We’re continuously improving and building on our product suite to offer our customers unique data and value

The only time you should look back is to see how far you’ve come, and there is no better time to do so than at the tail end of a financial year.

We’re proud to have grown our product suite, data sets and people power exponentially in the last two years. Our account management and customer support teams have grown by almost 100%. We’ve also implemented a ticketing and inbound phone call system, so you’re able to get the help you need sooner.

CreditorWatch has provided customers with more content to support them during COVID-19 and are holding webinars on a more regular basis. We’ve also improved our monitoring and alerts management to ensure you’re getting notified of the adverse changes you need to know about.

Chances are you’re familiar with our latest and greatest solutions below. If you aren’t, and would love to learn more, please get in touch with your account manager or email support@creditorwatch.com.au.

The best part? There’s much more to come. We have been working with Open Analytics for over a year to offer you even more refined data sets and develop faster and simpler business solutions, tailored to your needs.

Something big is also coming in spring 2021: it’s an industry-first that will reveal business risk in a way you didn’t think possible. Watch this space – we can’t wait to reveal all.

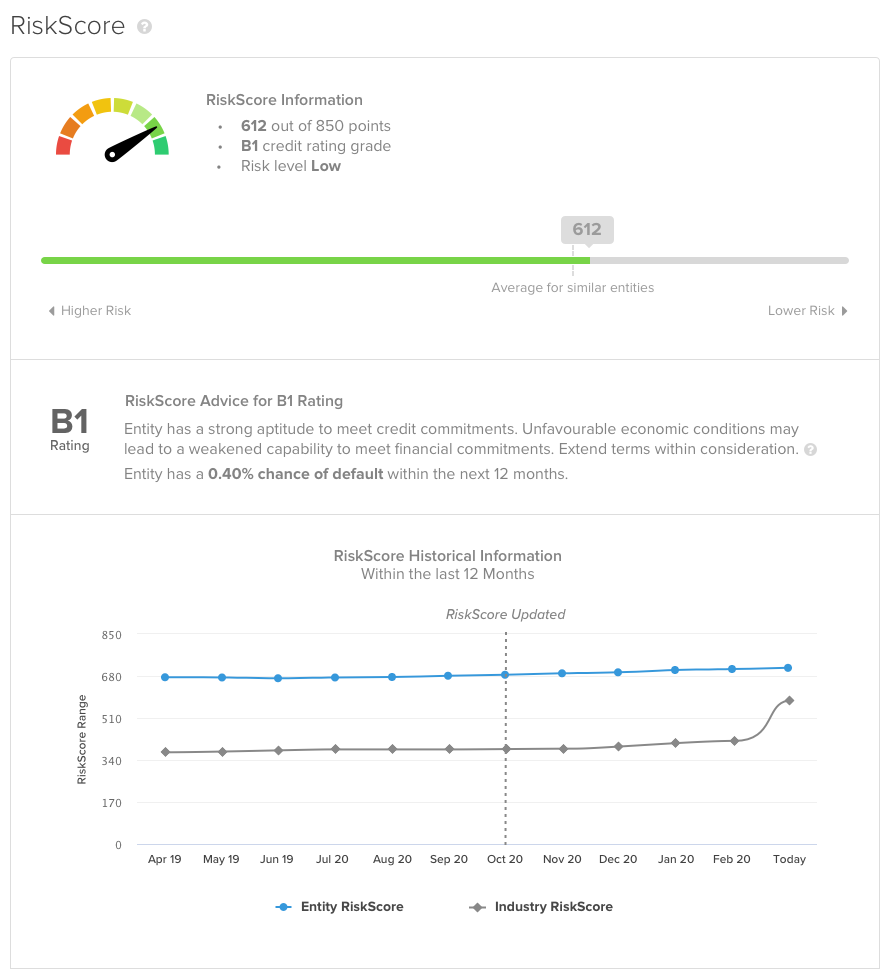

RiskScore

Our credit score and rating system, RiskScore, gives our customers unrivalled and transparent insights into their trading partners’ creditworthiness.

RiskScore differs from traditional bureau scores by including over 30 data factors, such as geo-demographic business data and trade payment data not available anywhere else. We’re the only bureau to make this data transparent to you to help predict future default. It’s the most predictive credit score and rating in the market – find out why in our whitepaper.

Downloadable credit reports

You can download and customise our new CreditorWatch credit reports in just seconds. Our credit reports were redesigned with additional reporting options and optimised design choices to make them easier to read and share, tailored specifically to your needs.

Our brilliant development team worked their magic to make it faster for these reports to aggregate more than 50 different sources of data, allowing for a deeper analysis of potential customers.

DebtorLogic

We kicked off 2020 with a relaunch of DebtorLogic, our ATB-analysis tool that transforms the way you identify risky debtors. DebtorLogic offers you the ability to assess the payment behaviour of customers and prioritise your collections.

Our makeover included new features like an industry customer comparison tool, payment analysis and customisable filters to drill down on the top-line data.

Financial Risk Assessment

Our Financial Risk Assessment was born from a desire to offer our customers more understanding over their debtors’ financials. We teamed up with the financial experts at Credit Source to offer you a detailed look into the financial health of businesses you’re thinking of trading with.

Whether you need to assess the financials of customers, suppliers or contractors, our range of reports have you covered.

Our incredibly-popular webinar Financials Stripped Bare is a great place to start to learn more about the factors that affect a business’s performance. Due to high demand, we’re releasing a follow-up white paper and webinar in a few months.