Your small business credit report – FAQs answered

Small businesses make up 98% of the Australian economy, so naturally, CreditorWatch fields dozens of questions a week from companies just like yours about credit reports. Understanding a business’ credit risk can be difficult for small business owners without a credit background or a standalone accounts receivable team, but it doesn’t need to be.

These are 10 of the most frequently asked questions we get asked about commercial credit reports, credit scores and using CreditorWatch. If we haven’t answered your question below, please get in contact here – we’re happy to help businesses of all sizes.

1. What is a good credit score for a small business?

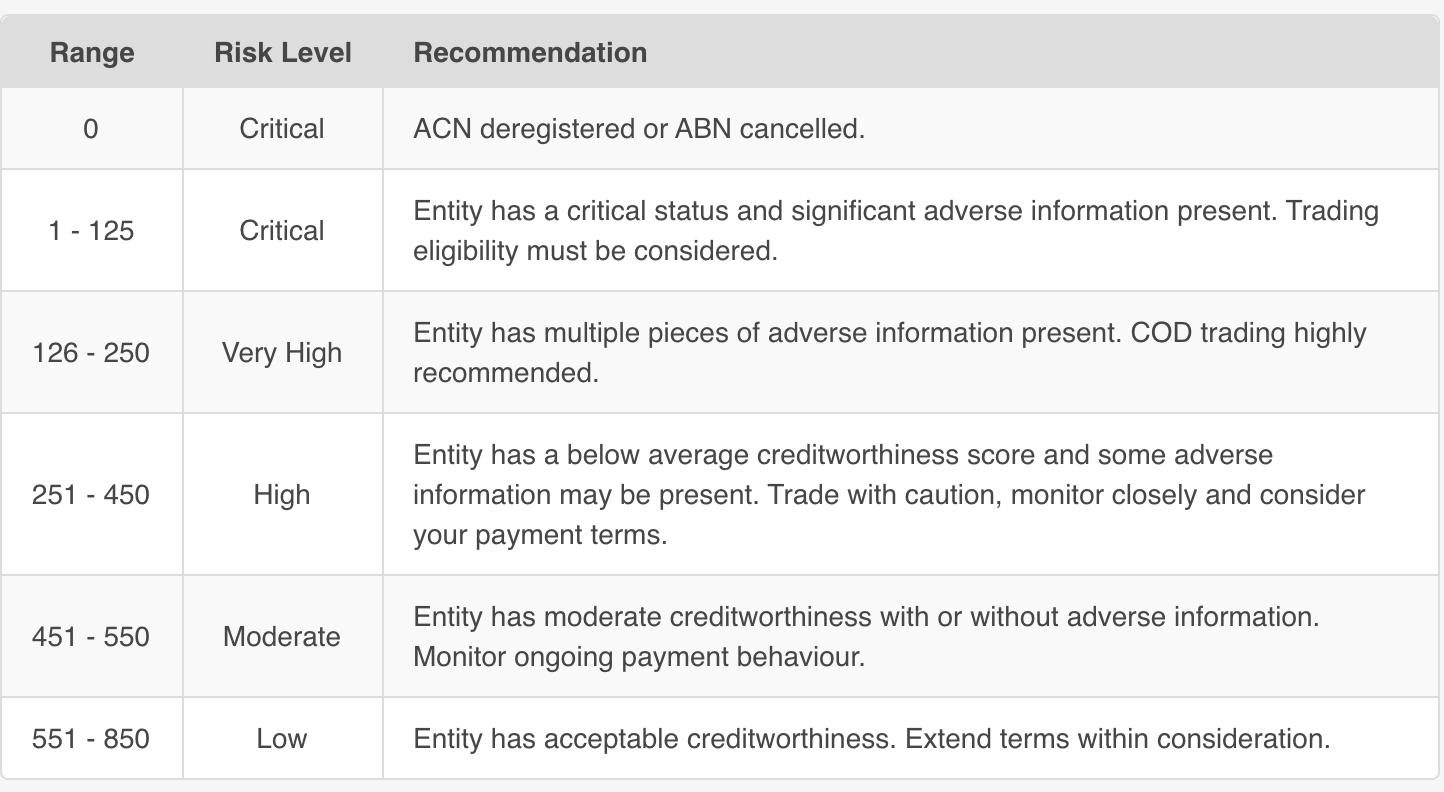

A credit score ranks businesses based on their riskiness and credit worthiness. It’s based between 0 and 850 – a higher score is considered lower risk and a lower score is deemed to be a higher risk entity.

2. Does my personal credit score affect my small business credit score?

No. Your personal credit score is completely separate to your business credit score. However, if you are trading as a sole trader/individual with an ABN, there will be a credit score for this entity, though this is still different to your personal credit score.

3. How much does a small business credit report cost?

CreditorWatch offers a variety of flexible subscription-style plans that give you access to as many credit reports that suit your business. Our no-lock-in contracts also offer you business credit monitoring services, so you never miss a change to a customer’s credit file. Find the plan that’s best for you here.

4. How can I access my own small business credit report?

Simply sign up for a 14 day free trial on CreditorWatch to access your own business credit report. You can even set up monitoring on your business credit report to receive alerts if any important changes occur.

5. Can I get an international business credit report?

Yes, international reports can be run through a CreditorWatch account. Please call 1300 50 13 12 for further information.

6. How do I register a payment default?

Payment defaults are like a black mark on a credit report that indicate a business hasn’t paid their bills. It can be registered on the organisation’s commercial credit report in CreditorWatch. You’ll need an active CreditorWatch account to do this.

7. Can I remove a payment default?

Defaults can be marked as ‘Settled’ once paid but will remain on CreditorWatch for up to five years. All CreditorWatch customers can see defaults that have been registered against any business.

8. Can I integrate XERO with CreditorWatch?

CreditorWatch offers integration with Xero and MYOB accounting packages. Please visit https://creditorwatch.com.au/xero for Xero integration or https://creditorwatch.com.au/myob for MYOB integration.

9. Is CreditorWatch a debt collection agency?

CreditorWatch is the step prior to engaging a debt collection agency. We actually help businesses avoid having to use a debt collector by identifying your bad debtors and assisting you to make better credit decisions. We can also help encourage your customers to pay you on time – learn more about our debt collection tools.

10. How can I find the directors of a company?

Director information will be available on any entity that is registered with ASIC. The information will be included in a CreditorWatch commercial credit report.