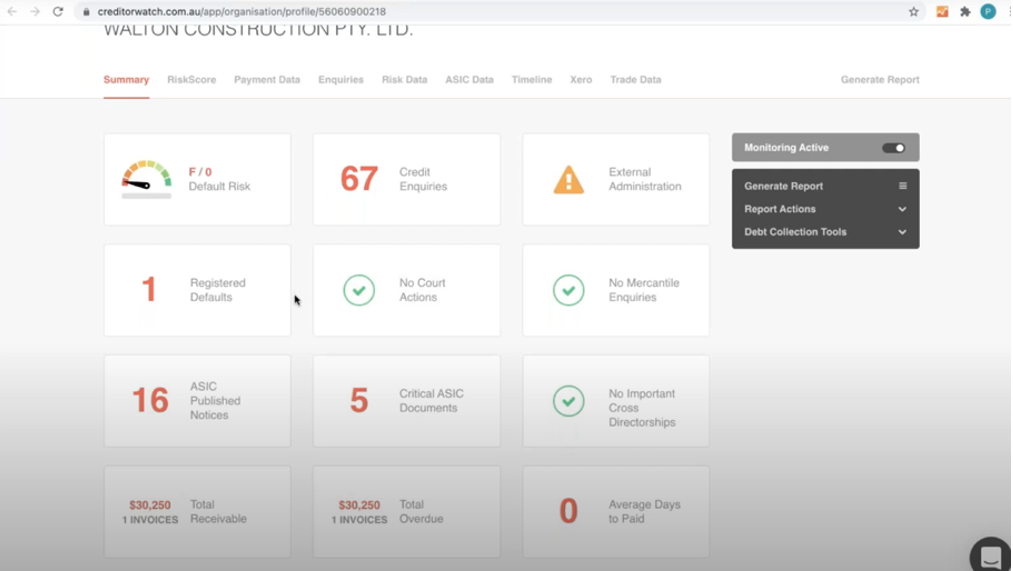

Enriched credit reports to make quick and accurate decisions

Your credit reports will be enhanced with additional data from your accounting package, providing more in-depth and accurate insights. When you receive an email alert about a customer and click through to their credit report, you will be able to see exactly what they owe you, including their total receivables and total overdue. This enables you to immediately understand the urgency of the account and act accordingly.

Without this integration, you may receive an alert on a customer, click through to their credit report, but can’t be sure if they currently owe you any money. You’ll have to log into your Xero or MYOB platform to check their outstanding debt before being able to connect that information and decide how to take action. This is not only time consuming but also increases the risk of human errors, potentially impeding your ability to mitigate risks.

-

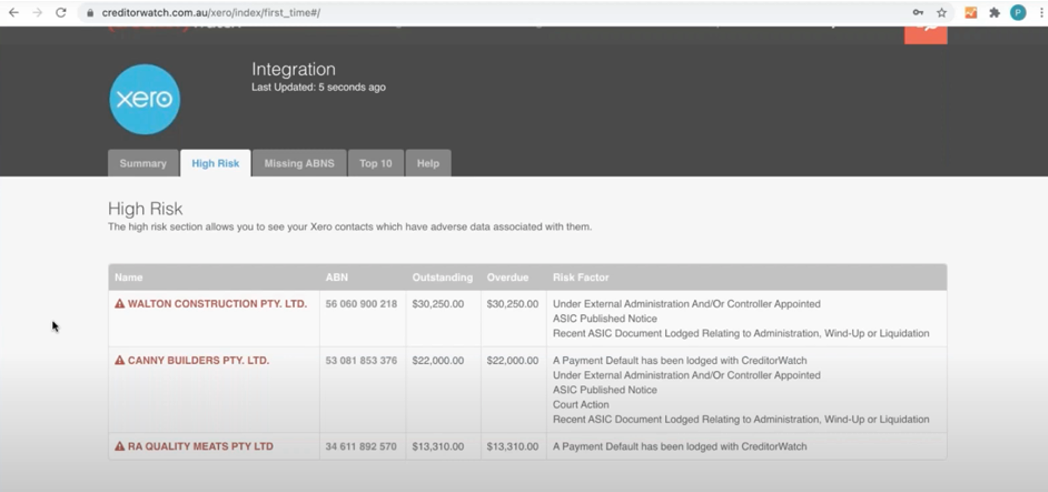

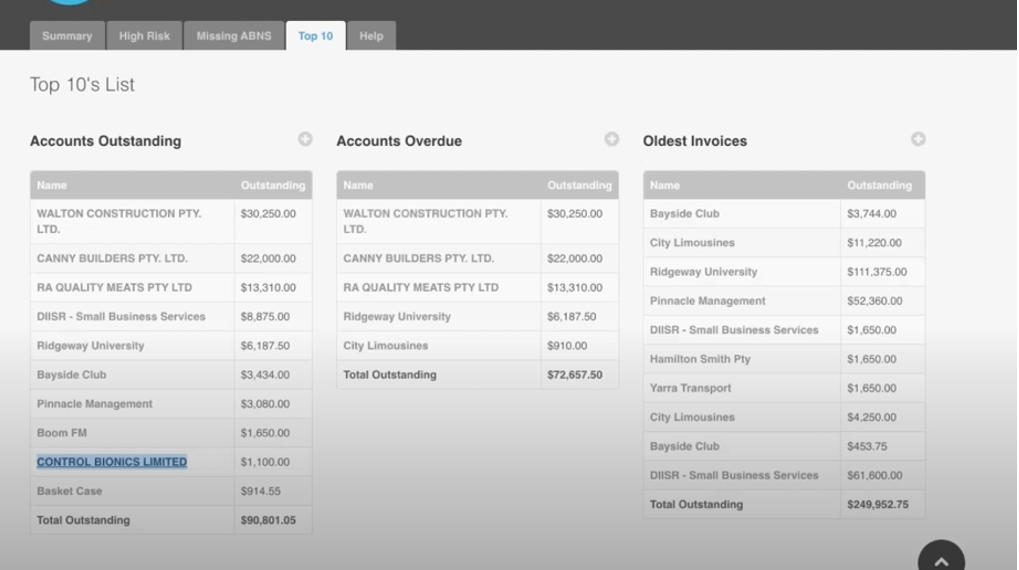

High risk and Top 10 lists provide clear overviews enabling timely action

This integration enables CreditorWatch to analyse your outstanding debtors against their credit files, identifying those that pose the highest risk to your cash flow. We’ll go through your entire ledger to identify existing customers with adverse data which suggests there’s a high chance they can’t or won’t pay their bills – for instance, a court action, payment default, administration appointment or cancelled ABN. This is presented in a High Risk List, giving you a clear overview of entity information, outstanding amount, overdue amount and types of risk associated with them. These are the accounts you need to act urgently on and collect immediately from.

Meanwhile, your Top 10 Lists give you a clear overview of your top outstanding accounts, overdue accounts and oldest invoices. This helpful tool reveals exactly who your biggest debtors are. Simply click through to their credit reports to understand their chance of default. All this information empowers you to act quickly to mitigate risk exposure.

CreditorWatch + Xero/MYOB = a comprehensive solution to protect your cash flow

By linking your accounting package with CreditorWatch, you’re able to automate key processes that are often overlooked by small businesses. This is a quick way to improve your credit risk management procedures, ensuring there are no gaps which could leave you with bad debt.

CreditorWatch is the most used credit bureau in Australia with over 55,000 users. Integrate your accounting package today to get more out of CreditorWatch and experience the credit risk management capabilities of larger organisations.

Not using an accounting software at the moment? Check out why you might want to make the switch. If you’re a larger organisation using your own ERP or CRM, use our API to integrate any or all of our features into your own third-party system. To find out more about integrating CreditorWatch, get in touch with us here.