Explaining automation, verification and integration in the business credit application process

In our COVID-impacted economy, it is critical to understand who your potential customers really are. Gathering vital information in a credit application has never been more important to your business. Traditionally, business credit applications have been a paper based and time consuming process that slow down sales. Now, businesses are streamlining their processes to improve cost-efficiency and the information they gather from applicants.

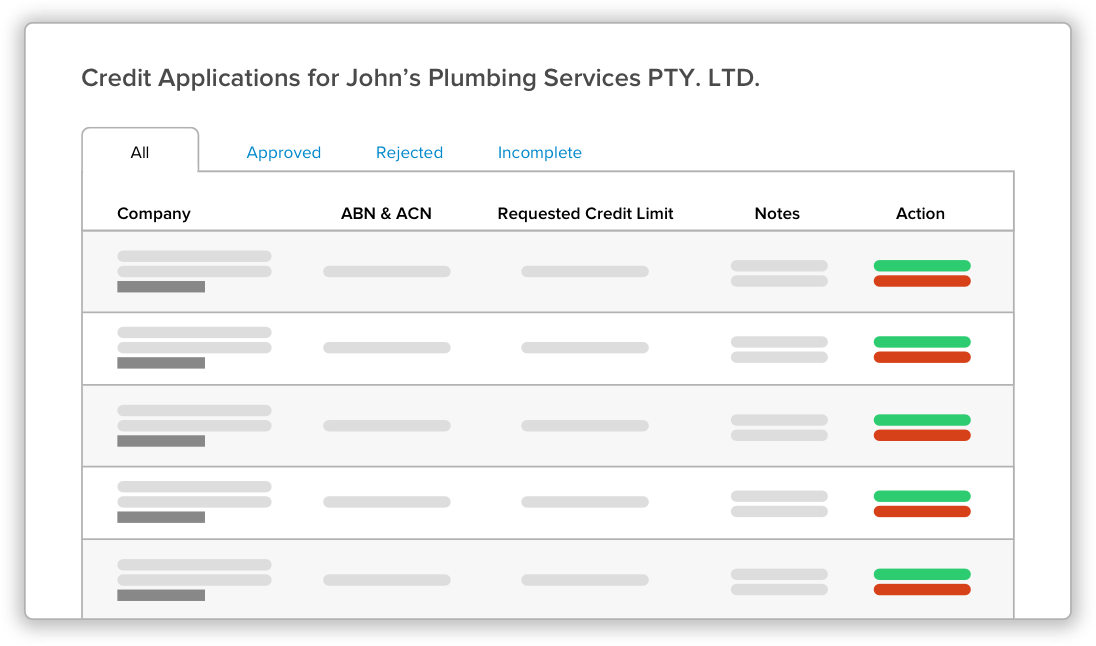

ApplyEasy is a customisable online solution that automates the credit application process, eliminating paperwork and minimising manual labour. It seamlessly integrates with CreditorWatch and PPSRLogic, enabling credit checks and PPSR registrations with each new credit application.

How do you automate the business credit application process?

ApplyEasy checks and validates your potential customers’ data in real time. Integrated with ASIC, ABR and the CreditorWatch credit bureau, it can auto-populate their details as they fill out the application. Further customise the process by implementing custom workflows specific to your business. Applications can be passed to the relevant team members for checks and approvals by updating your custom status labels. Each step is recorded with an audit trail and notes relating to the customer.

Auto-decisioning is made possible by setting up rules to recommend whether an application will be approved, referred or rejected. For example, applications with court judgements could be set to “reject”, while those trading less than six months could be set to “refer”. Each application also automatically undergoes a credit check which contributes to the final outcome. These rules can be customised for your business depending on the industries you work with, credit limits exposure and type of products/service you deliver.

ApplyEasy also enables you to register a security interest on the PPSR when approving credit to customers. Through your ApplyEasy dashboard, you’ll immediately be able to choose a registration template from PPSRLogic and begin the process.

What information is validated in a business credit application?

ApplyEasy automatically validates basic entity information such as the ABN, ACN, entity type, length of trading, directors and trustee (if applicable).

Secondly, you can check the creditworthiness of a prospective customer by looking at their credit report and the presence of court actions, defaults, mercantile enquiries and insolvency notices. Some more advanced recommendations include checking cross-directorships (other entities a director has been involved in), identifying and credit checking the UBO (Ultimate Beneficial Owner) of a business to see where your ultimate risk lies and viewing existing PPSR registrations to see which businesses currently have a registered security over the entity.

How do you verify signatures and documents when providing credit to customers online?

There are two options when it comes to signatures in an online credit application – wet signatures and electronic acceptance.

While wet signatures are the traditional method, electronic acceptance expedites applications by saving time and resources. The Electronic Transactions Act 1999 covers legalities surrounding the validity and acceptance of electronic acceptance. Whether you decide an electronic acceptance, wet signature or a combination of both is right for your business, ApplyEasy has you covered.

In most cases, I still recommend wet signatures for director or personal guarantees and electronic acceptance for Terms and Conditions, Privacy Policy and Direct Debit Forms. Applications can also be verified with supporting identification documents such as a driver’s licence or passport and IP address tracking.

Can online business credit application forms work for Trusts?

Absolutely. ApplyEasy’s Trustee function can recognise a business structure as a Trust based on its ABN and subsequently request additional information on the Trustee and a copy of the Trust Deed. ApplyEasy ensures you collect details of all entities/individuals involved, as it is difficult to pursue a Trust in the event of non-payment. I recommend you pursue the Trustee in combination with your director or personal guarantee.

Let’s make ApplyEasy work for you

ApplyEasy is highly customisable and our team is dedicated to developing individualised solutions for your needs. For further enquiries or a free demo, please get in touch with me at matt.jackson@creditorwatch.com.au or call 02 8188 2025.

Matt Jackson

Matt has over 12 years of experience in the credit industry and eight as the General Manager of CreditorWatch. Under Matt’s guidance, the CreditorWatch Sales and Account Management team has grown 100% year on year in both employee size and revenue.

Matt has over 12 years of experience in the credit industry and eight as the General Manager of CreditorWatch. Under Matt’s guidance, the CreditorWatch Sales and Account Management team has grown 100% year on year in both employee size and revenue.

Matt shares his knowledge, passion and enthusiasm with everyone he meets and has won multiple awards in the industry recognising his service. You can connect with Matt on LinkedIn or get in contact via matt.jackson@creditorwatch.com.au.