Leveraging Big Data to revolutionise Credit Risk assessment.

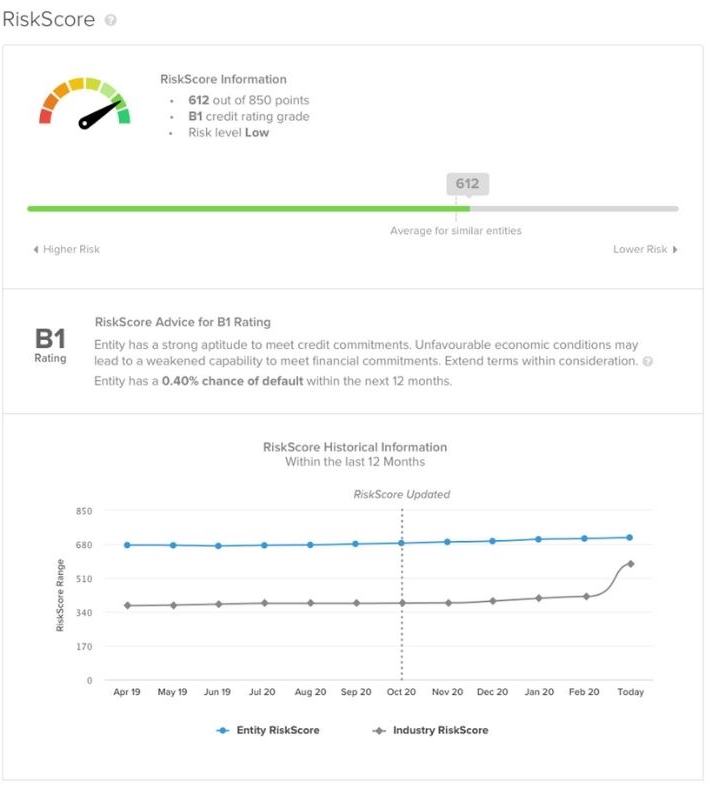

The latest partnership between CreditorWatch and Open Analytics is revolutionising credit risk assessment and automated credit decisioning. The new RiskScore product, incorporating CreditorWatch’s industry leading data with proprietary algorithms from Open Analytics, sets the benchmark for timely and accurate credit default prediction in the Australian B2B landscape.

CreditorWatch’s new RiskScore is a live rating that is the most current predictor on the market of future defaults and insolvencies. Behind the RiskScore, our algorithms analyse multiple subsets of data for each entity, including adverse risk data, and behavioural and demographic factors. This data-stacking approach allows the CreditorWatch business model to provide a unique RiskScore for each specific business incorporating:

- Tradeline Behavioural factors – by monitoring ASIC updates (e.g. changes to directors), as well as trade payment activity.

- Demographic data – including the new GeoRisk rating and a more comprehensive range of predictors available.

- Traditional credit risk drivers – such as court actions, member defaults, and insolvency events.

These data subsets are so dynamic that the RiskScore can prioritise trends and build a framework that is constantly adapting and incorporating new data as it assesses the stability of a business presently and into the future.

Taking a proactive approach to credit risk has already helped more than 50,000 businesses avoid bad debts. The platform allows you to monitor your entire ledger for adverse information via daily email alerts, which heightens awareness, reduces volatility, and enables you to make faster and more informed business decisions.

CreditorWatch’s collaboration with Open Analytics has already received a lot of praise, including being recognised by the Finnies Awards as a finalist in the Best FinTech Partnership 2021 (winner yet to be announced). Initially James O’Donnell, Founder and Director of Open Analytics was blown away by the scale and predictiveness of the CreditorWatch data.

“CreditorWatch has truly unique data assets, gathered from a network of more than 50,000 businesses across Australia,” he says. “Put simply, CreditorWatch captures more B2B transactional data from a wider range of businesses than any other organisation in Australia, and this unique data is among the most predictive early warning indicators for future defaults, capturing both trade turnover and payment arrears factors.

“Complimenting the transactional data is a vast array of other data elements including industry first commercial GeoRisk index, derived from aggregated transactional and socio-economic data, capturing insolvency risk associated with business location.”

“This unique data, which combines credit risk subject matter expertise and advanced feature engineering techniques, is the engine behind a credit rating system that is unmatched by any publicly available credit rating agency.”

The partnership between CreditorWatch and Open Analytics has formed the most ‘current’, predictive, and advanced rating system on the market. The RiskScore is a tool your business cannot afford to be without.

Get in touch with Grace to learn more or arrange a personalised demo at grace.kulbe@creditorwatch.com.au.

Grace Kulbe

Grace is one of our Melbourne-based Senior Consultant. In her role, Grace teams up with credit managers and finance professionals from a variety of businesses to help improve their credit risk processes.

Grace has a background in fintech, so she loves communicating the benefits of CreditorWatch’s market-leading technology to her clients and showing how it can make a positive impact to their business.

Outside of work, you’ll find Grace playing basketball, reading the latest fantasy fiction or enjoying a wine over dinner with friends. Connect with Grace on LinkedIn.

E: grace.kulbe@creditorwatch.com.au

M: 0437 087 664

About Open Analytics

Open Analytics is an Australian financial services company helping businesses to gain successful outcomes in credit risk and customer management. As the Founder and Director, James O’Donnell has an impressive background in creating risk scores for banks and credit providers driven by powerful and detailed algorithms. His focus on “pro-active, efficient and ethical decisioning processes” is evident in the Open Analytics vision and drive to modernise and strengthen underwriting, risk management and customer engagement for banks and credit providers.