As we emerge from the pandemic, many businesses are struggling with cash flow and seeking credit to get going again. Those who are unable to meet the strict lending criteria of major lenders such as banks are increasingly turning to second tier lenders. Although many potential borrowers are in a vastly different shape to what they were pre-pandemic, not all credit checks will pick this up. Credit enquiries are soaring but risks for lenders are high. To mitigate risk in this volatile economy, it is crucial for lenders to strengthen their credit modelling and decisioning processes around credit scoring.

CreditorWatch is Australia’s most innovative credit bureau, providing market-leading data and insights to the financial services sector since 2010. Our credit reports and exclusive data allow lenders to enrich their modelling, predict future defaults and improve decision-making.

By providing a holistic view of how safe an entity is – for the initial application and on an ongoing basis – CreditorWatch helps lenders make better credit decisions and avoid bad debtors and costly defaults.

Accurately assess creditworthiness and predict likelihood of default

Powered by CreditorWatch’s unique data and advanced machine learning techniques, Risk Rating is the most predictive and insightful credit score in the market.

Risk Rating indicates a business’ creditworthiness and predicts its likelihood of default in the next 12 months. It ranks borrowers based on their riskiness with one of 14 credit ratings (from A1 to F) and a numerical score from 0-850. The higher the score, the lower risk the entity poses.

Risk Rating uses three categories of data sources:

Tradeline behavioural data

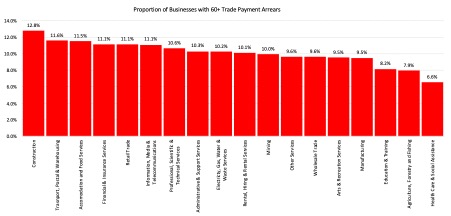

CreditorWatch has access to over 11 million monthly tradelines from corporate ATB uploads and SME Xero and MYOB integrations. This unique trade payment data, unavailable from any other credit bureau, provides early intelligence on future defaults and credit risk.

Business demographic and geo-risk data

Using machine learning and text mining, CreditorWatch generates a comprehensive range of risk predictors based on business location, business name, industry, scale, entity type, tax status, entity maturity, management structure and more.

Traditional credit risk drivers

These proven predictors of future entity failure include payment defaults, court actions, high-risk ASIC documents, mercantile enquiries, insolvency notices, bankruptcies, credit enquiries and adverse director activity.

Risk Rating creates a granular risk profile of entities and industries. It has been developed with five distinct segments, each based on entity type and calculated by a separate algorithm. This high level of segmentation provides the most accurate data for all types of entities, including sole traders, public companies and trusts, enabling lenders to improve their credit scoring models and make better credit decisions.

Understand payment trends across the market and propensity to pay an outstanding amount

Deteriorating payment behaviour is a leading indicator of credit risk. CreditorWatch captures data from over 15 million invoices each month, helping lenders predict future default. We uncover hidden signs of distress and identify high-risk debtors through our exclusive trade payment transactional data.

Payment Rating allows lenders to understand an entity’s payment history over the past 12 months. DebtorLogic, our interactive trade program, analyses their ATB; it identifies payment trends and determines an entity’s propensity to pay an outstanding amount. These tools enable lenders to compare an entity’s payment performance with its industry and avoid slow‑paying debtors.

CreditorWatch helps lenders easily identify their best and worst debtors, revealing those experiencing cash flow problems and those deliberately withholding payments. Lenders are empowered to prioritise collections and adjust payment terms to improve their overall collection rates.

Reveal borrowers’ loans and mitigate lending risks with Lenders Insights

When a business applies for finance, it may apply to multiple financiers and have multiple loans or lines of credit approved within a short time. Loan stacking is a common problem for lenders, however, existing approaches to mitigate this are tedious, lack useful information and error-prone.

Lenders Insights is our new platform for financial institutions, which increases transparency over a company’s loans, helping lenders reduce their risk profile when assessing loan applications. CreditorWatch collects information from lenders across Australia and shares this data to enrich the landscape of lending exposure in the market.

When a company applies for any type of finance, Lenders Insights will show its:

- Application Date

- Loan start date

- Loan Amount

- Term Length

- Term End Date

- Loan Status (e.g., active, in default, etc)

- Product type (e.g., unsecured, asset finance, invoice finance, etc)

Lenders will also receive live updates when a customer is attempting to or has stacked their loans. We will send an email or API notification to alert the lenders who have provided loan applications or approval information against that business. This will enable them to act quickly to mitigate potential risks.

Know your customer and comply with AML/CTF legislation

AUSTRAC’s Anti-Money Laundering/Counter-Terrorism Financing (AML/CTF) Act requires financial institutions to identify and verify their customers and understand their financial activities before providing any services to them. These AML/CTF laws are in place to detect, disrupt and prevent crimes like corruption, bribery, tax evasion and theft.

CreditorWatch’s Know Your Customer (KYC) process verifies client identities and assesses potential risks of doing business with them. Lenders can easily comply with KYC and AML legislation with our AML screening reports and Ultimate Beneficial Owners (UBO) reports. These reports include Politically Exposed Person (PEP) checks, sanction checks and adverse media checks on individuals. Additional KYC services include Verification of Identity (VOI), Document Verification Service (DVS) and entity and individual verification.

We help lenders meet reporting obligations and mitigate potential exposure to criminal and financial risk.

Enrich existing data with our commercial credit data block

CreditorWatch’s data block plays a crucial role for many financial institutions and credit managers in their credit decisioning process. Our data block takes monthly snapshots going back to January 2015, enabling lenders to perform real-time decisioning, historical factor analysis and model development. This epic dataset contains 40-plus factors categorically designed for user-friendly integration into credit processes, internal credit models and credit decisioning tools.

CreditorWatch’s solutions can be flexibly packaged and delivered to lenders, tailored according to their preferences and design specifications. Whether they require our full product suite or a single product, our API seamlessly integrates our solutions directly into their ERP, CRM or third-party decisioning system.

CreditorWatch – the ideal partner for financial institutions

CreditorWatch helps financial institutions accurately assess creditworthiness and enhance their modelling and decisioning to mitigate credit risk. Our insights complement their existing data to provide a complete understanding of their debtors’ financial health and credit risk.

Discover more tools and features to enhance due diligence for lenders:

- 24/7 Monitoring and Alerts – Stay vigilant of ongoing credit risk and be notified about any adverse activity

- Financial Risk Assessments – Get an expert analysis on an entity’s financial performance

- PPSRLogic – For asset-based lenders to streamline their PPSR registrations

- Portfolio Health Check – Conduct a data wash and identify the riskiest debtors

- Business Risk Index (BRI) – Economic index providing dynamic insights into the credit risk exposure of businesses in 300+ regions across Australia.

To find out more about how CreditorWatch can help you manage credit risk, get in touch with us today.