CreditorWatch’s RiskScore, available on all its credit reports, indicates a business’ creditworthiness and predicts the likelihood of default in the next 12 months. It ranks entities based on their riskiness with one of 14 credit ratings (from A1 to F) and a numerical score from 0-850. The higher the score, the lower risk the entity poses.

Segmentation by entity type

RiskScore was developed with five distinct segments, each based on an entity type and tax status and calculated by a separate algorithm. This high level of segmentation provides you with the most accurate data no matter what kind of entity you’re performing a credit check on, including sole traders, public companies and trusts.

| Segment | Average Rating |

|---|---|

| Trusts (all) | A1 |

| Public companies (all) | B3 |

| Private companies & partnerships (GST registered) | C1 |

| Sole traders (GST registered) | C2 |

| Private companies & partnerships (not GST registered) | C2 |

| Sole traders (not GST registered) | D2 |

RiskScore calculates the creditworthiness of joint ventures under the ‘Private Companies and Partnerships’ segment. The ratings assigned to joint ventures include data capturing any adverse cross-directorship information along with behaviours and demographic risk of the joint venture entity itself.

Rating recommendations

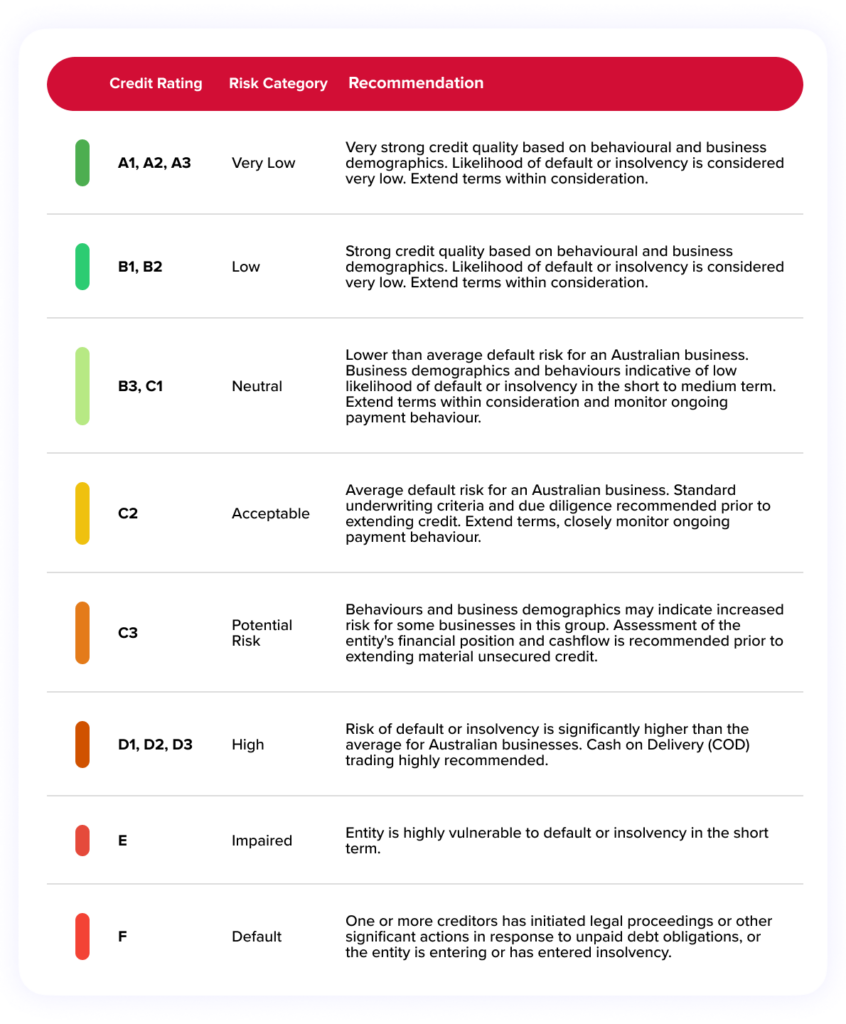

CreditorWatch’s rating system includes a rating from A1 to F, a risk category designation and a recommendation on action to take to mitigate risk, as well as the numerical credit score from 0 to 850.

Our data sources

Trade line behavioural data

CreditorWatch customers from small, medium and large businesses, contribute over 11 million monthly tradelines. This unique business-to-business transaction data includes both positive and negative repayment behaviour from two sources: corporate ATB uploads and SME payment data.

CreditorWatch is the only Australian bureau to gather payment information directly from small businesses. Our unique trade payment data is the most predictive early warning indicator for future defaults and credit risk.

Business Demographic Risk Data

CreditorWatch uses machine learning to enrich our business demographic data and make a more comprehensive range of predictors available, including:

- Geographical risk clusters that capture economic stress associated with business location, including unemployment and commercial rental costs to a postcode level.

- Natural language processing is applied to business names to classify high-risk business types. This offers a more granular look at industry risk whilst complementing our ANZSIC industry classifications database.

- A wide range of additional risk factors that assess the entity maturity (such as its age and the length of time at its current address), type of entity and number of directors are also included in the algorithm.

Traditional credit risk drivers

Our model also includes traditional adverse risk information that are proven predictors of future entity failure. CreditorWatch customers are alerted to this data via our 24/7 monitoring feature. Some key predictors include:

- Payment defaults, our most unique and predictive piece of adverse information.

- Court actions from all reporting courts in Australia.

- ATO tax debt default data.

- High-risk ASIC documents (such as strike-off action and director changes).

- Mercantile enquiries, which indicate potential future court actions.

- Insolvency notices.

- Credit enquiries, including frequency and ordered by industry and date.

- Director behaviour and their previously failed businesses to help identify risk and illegal phoenixing activity.

Get in touch

Get in touch today to hear how CreditorWatch can help your business better manage credit risk exposure without breaking the bank. Or try our 14-day free trial.

Get started with CreditorWatch today

Take your credit management to the next level with a 14-day free trial.