- Product SuiteDiscover Product Suite

Explore our suite of integrated products and all-in-one credit management platform

- SME

- Corporate

- Enterprise

Product Solutions

- Pricing

- News Hub

- Company

- Free Trial

- Login

Explore our suite of integrated products and all-in-one credit management platform

Uncover detailed insights about the financial health of your trading partners.

Financial Health Insights

A Financial Risk Assessment provides a comprehensive look into the financial viability of your customers, suppliers or contractors. Find out if they can pay you on time and honour their contracts. Confidently make decisions and mitigate risks upfront. This is particularly useful when dealing with large credit limits, critical supplier contracts or sizeable tenders.

In-Depth Customer Financial Reports

Financial Reporting

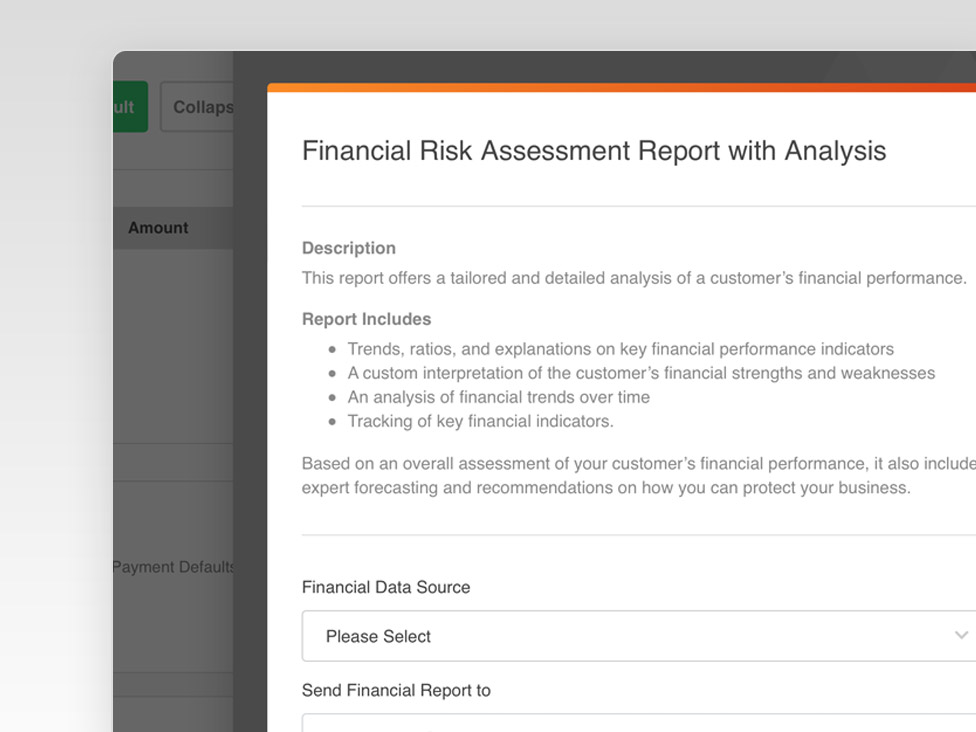

The Financial Risk Assessment uses company financials, ASIC records and CreditorWatch’s exclusive trade payment data. Experienced analysts assess an entity’s financial data, including cash flow, income statements and balance sheets, over a two-to-three-year period. View trends, ratios and explanations on key financial performance indicators. We also offer a tailored analysis of an entity’s financial performance and expert forecasting and recommendations on how you can protect your business.

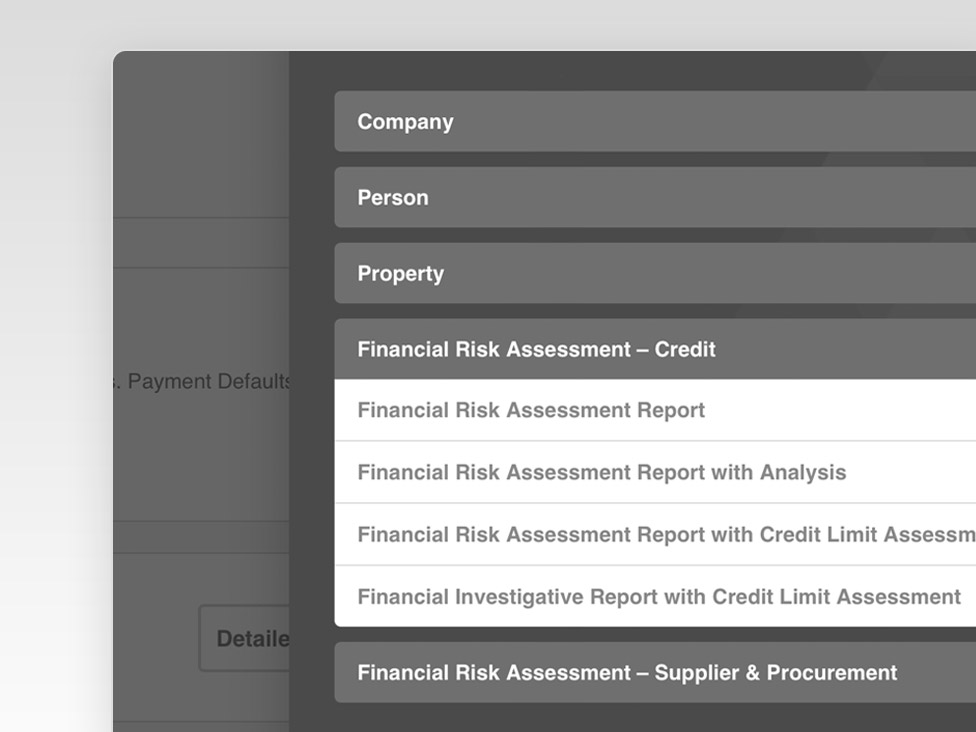

We offer four types of financial risk assessments to help you assess potential suppliers and contractors.

A Financial Risk Assessment is invaluable for finance, credit and procurement managers wanting to analyse an entity’s financial performance before granting credit, a tender process, a high-value agreement or major contract renewal. It helps you consider the effects of a collapse or delinquent payment from a major customer or the failure of a major supplier. By mitigating risk upfront, you can avoid potential issues like court actions, project delays and bad debts.

Protecting Your Business

CreditorWatch offers various types of Financial Risk Assessment reports for trade credit and procurement, depending on your needs. We help you assess the financial stability of your trading partners to better protect your business from financial hardship.

The Financial Risk Assessment uses company financials, ASIC corporate records and CreditorWatch’s exclusive data. All this information is assessed by an experienced analyst.

We only need an entity’s full business name and their ABN or ACN to extract financial records from ASIC or ASX. If the entity hasn’t published their financial information on ASIC or ASX, you will need to request two-to-three-years of their financial records from them directly. We will take you through the process of obtaining and sending the financials through.

You must be a CreditorWatch customer to request a report. If you’re not an existing customer, get in touch and we’ll help you out.

CreditorWatch offers eight Financial Risk Assessment reports to meet the varied needs of our customers. They are offered at a competitive market rate and valued at different price points. Please get in touch with us for more information.

You can request a Financial Risk Assessment on the right-hand side menu on any of your customer’s credit reports. If you have any questions, please contact us on 1300 50 13 12 or email us at admin@creditorwatch.com.au.

Download a free sample Financial Risk Assessment

Start making better financial decisions with a 14-day free trial.