CreditorWatch RiskScore: Our new commercial credit score and rating

It’s never been more important for businesses to have confidence in their trading relationships. Which is why it’s critical to have true and transparent insights into a trading partner’s creditworthiness, to be able to offer terms of trade safe in the knowledge invoices have a high likelihood of being paid.

Credit scores calculated by credit bureaux have long delivered businesses an easy way of assessing commercial creditworthiness. But in 2020’s high risk environment, they are limited in the factors they consider that predict future default. They also don’t offer transparency over the predictors that comprise the score.

Businesses now need a tool that looks beyond high-risk events such as director bankruptcies so they can assess a broader range of factors such as trade payment data, location and geographic risk when deciding whether to extend terms. Assessing variables such as socio-economic and macro-economic data, company structure, director numbers and industry can also help creditors to make informed decisions about the entities with which it is safe to trade.

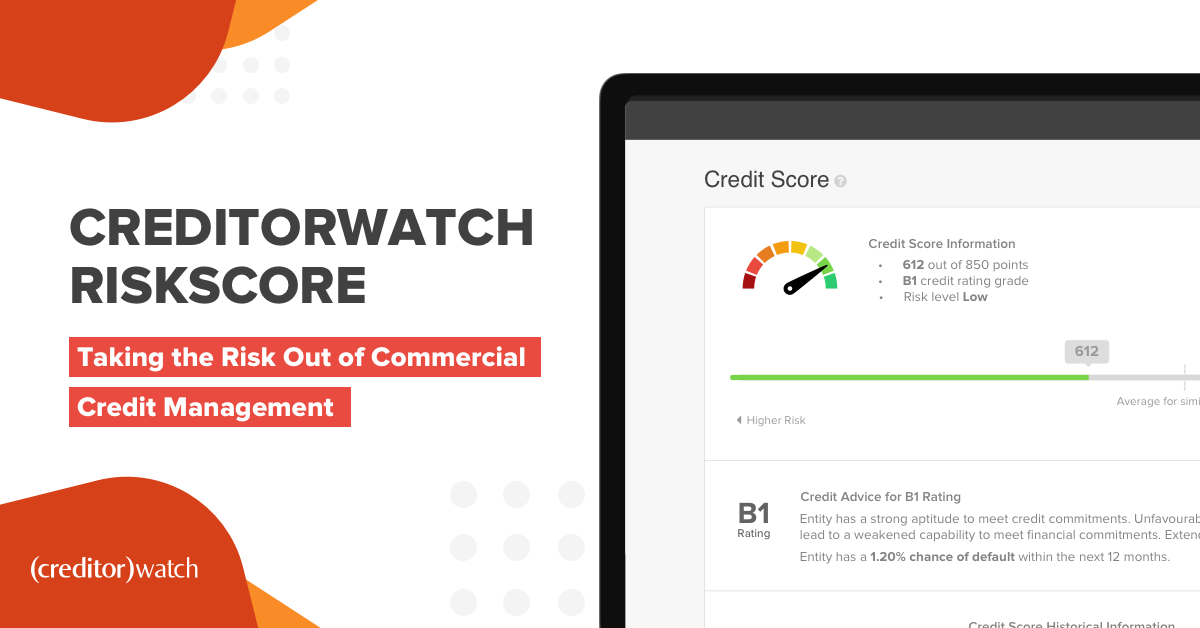

CreditorWatch RiskScore, a new tool we have developed with Open Analytics, helps achieve these aims. By incorporating a wider range of predictors versus traditional bureau scores, CreditorWatch RiskScore is able to more accurately predict the likelihood of a business defaulting on its obligations.

What is CreditorWatch RiskScore?

RiskScore indicates a business’ creditworthiness and predicts the likelihood of default in the next 12 months. Our new score also ranks entities based on their riskiness with one of 14 credit ratings (from A1 to F) and a numerical score from 0-850. The higher the score, the lower risk the entity poses.

CreditorWatch RiskScore in action: two case studies

Below are two hypothetical case studies that show how important it is to really get below the surface of some of the more usual data points included in bureau scores and to also consider other variables. The result is a much better understanding of a business’s creditworthiness and risk factors.

CASE STUDY 1: Sydney Nutritionists

This business looks like it is low risk, based on standard a bureau check. There are no adverse flags and it operates in the low risk health care sector. But it’s a different story when other predictors are considered.

Trade arrears indicate the business could be experiencing stress, given missed payments to suppliers generally occur before bank loan defaults or insolvencies. A relatively small number of tradelines also potentially indicate weaker cash flow or that it’s a smaller business.

Additionally, businesses with one director are higher risk versus other small businesses with two to three directors. Other red flags include the fact it’s a young business, its location in Surry Hills, which is an area with very high commercial rents and its sub-sector in nutrition.

| Predictor | Example 1 | |

| Identifiers and Basics | Name | Sydney Nutritionists |

| ABN / ACN | 123456789 | |

| Address | Surry Hills, NSW | |

| Industry (ANZSIC) | Health care and social assistance | |

| High Risk Indicators | Court action last 12 months | Clean |

| Total dollar value court judgements last 12 months | Clean | |

| ASIC public notice last 12 months | Clean | |

| Default registered last 24 months | Clean | |

| Adverse cross directorship | Clean | |

| Trade Payments | Trade arrears category | 90+ days past due last 12 months |

| Value of 60+ days past due invoices last 12 months | $11,235 | |

| Number entities watched last 12 months | 2 | |

| Number trade lines active current month | 2 | |

| Business Demographics | Number of directors | 1 |

| Age of business | 2 years, 3 months | |

| GeoRisk Index – rent and mortgage cost decile | High risk | |

| GeoRisk Index – unemployment decile | Neutral | |

| Text mining risk category | High risk |

CASE STUDY 2: Smith and Associates Civil Construction

With significant court actions, director defaults and operating in a relatively high risk industry, this business looks very high risk, based on standard bureau checks. But the company’s scale, transaction footprint, its number of directors and multiple positive risk indicators would likely outweigh the adverse risk indicators.

| Predictor | Example 2 | |

| Identifiers and Basics | Name | Smith and Associates Civil Construction |

| ABN / ACN | 123456780 | |

| Address | Brisbane CBD | |

| Industry (ANZSIC) | Construction | |

| High Risk Indicators | Court action last 12 months | 1 |

| Total dollar value court judgements last 12 months | $35,500 | |

| ASIC public notice last 12 months | Clean | |

| Default registered last 24 months | Clean | |

| Adverse cross directorship | Director previous default | |

| Trade Payments | Trade arrears category | Clean |

| Value of 60+ days past due invoices last 12 months | 0 | |

| Number entities watched last 12 months | 11 | |

| Number trade lines active current month | 80 | |

| Business Demographics | Number of directors | 6 |

| Age of business | 25 years, 6 months | |

| GeoRisk Index – rent and mortgage cost decile | Neutral | |

| GeoRisk Index – unemployment decile | Low risk | |

| Text mining risk category | Moderate risk |

CreditorWatch RiskScore isn’t intended to completely replace bureau scores. Rather, it is another method of assessing credit risk businesses can add to the arsenal of tools that can be used to assess creditworthiness.

It is particularly useful for businesses that have a high volume of trading relationships, giving these businesses a trustworthy, robust way of assessing creditworthiness, so they can focus on their core competencies and leave credit checking to the experts.

For more information on RiskScore, please download the full white paper or brochure.

If you have any questions, please get in touch with our friendly team at support@creditorwatch.com.au or contact your account manager.