Learn how to reduce the risk of using subcontractors

Subcontractors perform 80-85 per cent of all the work in the Australian construction industry; the highest involvement of subcontracting in the world. Outsourcing in the construction industry is widespread because subcontractors provide the scalability and flexibility to achieve specific short-term project objectives.

Outsourcing construction work comes with risks, including poor performance and low quality work, weak project management, legal disputes and financial instability and insolvency.

It is crucial to be proactive in mitigating risk exposure and learn how to avoid high-risk subcontractors. If your response is reactive, the costs to your business increase exponentially, and some might not be recoverable.

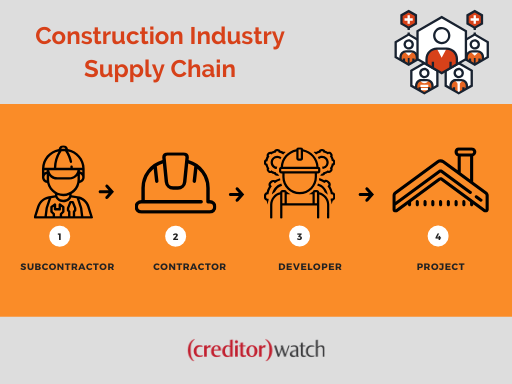

Although subcontractors are independent contractors, all entities involved in the construction project are intrinsically interconnected. If the subcontractor is unable to execute their responsibilities, this will implicate the main contractor as they will be unable to fulfil their commitments to the project owner or developer.

There will often be a chain reaction when any entity encounters an issue. For instance, if one entity in the construction supply chain becomes insolvent, the rest might not be able to get paid, the timeline may be delayed, and the whole project will be affected.

Since delays or failures in one area could cause significant knock-on effects for the rest of the project, it is in the interest of every construction business owner to protect themselves from the threat of counterparty default or insolvency.

The four main risks of subcontractors in the construction industry

The four main types of risks associated with subcontractors are:

- Poor performance and low quality work

Can you rely on your subcontractor to be adequately qualified and deliver high quality work? - Weak project management

Communication and understanding between subcontractors and contractors is reliant on strong project management skills. - Legal disputes

It’s essential that the contract is signed and is clear on issues like payment and site conditions before construction work begins. - Subcontractor insolvency

a) Illegal phoenixing

“The biggest issue with subcontractors is their financial capacity – whether they can take on the project and stay financially viable throughout its duration,” says Joanne Elzain, Finance Director of Maxcon.

Reduce the risks before, during and after the project

Managing subcontractor risk in the construction industry is an ongoing process and one that requires you to do your due diligence.

Some of our tips include:

- Prequalify subcontractors to mitigate the risk of poor performance

- Assess the subcontractor’s financial position to mitigate the risk of insolvency

- Always use contracts for legal protection against disputes

- Conduct construction safety training

- Create a communication plan and practice record-keeping

- Manage cash flow

- Spot the subcontractor warning signs

Read our downloadable resource titled ‘Managing risk with subcontractors in the construction industry‘ for more details on how to implement these tips in your business.

How the construction industry uses CreditorWatch

Many of CreditorWatch‘s 50,000+ customers are credit managers, project managers, business owners or developers in the construction industry.

We offer innovative tools to protect your cash flow and reduce your risk when dealing with subcontractors, sole traders and other businesses.

These include:

- Credit reports: perform credit checks on contractors before hiring them; understand their financial stability.

- Monitoring and alerts: get real-time notifications if there are any red flags in your contractor’s financial status.

- Credit scores: understand the propensity of a contractor failing in the next 12 months.

- High risk summary: identify existing contractors or suppliers that pose a credit risk to your business.

- Portfolio Health Check: ensure your database of contractors is kept updated with accurate information.