Creditorwatch proudly supports Maxima and AICM initiative for young professionals

Late payments are putting Australian businesses under pressure, with 17% rating overdue invoices a major threat to profitability, cash flow and confidence

Feb 27, 2026Explore our collection of news and insights

No Results Found

Sorry we couldn’t find what you were looking for.

Employment rose by 18,000 in January despite post-COVID seasonal distortions that typically depress hiring early in the year. The unemployment rate edged down again to 4.1% (fourth straight decline), reinforcing the view that labour demand remains strong.

Feb 19, 2026

Australia’s cafés and restaurants are facing record-high failure rates, with new data showing the food service sector is under significantly more pressure than pubs, clubs and bars.

Feb 18, 2026

The RBA’s Monetary Policy Board today lifted the official cash rate by 25 basis points to 3.85%. The decision reflects the Board’s assessment that inflation has stabilised in a 3–3.25% range, remaining above its 2.5% target, with inflation described as having picked up materially in the second half of 2025.

Feb 03, 2026

Economic conditions are prompting Australian businesses to adopt a more cautious approach to growth, according to CreditorWatch’s national Business Sentiment Survey of more than 1,000 business decision makers.

Jan 27, 2026

This video showcases how Ray White Commercial, City Fringe, in Sydney partners with CreditorWatch to proactively manage tenant risk, arrears and compliance in a challenging commercial property market.

Jan 15, 2026

CreditorWatch’s November Business Risk Index data reveals business failure rates across 2025 have been highest across the three eastern states of NSW, Queensland and Victoria.

Dec 17, 2025

Australia’s fight against money laundering and terrorism financing is built on a regulatory framework that makes one thing clear: money must be visible, traceable and accountable.

Dec 15, 2025

We’re thrilled to announce that CreditorWatch has successfully completed its SOC 2 Type 2 audit, marking a major milestone in our ongoing mission to protect customer data and uphold the highest standards of operational integrity.

Dec 09, 2025

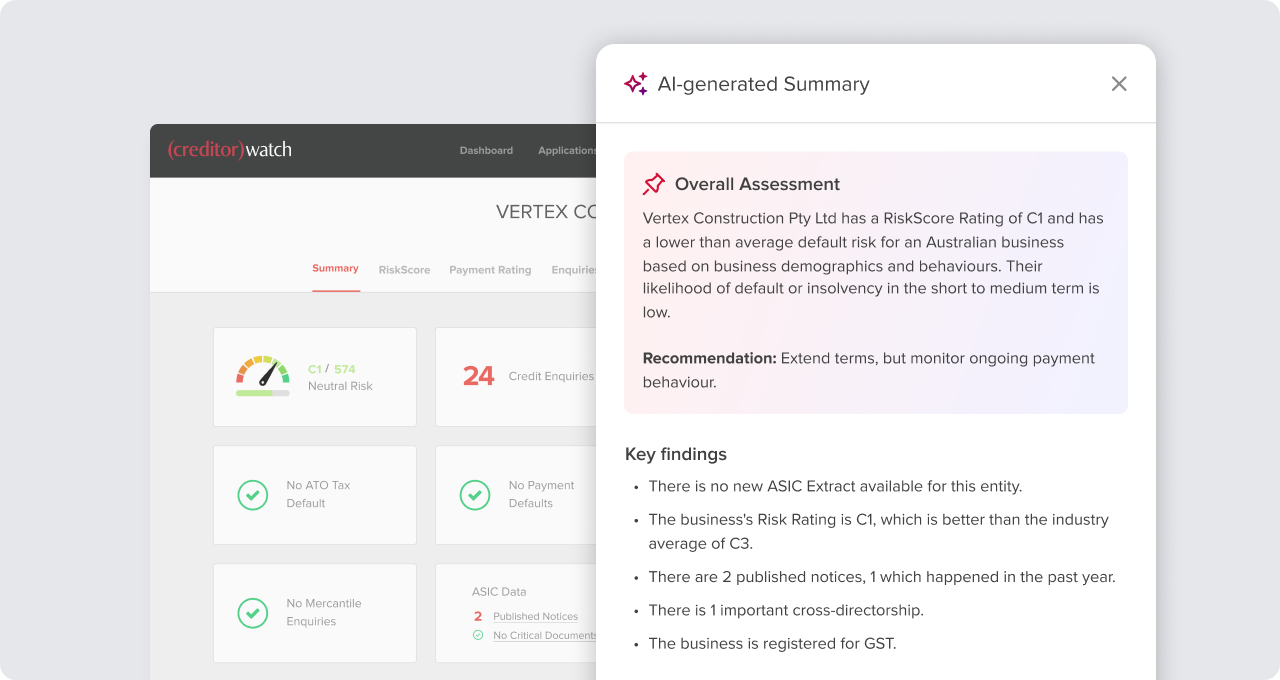

CreditorWatch, has unveiled a major new enhancement to its credit reporting platform with the launch of AI Business Profile Summaries, a powerful generative-AI feature designed to streamline credit risk assessment and help Australian businesses make faster, smarter decisions.

Dec 08, 2025

CreditorWatch’s October Business Risk Monitor reveals a turnaround in the prospects for industries exposed to consumer discretionary spending, with retail being the exception.

Nov 27, 2025

CreditorWatch’s latest Annual Business Sentiment Survey reveals a significant shift in how Australian businesses are embracing artificial intelligence (AI), with adoption rates, satisfaction levels and expectations of its impact all rising sharply over the past year.

Oct 28, 2025

No change in interest rates was the almost universal expectation among market economists, and financial markets priced very low odds of a reduction (just a 3.5% probability of a cut was priced). Interestingly, market pricing does not factor in another cut until February next year following recent stronger consumer spending and higher monthly inflation data.

Sep 30, 2025

Discover practical strategies to manage customer credit risk and protect your bottom line. Learn how to assess insolvency risk, monitor ATO tax defaults, and implement best practices in credit management

Aug 29, 2025

The July Business Risk Index from CreditorWatch reveals a duality in the Australian business landscape with certain sectors and regions showing resilience while others continue to struggle.

Aug 26, 2025

For business owners, smooth and even cash flow is crucial for the growth and success of your operation. However, when faced with challenges like late payments on outstanding invoices, businesses may experience disruptions that ripple through operations, hindering growth opportunities and jeopardising their chances of success.

Aug 23, 2025

CreditorWatch’s May Business Risk Index data reveals further indications of an improvement in conditions for Australian businesses. CreditorWatch’s key proprietary Trade Payment Defaults series fell 6.5% in June 2025.

Jul 23, 2025

Discover why evaluating customer credit risk is essential for your business's financial health. Learn how to mitigate risks, ensure timely payments, and streamline onboarding with CreditorWatch.

Jul 07, 2025

Tariff-related uncertainties and gyrations in markets took a back seat to a significant step up in geopolitical tensions and military conflict in the Middle East in June. Like the April tariff announcements, which were relatively quickly reversed or paused temporarily, the hostilities between Iran and Israel also relatively quickly de-escalated into a ceasefire following the US‘s targeted attacks on Iran’s nuclear facilities.

Jun 30, 2025

Where April was all about the imposition of - and financial market reactions to - President Trump’s higher than expected reciprocal tariffs and the subsequent escalating US-China trade war, May was the complete reverse.

May 29, 2025

The April Business Risk Index from leading credit reporting agency CreditorWatch reveals both good and bad news for Australian businesses. Encouragingly, the level of insolvencies has plateaued in recent months, albeit at high levels.

May 22, 2025

Markets were all but fully priced for such an outcome. CreditorWatch Chief Economist Ivan Colhoun believes this was the correct decision by the RBA and appropriately balances making further progress reducing inflation toward target.

May 20, 2025

CreditorWatch, has released the March results for its Business Risk Index (BRI), revealing that ongoing cost-of-living and cost of doing business pressures continue to drive elevated payment defaults between Australian businesses across a number of key sectors.

Apr 15, 2025

When forecasting I often like to: 1) identify the starting point for the forecast (the factors that have combined to produce the current business conditions); and 2) consider the big forces that are likely to affect the outlook.

Mar 27, 2025

CreditorWatch, has released the February results for its Business Risk Index (BRI), which reveal Australian businesses remain under pressure across key metrics. Cost increases and household cost-of-living pressures continue to impact the hospitality sector, with closures hitting a record high of 9.3%

Mar 19, 2025

Strong cash flow is crucial for business success and longevity. But chasing outstanding invoices can prove difficult. Late payments are a real problem, particularly for small businesses. This is where a best practice overdue invoice reminders workflow comes into play.

Mar 03, 2025

CreditorWatch, has released the January results for its Business Risk Index (BRI), revealing positive signs for Australian businesses at the end of 2024 and early 2025. However, the improvements are likely to be short lived, with the proposed tariff regime of the Trump administration expected to hinder growth, particularly for export-reliant sectors such as manufacturing and transport.

Feb 20, 2025

Extreme weakness in business conditions in mining drove this month’s slip in business conditions and looks to contain more noise than signal, though forward orders and profitability in mining have deteriorated so it’s not all noise.

Feb 11, 2025

The most interesting aspect of the NAB quarterly survey is the news that the number of firms reporting the availability of labour as a significant constraint remains a very high 34% and this has not changed over 2024. This is good news for job seekers and suggests the RBA does not have to engage in either a rapid or large series of interest rate reductions.

Feb 06, 2025

Important data points like today’s Retail Sales data will enter the RBA’s thoughts as it decides whether to cut Australian interest rates at the February Board meeting in two weeks’ time.

Feb 03, 2025

CreditorWatch's latest data on Australian Tax Office (ATO) tax debt defaults has revealed thousands of Australian private businesses have collapsed over the past 12 months after failing to address significant tax debts with the ATO.

Dec 20, 2024

CreditorWatch, has released the November results for its Business Risk Index (BRI) with all key metrics pointing to an extremely challenging start to 2025 for Australian businesses, particularly small businesses.

Dec 12, 2024

We’ve long been at the forefront of using AI to enhance credit risk assessment at CreditorWatch. Our machine learning (ML) models are the cornerstone of our credit scoring system, providing businesses with accurate and reliable risk assessments.

Dec 10, 2024

CreditorWatch, has released the August results for its Business Risk Index (BRI) revealing that the rate of business failures is at its highest level since January 2021, when Australia was in the midst of the COVID-19 pandemic.

Nov 20, 2024

The 0.8% trimmed mean outcome probably does just enough to avoid a surprise rate rise next week, but shows only continuing very slow progress in returning inflation to target, especially with the possibility of some bias lower from the presence of the big electricity subsidies in the quarter.

Oct 30, 2024

CreditorWatch, has released its latest industry risk ratings, revealing businesses in the hospitality sector are currently exhibiting an extremely high level of risk compared to other sectors.

Oct 28, 2024

CreditorWatch, has released the September results for its Business Risk Index (BRI), revealing that late payments are at their highest rate since the end of JobKeeper in March 2021, as more businesses struggle to pay outstanding invoices.

Oct 16, 2024

Credit reporting bureau, CreditorWatch, has released the August results for its Business Risk Index (BRI) revealing that the rate of business failures is at its highest level since January 2021, when Australia was in the midst of the COVID-19 pandemic.

Sep 18, 2024

Larger businesses are driving the adoption of new technologies across Australia, with AI the primary technology industries are adopting to enhance competitiveness, according to newly released findings from CreditorWatch and its Business Sentiment Survey

Sep 11, 2024

CreditorWatch’s market leading combination of unique data, cutting-edge technology and deep industry expertise sets us apart. We have a team of Data Scientists who play a crucial role in training and refining our AI models.

Sep 06, 2024

Four years after the pandemic, we are still coming to grips with how business and work has changed. In bygone days, a person would accept a transaction simply using their mark, seal or signature.

Aug 07, 2024

One question clients often ask us is, “What is my position when my customer is a trust”? Trusts can cause confusion and misunderstanding, often because they are less transparent than other business structures and the concepts can be hard to understand.

Aug 05, 2024

A common feature of the onboarding process for many suppliers is a personal guarantee taken from an owner or director of the company customer. These personal guarantees can lie dormant for months and years on end until the customer can’t (or won’t) pay any longer.

Aug 01, 2024

For suppliers of goods and equipment, the Personal Property Securities Act 2009 (Cth) (PPSA) is a fundamental requirement to protect you if your customer becomes insolvent. After all, the PPSA has been active since 2012 - well over a decade!

Jul 19, 2024

Credit reporting bureau, CreditorWatch, has released the June results for its Business Risk Index (BRI) which reveal a dramatic and concerning drop in the value of invoices held by Australian businesses as declining consumer demand forces cuts to inventory.

Jul 16, 2024

In today’s interconnected financial system, businesses face an ever-evolving landscape of risks. Among these is an area little discussed in small business circles: money laundering and illicit financing.

Jul 10, 2024

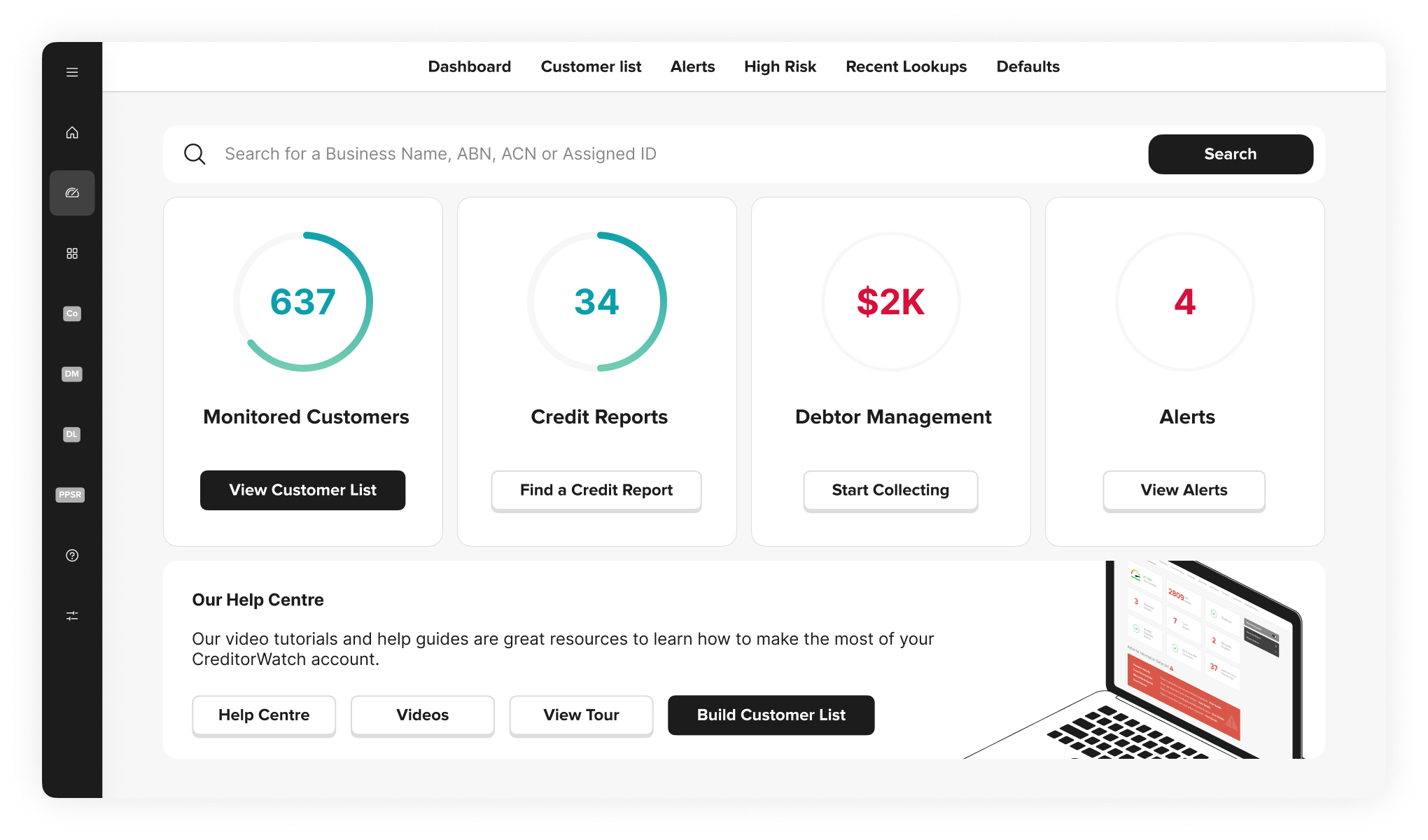

CreditorWatch has been providing Australian businesses with innovative credit management products and unique data insights since 2010, helping them confidently manage their commercial relationships, improve productivity and reduce exposure to financial risk and bad debt.

Jul 03, 2024

We know that margins are currently slim. Consumers are tightening their belts in response to interest rate hikes and inflated prices on essential goods, including groceries and utilities. Businesses in industries across the board are also dealing with challenges such as price rises, increased labour costs and higher interest rates, which is elevating their levels of credit risk.

Jun 28, 2024

Credit reporting bureau, CreditorWatch, has released the May results for its Business Risk Index (BRI), revealing that insolvencies for Australian businesses are now at a record high as the impacts of stubbornly high inflation, interest rate increases and declining consumer demand squeeze margins.

Jun 18, 2024

We know that margins are currently slim. Consumers are tightening their belts in response to interest rate hikes and inflated prices on essential goods, including groceries and utilities. Businesses in industries across the board are also dealing with challenges such as price rises, increased labour costs and higher interest rates, which is elevating their levels of credit risk.

Jun 07, 2024

Late invoice payments are among the most challenging factors to manage when running a business. They create uneven cash flow, which can have a number of serious flow-on effects such as problems paying invoices and costs such as wages and utilities, difficulty planning for the future and, in extreme cases, can even force businesses to close down.

May 24, 2024

Credit reporting bureau, CreditorWatch, has released the April results for its Business Risk Index, revealing that hospitality businesses (food and beverage services) are most vulnerable to current economic conditions by a significant margin over other industries, with a 7.45 per cent chance of failure over the next 12 months.

May 21, 2024

CreditorWatch has been providing Australian businesses with innovative credit management products and unique data insights since 2010, helping them confidently manage their commercial relationships, improve productivity and reduce exposure to financial risk and bad debt.

May 16, 2024

Application Programming Interfaces - or APIs - are the cornerstone of seamless communication and collaboration between applications and software systems. APIs can empower businesses to adapt to changing market dynamics, improve operational agility, and provide enhanced customer services.

May 10, 2024

CreditorWatch, a leading Australian commercial credit reporting bureau, today launches a new debt recovery tool, Debtor Management to help finance teams and small business owners (SBOs) and operators recover a larger proportion of overdue debt.

May 08, 2024

Outstanding invoices and late-paying clients are frustrating for businesses of every size. In a challenging business environment, establishing an efficient debt collection process can mean the difference between growing your business and struggling to keep the lights on.

Apr 29, 2024

It’s been widely reported that the ATO is increasing its debt collection activity after holding off taking action during the COVID pandemic. Companies running a business will incur certain tax debts that need to be reported and paid to the Australian Taxation Office (ATO), including PAYG withholding payments and superannuation guarantee payments on behalf of employees, as well as any GST payable by the company.

Apr 15, 2024

It’s weird isn’t it, how keeping personal information private requires transparency. Who knew? Here’s a fun fact: Privacy Awareness Week (“PAW”) will be held this year from Monday 6 May 2024 until Sunday 12 May 2024. “Is this important?” we hear you ask, and “Why should I care?”

Apr 15, 2024

CreditorWatch is thrilled to announce that it has been honoured with the prestigious HRD 5-Star Employer of Choice award, celebrating its commitment to nurturing an exceptional workplace culture. At CreditorWatch, our people make the difference, and we prioritise their wellbeing and development above all else. From comprehensive benefits to meaningful learning and development programs, we ensure that every team member feels valued and supported.

Apr 09, 2024

When it comes time to access credit or engage with new suppliers and trading partners, your company credit history can be as important as your reputation in the industry. If you’re unaware of your business’s creditworthiness, you may struggle to gain favourable financing terms or establish a foundation of trust with stakeholders.

Mar 07, 2024

Businesses in Australia are currently experiencing challenging economic conditions. When performing customer due diligence, it’s important to note that there are always tell-tale signs that companies display when in financial distress.

Jan 29, 2024

If you’re looking to safeguard the financial health of a business and improve customer relationships, establishing well-defined credit procedures and credit policy is crucial. A credit policy acts as a blueprint for how your business extends credit to customers.

Jan 16, 2024

If business growth has plateaued, and your business feels like it is just going through the motions, it might be time to give it a new lease on life. For many small businesses, there comes a point in the business life cycle where they feel like progress has stopped.

Jan 10, 2024

With the holiday season in full swing, there's no better time to reset and get reinvigorated with the best insightful and informative business podcasts to provide you with fresh ideas for the year ahead.

Jan 08, 2024

A ‘cross directorship’ refers to when an individual is the director of more than one company. While this is not always a red flag for financial risk, it can become one if that director has a history of poor payment behaviour, fraud or misconduct within that other business and you’re unaware of these transgressions.

Jan 04, 2024

Times have been tough for Australian retailers as cost-of-living pressures force consumers to tighten their belts. In this article, we look at how retailers can set themselves up to start 2024 in the strongest possible condition.

Dec 17, 2023

Late payments can be crippling businesses, particularly those operating on tight margins, such as SMEs. This pressure intensifies during the summer holiday season, a period that traditionally sees an increase in late payments and payment defaults as many businesses shut down for the period with unpaid invoices.

Dec 08, 2023

A strong credit profile is one of the cornerstones of a successful business. As with an individual credit score, having an excellent business credit profile will mean the business is more likely to gain approval for financing, such as a line of credit or business loan, or more favourable terms with suppliers.

Nov 24, 2023

A successful strike-off action indicates that the Australian Securities and Investments Commission (ASIC) has taken the necessary steps to deregister a company formally. This implies that the business name has been struck from the Australian Business Registry (ABR) and all associated parties, be they employees or creditors, have been notified of the winding up of the company.

Nov 16, 2023

Significant changes to the unfair contracts regime come into law today, with new multi-million penalties for companies and individuals forcing trading partners to sign contracts that are deemed unfair. Are your contracts fair and equitable?

Nov 09, 2023

Off-the-shelf accounting software has revolutionised the ease with which small businesses can manage their finances. From tracking your finances and making reconciliation smoother to accounts payable and staff payroll, ERPs (enterprise resource planning) and accounting software like Xero, MYOB and QuickBooks makes doing business easier than before.

Oct 30, 2023

Of course it’s important to gather the right information when onboarding a new customer. Without it, you might not be able to set them up properly in your customer relationship management (CRM) system.

Oct 18, 2023

In the complex landscape of tax obligations, the Australian Taxation Office (ATO) aims to employ a strategic approach to debt management, carefully crafted to cater to the diverse needs of businesses while maintaining fairness and equity.

Oct 11, 2023

The PPSR, the government Personal Properties Securities Register, is akin to home and contents insurance. It should be quick to set up and, once done, will protect you in case of an adverse event (for example insolvency).

Sep 21, 2023

Capturing relevant information when completing customer onboarding smooths the experience across four key areas of the onboarding stage; compliance or due diligence, credit risk, employee experience and customer satisfaction.

Sep 12, 2023

It's an occurrence seen all too frequently within wholesale trade and retail in Australia. A trading partner with high levels of outstanding debt goes insolvent, only then to re-emerge under a new name with the slate somehow miraculously wiped clean.

Sep 07, 2023

Imagine if you could look into a crystal ball, see into the future and know whether your trading partners were going to pay you on time. While it can’t 100% guarantee outcomes, trade payments data is as close to a crystal ball as you can get when it comes to credit control and looking into the health of a business’s bank account.

Sep 06, 2023

For businesses that trades credit with customers, staying ahead requires more than just ambition – it requires smart decision-making, streamlined processes, and a keen awareness of risk.

Sep 03, 2023

A lot can change across a customer’s lifecycle, whether that’s over a few months or 10 years. Just because a customer was in a strong financial position when you completed due diligence and ran their business credit check, doesn’t mean they’ll be as financially strong five years down the track.

Aug 16, 2023

Whether you’re a long-time credit controller, a new business owner or a seasoned finance manager, a clear, consistent credit risk management process is key to doing more business, with the right customers, and getting paid faster.

Aug 03, 2023

To empower business owners and credit professionals in navigating insolvent trading partners, we've compiled a comprehensive and data-driven report: 'Safeguard your business from insolvency', enriched with insights from industry experts.

Jul 26, 2023

In the ever-changing realm of finance, where uncertainty looms and economic conditions can shift rapidly, conducting proper due diligence of vendors and customers through financial risk assessments (FRAs) has never been more important.

Jul 24, 2023

Credit card companies pass a large amount of consumer and business data on to credit reporting agencies and bureaus, such as CreditorWatch, to inform their credit scores and debtor risk analysis. Each credit reporting body has independent in-house policies for collecting this data, including the frequency, time points of collection, and sources.

Jul 17, 2023

‘Know Your Customer’ (KYC) compliance involves meeting the standards set by regulators for customer verification and identity checking, depending on your type of business, service provided and industry. Enforcing KYC checks allows regulators and authorities to mitigate criminal activity such as money laundering and the financing of terrorism.

Jul 17, 2023

Typically in Australia, when a debt collector takes up the collections effort for a creditor (or buys the remainder of the debt), the creditor will provide them with any contact details it has on file. If this is insufficient or the debtor’s details have changed, the collections agency or creditor may use search tools such as CreditorWatch’s business search portal to find missing information. In certain circumstances, a creditor or debt collector can apply to a court for a ‘substituted service’, allowing them to attempt contacting a debtor via less traditional means such as social media.

Jul 13, 2023

When a business, bank, credit union or lender have exhausted their in-house options to recover money owed, they turn to a debt collection service for debt recovery in Australia. These agencies and providers follow up on late or non-paying debtors, either for a fee to the creditor or after buying the remainder of the debt outright.

Jul 12, 2023

Even if a debtor changes address or other details, debt collectors can still attempt to serve legal documents via several different means. Remaining uncontactable does not instantly wipe the debt, and you may be liable for further legal action or asset seizure in the future.

Jul 03, 2023

The ‘unfair contract terms’ laws (as set out in the Australian Consumer Law (ACL) establish out a regime whereby a term in a consumer or small business contract will be void if the term is unfair and the contract is a standard form contract.Australia’s Unfair Contract Terms regime (UCT) has now been significantly expanded in respect of ‘small businesses’. The changes were passed by Parliament on 28 October 2022 and will come into effect on 9 November 2023.

Jun 16, 2023

This year has already thrown up a number of challenges for business and individuals alike. Continued inflation, rising interest rates, supply chain issues, labour shortages and extreme weather have all meant that a large number of companies have and will continue to face various challenges that can lead to financial distress, including insolvency.

Jun 13, 2023

Dealing with overdue payments is an unfortunate reality for many businesses, particularly in tough economic conditions. When efforts to collect debts internally prove ineffective, enlisting the services of a debt collector becomes a viable option.

Jun 06, 2023

Credit checking for Australian businesses is the speciality of the CreditorWatch team. Credit checking due diligence helps creditor companies, lenders, and banks create a clear picture of borrower risk. This analysis helps determine what credit terms to extend to debtors, if any.

May 26, 2023

Running a credit check on a business is essential for proactive risk mitigation strategies. Checking credit scores for businesses is made intuitive with the advanced RiskScore platform from CreditorWatch. You can check the creditworthiness of any existing or prospective company client with a simple ABN or ACN search, and better inform your decisions with sophisticated data. Read on to learn how to do a credit check in our guide below.

May 25, 2023

In today’s job market, building a strong network and finding a great mentor are critical to achieving your goals. This is especially true now that the job market is more competitive than ever before, with hundreds of qualified candidates vying for the same positions.

May 24, 2023

Good debt refers to borrowing that can generate long-term benefits and enhance a business's financial position. In contrast, bad debt refers to borrowing that does not contribute to the growth or profitability of a business and can potentially harm its financial health.

May 22, 2023

The tech industry has long been associated with relentless investment and rapid growth. However, amid rising interest rates and difficult market conditions, the global fintech market is facing increasing challenges. It is crucial for industry players to reassess their strategies and prioritise sustainable growth. In an insightful article for FinTech Australia titled 'How to manage the Fintech margin squeeze’, our Enterprise Account Director, Stirling Streeter, delves into the consequences of the ‘growth at all costs’ mindset and offers valuable guidance on risk mitigation.

May 22, 2023

As a business or individual consumer, you cannot manipulate someone else’s credit score. However, you can alert reporting bodies, such as CreditorWatch, of negative payment behaviour or adverse events to inform their analysis.

May 19, 2023

Afterpay took the Buy Now, Pay Later (BNPL) services market by storm when it was launched in Australia in 2014, appealing to young consumers with the prospect of interest and fee-free payments (if made on time). To make a profit, most of Afterpay’s revenue comes from merchants, with a flat merchant fee of $0.30 and a 4-6% commission based on the value of the sale. Late charges from customers also account for a proportion of its income.

May 19, 2023

A credit reference check, or credit report check, describes accessing a business or individual’s credit file with a reporting body. Australian companies can sign up for a free trial of the credit reporting tools from CreditorWatch to check the creditworthiness of trading partners before extending terms. Conducting this due diligence allows for proactive corporate risk management, avoiding risky debtors before they threaten vital cash flow.

May 17, 2023

Credit reporting agencies in Australia, such as CreditorWatch, analyse enormous datasets to generate credit scores for businesses or individual consumers. Companies, banks, lenders and other creditors use this information to determine the suitability of debtors and applicants for loans.

May 16, 2023

Financial risk is the potential for loss or adverse consequences resulting from inadequate or failed financial decisions, investments, or operations. It encompasses various factors that can impact a company's financial stability and profitability.

May 15, 2023

In today's financial landscape, maintaining a healthy credit score is crucial for accessing various opportunities, from securing loans to renting an apartment. Unforeseen circumstances or past financial mistakes can leave individuals burdened with a less-than-ideal credit history. This is where credit repair companies step in, offering their expertise to help individuals repair and restore their creditworthiness. In this article, we will delve into the world of credit repair companies, exploring their purpose, operations, benefits and the signs of reputable service providers in Australia.

May 15, 2023

The term ‘financial risk’ refers to the potential for a loss of earnings or income. The higher the likelihood or severity of that outcome, the greater the financial risk. Businesses and individuals alike must responsibly manage their exposure to these risks to mitigate the prospects of insolvency, default or bankruptcy.

May 12, 2023

A credit report details a potential borrower or debtor’s risk to the lender or creditor. A credit reporting agency, such as CreditorWatch, analyses large subcategories of business data to generate our reports and credit scores for Australian companies.

May 12, 2023

At CreditorWatch, we understand and value the confidence you place in us when you register to use our platform. We know that you rely on us to support your business with credit risk management tools that help you protect and grow your business while ensuring that your data is safeguarded with gold-standard security protocols.

May 11, 2023

At CreditorWatch, we understand the current challenges faced by construction firms in Australia. That's why we are excited to announce the release of our latest report, 'Cracks in the Foundations 2023.' This comprehensive report provides valuable insights and guidance to help businesses navigate the tough trading environment and kickstart growth. Download the free report here: https://creditorwatch.biz/3NCuest

May 11, 2023

The term ‘risk’ refers to the probability of an adverse outcome occurring. The higher that probability, the riskier the activity. ‘Financial risk’ applies that concept to a potential loss of income or revenue for a business or individual.

May 08, 2023

Debt collection describes recovering overdue funds owed to a creditor, administered by a third party for a fee. If a business or individual considers themselves unable to recoup money owed after taking steps to collect it - they may decide to contract the services of a debt collector.

May 04, 2023

A security interest is a debt or obligation secured by personal property (known as collateral) as defined by the Australian Financial Security Authority (ASFA). In the event that a debtor fails to meet their obligations, such as defaulting on payments, the secured creditor can take possession of the collateral.

May 03, 2023

Customer due diligence (CDD) is the process of verifying the identity of a customer, assessing the potential risks associated with their activities, and determining whether their behaviour and transactions are consistent with their known or stated activities.

May 02, 2023

Running a credit check on a prospective new client can help a business mitigate the risk of bad debt. However, some companies may find this exercise intimidating or confusing. Luckily, the credit reporting suite from CreditorWatch takes the hassle out of this essential process.

May 01, 2023

Financial risk represents the likelihood of an unfavourable outcome relating to personal or business decisions. The higher the financial risk exposure, the greater the chance of losing money or becoming indebted.

May 01, 2023

Closing a credit card account may impact an individual or business’s credit scores, depending on the nature of the closure. Any credit account closure can affect credit scores to some degree, as reporting bureaus look favourably on maintaining regular payments on these products, and you will subsequently have less information on file.

Apr 30, 2023

A business credit card allows a business owner or one of their nominated staff to purchase items on credit. The balance of this credit gets settled at the end of the statement period, which may vary from one credit product to the next.

Apr 29, 2023

A common struggle facing small business owners is juggling the need to protect cash flow from risky trading partners, with the lack of time and resources available to manage this risk properly.

Apr 11, 2023

A credit report is a detailed record of a business or individual's credit history, which includes information about their credit accounts, credit inquiries, and payment history. This report is compiled by credit reporting agencies, such as CreditorWatch, based on the data provided by lenders, credit card companies, and other creditors.

Apr 05, 2023

Getting your head around the ins and outs of credit reports can be challenging, especially the differences between key terms, such as credit report vs credit score. Let’s break down everything individuals and businesses need to know about credit reports.

Mar 31, 2023

Credit management is the process of managing the credit risk associated with extending credit to customers or clients. Its main purpose is to ensure that businesses can collect payments for goods or services provided to customers within a reasonable period of time, while minimising the risk of late payments, defaults and bad debts.

Mar 31, 2023

A business credit card works like a personal credit card, in that it allows an owner or employee to make company purchases on credit, which should be repaid to the card provider at the end of the statement period.

Mar 30, 2023

Q: What is the difference between a mortgagee and a mortgagor? A: A mortgagee is a lender or financial institution that provides a loan to purchase a property. A mortgagor is a borrower who receives a loan, using their assets as collateral.

Mar 30, 2023

According to the latest annual cyber-threat report from the government cyber-security agency, the ACSC (Australian Cyber Security Centre), cybercrime increased 13% over the last financial year with a rise in the sophistication of cyber threats, making crimes like ransomware and fraud easier to replicate at a greater scale.

Mar 29, 2023

It’s a clichéd phrase, this “Line in the Sand” stuff isn’t it? It says “Just stop, I’ve had enough”. Whether it’s an over excited puppy, an annoying colleague or even listening to your own internal critic, we all know there comes a time when we need to put a halt to things as they are.

Mar 27, 2023

Do you remember that awkward conversation with your bookkeeper? Yeah, you know the one. They asked you about your accounts receivable and you confidently launched into a rundown of the business expenses you’d recorded for the past month

Mar 27, 2023

When a business applies for funds from a bank, lender or credit union, it is applying for a business loan. Short term loans for business may be ‘secured’ (underwritten by collateral such as property) or unsecured, with interest varying accordingly.

Mar 27, 2023

Data breach. Two words that send shivers down any company exec’s spine. Unfortunately, they’re increasingly common, the effects are widespread across a business’ operations and the financial impact can be massive. At CreditorWatch we’re acutely aware of the trust you place in us when you sign up to use our platform. We’re continually monitoring our information security management to ensure that our platform remains at the highest level of security.

Mar 24, 2023

Outsourcing across many roles and industries has become increasingly popular over recent years. And as the popularity of outsourcing has grown, so has the ease of finding and engaging outsourced support. Outsourced credit control services is among those that have grown in popularity.

Mar 21, 2023

Proper credit control is crucial for maintaining smooth and even cash flow within a business. But what is the definition of a credit controller? A credit controller manages credit that is extended to customers. Central to this role is the responsibility for collecting payment on all invoices issued and monitoring payments so that customers who do not pay on time can be followed-up and outstanding payments can be collected.

Mar 20, 2023

Every Australian consumer has a credit file with the three main consumer reporting bureaus: Experian, illion and Equifax. CreditorWatch differs to these bureaus in that it is a specialist B2B credit reporting bureau and doesn’t collect data on consumers.

Mar 20, 2023

The major credit reporting bureaus in Australia have different scales for their credit scores. Your credit score will differ depending on the entity providing the credit file, as each reporting bureau uses different metrics and different rating categories to inform the score.

Mar 16, 2023

CreditorWatch today launched its automated debt collections solution, CreditorWatch Collect. The latest offering from the commercial credit reporting bureau gives businesses struggling to keep on top of cash flow access to a tool to transform their accounts receivables and collections processes.

Feb 28, 2023

Credit Portfolio Management (CPM) involves the analysis of a business or lender’s credit portfolio to determine an effective balance of net risk and growth. The larger the diversity of borrowers and loan amounts, the more critical this process is.

Feb 27, 2023

A business’ revenue, or credit, can only be used to buy commercial real estate, which has the express purpose of being used for commercial ventures. In instances of a mixed-use block, a commercial loan product may be available to account for a percentage of the purchasing price.

Feb 21, 2023

Bankruptcy has a sinister reputation. It carries the stigma of failure and a perception that someone is incapable of managing their personal finances. However, there is a light at the end of the tunnel for anyone going through bankruptcy.

Feb 20, 2023

When you file for personal bankruptcy the details are kept on the National Personal Insolvencies Index (NPII). This public register allows any interested party to search for bankruptcy filings in order to inform their decisions and actions.

Feb 15, 2023

Strong cash flow is crucial for business success and longevity. But chasing outstanding invoices can prove difficult. Late payments are a real problem, particularly for small businesses. This is where a best practice overdue invoice reminders workflow comes into play.

Feb 06, 2023

As we emerge from the COVID-19 pandemic and the business landscape returns to normal, the ATO is again ramping up its enforcement of outstanding tax liabilities with more than 50,000 Director Penalty Notices (DPNs) issued last year on directors, which if not dealt within the strict timeframes specified, can lead to personal liability.

Feb 02, 2023

Whether you’re seeking a long-term business loan or a small loan to start a business, having a less-than-stellar company credit history can feel like a life sentence. However, there are options available to business owners that could be worth considering, to improve the likelihood of approval for a loan or line of credit and improve your business credit score.

Feb 02, 2023

Automating your accounts receivable is an easy, fast and cost-effective way to stand out from your peers and shift your career up a gear. While automation can be daunting, it’s a forward-thinking, digitisation project to lead.

Jan 19, 2023

Almost 90% of CFOs say that a lack of automation is one of the main roadblocks to an efficient financial close process. Yet most businesses continue to rely on spreadsheets and only the most basic level of automation when it comes to their accounts receivable.

Jan 18, 2023

Know Your Customer (KYC) due diligence means checking customer and partner business identification to protect against criminal activity. Within Australia, certain businesses are required to comply with KYC safeguards and reporting through Anti Money Laundering (AML) and Counter Terrorism Financing (CTF) legislation, also referred to as the AML/CTF Act.

Jan 18, 2023

Once a company is deregistered within Australia, it ceases to exist as a legal entity and can no longer trade. Should you meet certain criteria, you may be able to reinstate the company – effectively restoring it to its form prior to deregistration.

Jan 03, 2023

The term ‘recession’ has typically described two consecutive quarters of negative Gross Domestic Product (GDP) growth, although other metrics may be applied by economists. It is denotes a downturn in economic conditions and activity for a particular region or country.

Dec 27, 2022

If the shareholders of an insolvent company vote in favour of liquidation, or if creditors vote in favour of liquidation this is commonly referred to as creditors’ voluntary liquidation. It is the most common type of insolvent liquidation.

Dec 23, 2022

Gone are the days where businesses had to rely upon paper-based applications when assessing new clients that sometimes took weeks to complete. Things are now much quicker but in this challenging operating environment, performing proper due diligence prior to approval of credit applications is crucial.

Dec 19, 2022

DebtorLogic is a debt collection strategy that helps you stay ahead of bad debt by revealing how your customers pay you in comparison to the rest of the market. It helps businesses to get paid faster and improves cash flow by taking a proactive approach to debtor management.

Dec 01, 2022

The Australian economy is struggling with supply chain issues, rising interest rates and ongoing financial uncertainties. While growing debt could potentially cause the demise of your business, collecting outstanding payments is proving to be more difficult than expected.

Nov 30, 2022

The silly season is upon us and chances are your calendar is already beginning to fill up with end of year catchups and Christmas parties. Then there are the many meetings to discuss projects that must be completed before we all head off for a bit of respite and sun.

Nov 28, 2022

It’s a tricky time to be operating in the construction industry. As seen with the recent collapses of multiple Australian construction companies, increased operating costs and a downturn in revenue can quickly result in defaults and insolvency. It sounds simple, and it’s not always easy, but the best way to safeguard your business from the myriad challenges confronting the industry is to ensure that cash flow is regular and protected. If you have the money to pay the bills, then you’re more likely to survive and thrive.

Nov 16, 2022

The Personal Property Securities Register (PPSR) is an online federal government notice board of security interests in personal property. The PPSR is a regulated database of official interests in specific property - including cars, goods, company assets, and other items. When specific types of loan, rental, hire-purchase or other agreements are signed, the property in question (referred to as ‘collateral’) underwrites it. Implemented in January 2012, the security interest register keeps an official log of which parties have a stake in which collateral.

Nov 14, 2022

Your personal credit history can affect your business credit history, including your ability to gain access to credit products, such as a business loan or a business credit card. If you have a poor credit score, it can make it much more challenging to gain approval for credit products, as a lender may review both your personal credit history as well as your business credit history. However, having bad personal credit and poor credit history isn’t a life sentence and it can be possible to boost your chances of credit approval.

Nov 11, 2022

We sat down with Claire O’Neill, Assistant Commissioner, Integrity at the ATO to find out the options that businesses with outstanding tax debts have, and the steps that the tax office will take to work with businesses before taking extreme action such as publicly declaring tax debts.

Oct 26, 2022

For relevant officeholders enquiring how to close a company formally, the process is not as complicated as it may seem. In simplest terms: if your company has asset holdings totalling under $1000 and has not declared insolvency, you may be eligible to apply for voluntary deregistration.

Oct 23, 2022

As profit margins dwindle under rising inflation and operating costs, identifying your high risk customers is paramount. Trading with risky clients jeopardises cash flow, integrity, and exposure to litigation.

Oct 23, 2022

Within the risk-laden world of construction, integrity and reputation are crucial for survival. Risks to cash flow from non-payment are high. Extending credit to late-paying clients may ultimately send both businesses down the insolvency path.

Oct 23, 2022

While many of the movement restrictions and space limitations have eased since COVID-19 first hit Australian shores, businesses in the hospitality sector are still experiencing the impacts of the pandemic.

Oct 23, 2022

Enterprises within the hiring and rental business historically operate on a critical foundation of trust. Understandably so, as the value and volume of goods loaned are often significant.

Oct 23, 2022

The Personal Property Securities Register (PPSR) is the Australian Government’s online noticeboard of security interests in almost anything of value, except for land, buildings and fixtures. It’s important for businesses to know about the PPSR – but what kind of risk protection can it provide?

Oct 20, 2022

The real estate industry relies upon the regularity and consistency of tenancy payments to drive revenue. Property Management often forms the cash flow base for boutique and franchise shop fronts alike, and any disruption can adversely affect the bottom line quickly.

Oct 14, 2022

The process of chasing up unpaid debts can feel like an intimidating task, particularly when you’re dealing with multiple products and transactions along an extensive supply chain. However, for businesses in the wholesale sector, it doesn't have to be.

Oct 12, 2022

Overdue invoices can cause a serious headache for retail and wholesale businesses, especially considering the reliance on steady cash flow to buy more stock and supply your goods. Not only is the impact detrimental to your accounts receivable, but also the time spent chasing up late payments eats into operational hours.

Oct 11, 2022

No matter what your business is manufacturing, the key to the process is cash flow. It’s the vital stream of revenue that allows you to buy your raw goods, pay for the utilities required to produce the product, and maintain the wages for staff. As soon as there is any disruption to cash flow, by virtue of slow creditors, it can spell trouble for your operation.

Oct 11, 2022

Within the often murky world of construction, transparent data gives your team the inside track. Prospective trading partners in the sector have been known to sometimes take steps to obscure or obstruct the discovery of credit risk or instances of malpractice.

Oct 09, 2022

Procurement teams play a vital role that, in many ways, dictates the viability of the operation they represent. Large-scale Australian manufacturing businesses need to source the right goods, at the right price, from the most reputable suppliers in order to have any remote chance of long-term sustainability.

Oct 05, 2022

The construction sector within Australia is notoriously high-risk. Any exposure to the adverse payment behaviour, credit risk, or directorial malpractice of a trading partner can threaten the viability of your operation. Failing to implement an appropriate debtor management strategy, or using incorrect data, may result in default or insolvency implications for your business. It’s essential that all creditors be managed effectively, with collections prioritised, in order to safeguard your cash flow.

Oct 04, 2022

For fintech businesses, the use of open networks is one of the foremost advantages of the sector. It differentiates product offerings from competitors and allows market-leading technology to be leveraged. However, this same system exposes these businesses to a litany of risks in a sector that does not assume the same regulated transparency, compliance, or risk reduction policies that lenders or banks are subject to.

Oct 04, 2022

The construction industry is operating amidst an abundance of higher credit risk factors, including ongoing supply chain and materials delays, as well as higher costs for materials. When a construction business takes on a project in the current environment, it’s likely exposing itself to some degree of risk.

Sep 30, 2022

Following up on unpaid invoices and outstanding debts can be a frustrating and awkward process. Any unpaid credit to your business can have a devastating impact on your cash flow and your ability to turn over stock. Luckily, the credit collection process is not one you must go through alone.

Sep 28, 2022

Company credit checks are an underutilised resource that can offer significant benefits to any business. Not only can performing a credit check on customers, suppliers or potential business partners protect you from credit risk and cash flow issues - you’ll be able to make more informed, data-driven decisions to facilitate business growth.

Sep 26, 2022

One of the best tools at your disposal to reduce business credit risk is accurate, up-to-date data. Unfortunately, dirty data is a common problem that limits the ability of a company to take action to mitigate credit risk. Luckily, there are steps you can follow to be proactive about your data management and data hygiene.

Sep 26, 2022

Within the unprecedented high-cost trading environment across multiple Australian industries, high volume Transport and Logistics companies are broadly exposed to credit risk. Ensuring the creditworthiness of suppliers and clients alike is crucial to securing the future of your cash flow and business.

Sep 26, 2022

At the apex of technology, research, and financial markets - fintech companies are breaking new ground and changing the ways that clients operate. The impacts of smart product offerings, leveraging the latest developments in science and engineering, have been enormous for both individual consumers, and partner businesses.

Sep 23, 2022

Data is king in the world of contemporary business. Operators that are able to accurately collate and analyse data from trading partners, customers, and local areas can leverage that information to elevate performance.

Sep 23, 2022

Getting on the front foot with your debtor management can mean the difference between healthy cash flow and potential insolvency. There are tools and insights available for proactive debtor management, which can alert you to the dangers of customers at risk of default ahead of time.

Sep 23, 2022

As a hiring or rental business, the top priority (alongside regular revenue) needs to be the security, and retention of ownership, of any loaned or collateral assets. If your security stake in an asset is unproven, you may never either recover the good or be compensated for it, according to strict compliance guidelines.

Sep 20, 2022

The building and construction industry within Australia is notoriously high-risk. It is quick to be adversely affected by any downturn in the nature of trading conditions, including supply chain delays, steep price hikes on imported goods and raw materials, and rising domestic inflation.

Sep 20, 2022

Bad debt can be fatal to a business. CreditorWatch helps you avoid this by taking a proactive approach to debtor management. Our interactive trade payment program, DebtorLogic, reveals your debtors’ payment trends, enabling you to identify risks and prioritise collections.

Sep 19, 2022

Australian businesses currently in a very fragile state due to the shifting and changing nature of the economy. It is important to focus on the financial health of your business and the steps you can take to improve it.

Sep 16, 2022

For as long as financial services have existed, unscrupulous entities have found ways to exploit their weak spots for personal gain. Fraud itself is nothing new, but there are concerns that those weak spots are now more plentiful and easy-to-find than ever before.

Sep 07, 2022

As a creditor, you want to be sure that your debtors can repay their dues and that each customer is reliable with a trustworthy credit history. CreditorWatch is Australia’s leading credit check business. Our business credit reports help you identify risky customers, allowing you to proactively mitigate risks to protect your business.

Sep 05, 2022

As a wholesaler, your investments and trading need to come with a high degree of financial safety and security. Any credit risk should be mitigated from the outset and a key tool for wholesalers is the Australian Government’s Personal Property Securities Register (PPSR).

Sep 05, 2022

Employing around 1.16 million people in 2021, the construction industry is significant to Australia’s economy. The industry's value sat at $202 billion in 2021 with $81.84 billion of that coming from the private sector.

Sep 05, 2022

Debt collection is a process of empathy as much as it is strategy. Any company collecting debts from its customers must understand the position each party is in and make it as seamless a process as possible to ensure everyone can focus on running a strong business.

Sep 05, 2022

In Australia, the hiring and rental industry, by its nature, requires a higher degree of asset and cash flow security. On the provision side, this is due to revenue streams depending not only on transactional volume, but also the maintenance, care, payment for and return of the individual goods leased or loaned.

Aug 31, 2022

In a time of increasing insolvencies and bankruptcies, and rising costs of doing business, an intimate knowledge of the directors of current or future potential trading partners can be of great value to your business.

Aug 31, 2022

The manufacturing industry is one of the most vulnerable sectors when it comes to the risk of fraud and corruption. Horror stories involving inferior product quality, false warranty claims, and stock theft and misuse, among many other unfortunate scenarios, have caused significant fraud-based losses to many manufacturing companies and their livelihoods.

Aug 31, 2022

Real estate industry performance is intrinsically linked to the trading conditions of the housing market. In times of boom, the sales volume for agents increases - driving a swell in available cash flow for all associated businesses.

Aug 30, 2022

It’s a tale as old as time for too many businesses within Australia. You engage with another company, everything runs smoothly for a few months, and then out of nowhere that company collapses – and you’re left struggling to reclaim debt.

Aug 29, 2022

The trading environment in Australia throughout 2022 has seen some unprecedented challenges. As rates of insolvency have risen across numerous industries, it is more important than ever to ensure appropriate risk mitigation strategies are in place to protect both your business and its assets.

Aug 29, 2022

When making purchases on behalf of your business, it is imperative that your suppliers and contractors are trustworthy, creditworthy and timely in the delivery of their products.

Aug 29, 2022

The current trading environment for the food and beverage services sector is creating significant downward pressure on cash flow, while amplifying credit risk. This can be attributed to low consumer sentiment, higher inflation levels, supply chain issues, and multiple other factors.

Aug 29, 2022

When a business credit application is made, it’s important to dot every i and cross every t before committing to a partnership with the applicant. This should involve a process of thorough due diligence where you research a business’s credit report and make an informed decision around whether they present a risk to your cash flow.

Aug 22, 2022

The Personal Property Securities Register (PPSR) is an official government register of interests in personal property. Operating as an online noticeboard, you can register with PPSR to show that you have rights over personal property which secure a debt or obligation that someone owes you.

Aug 18, 2022

Within the current business trading environment in Australia, cash flow is king. To adequately protect the balance sheet of your business, it is essential that you determine the creditworthiness and payment tendencies of any partner business.

Aug 17, 2022

Spanning a broad cross section of Australian businesses, from art galleries to theatres, gyms to sport and recreation clubs - the arts and recreation services industry is a fickle beast.

Aug 17, 2022

When you begin trading with a new business, the history of its directors may not be something that you immediately think of as being important. But extending credit to companies that have unscrupulous directors will not only putting your business at risk but can also potentially expose you to criminal activity.

Aug 17, 2022

It’s a challenging time for the construction industry, thanks to ongoing labour shortages, and supply chain issues, in tandem with rising inflation levels increasing local business expenses.

Aug 16, 2022

Since 2020, businesses across all sectors and regions have taken a beating with trading conditions the most challenging they have been in years. With multiple impacts such as rising inflation and interest rates, labour shortages, supply chain disruptions and more, CreditorWatch’s Business Risk Index forecasts business insolvencies to continue rising over the coming months.

Aug 15, 2022

The current business trading environment within Australia is facing unprecedented challenges, as seen with fluctuating revenues and higher inflation. With company insolvencies rising, it’s important to understand the difference between liquidation, voluntary administration and bankruptcy.

Aug 10, 2022

In the ups and downs of today’s global economy, wholesalers often bear the brunt of it all when it comes to another supply chain collapse. So, what can you do to make sure your wholesale business steers clear of toppling supply chains and keep your ledger strong?

Aug 03, 2022

When performing customer due diligence, what are the red flags to look out for? It is likely that five to 15 per cent of your ledger has adverse information you’re unaware about. To mitigate credit risk, it is important to be able to identify risk indicators which highlight entities in financial distress.

Aug 02, 2022

When performing a business credit check, it is important to understand the concept of cross directorships. This is where some directors you work with may own or have previously owned multiple companies, and potentially increasing their credit risk.

Aug 01, 2022

In a world where the trading environment is increasingly uncertain and information comes at us at an overwhelming rate, having accurate, reliable, and up-to-date business data can make all the difference in how well your business is protected.

Jul 29, 2022

It’s been a volatile few years for the construction industry, with rising inflation, global supply chain disruptions, labour shortages and fixed price contracts putting increased pressure on clients and businesses alike. However, there are options available for companies to avoid late payments, and potentially get paid faster.

Jul 29, 2022

As we have commenced Financial Year 2023, the rates of insolvency within the financial services industry have risen, illustrating the critical challenges these businesses continue to face. Managing credit risk is essential to maintain the flow of revenue from trusted trading partners, and avoid the prospect of default.

Jul 29, 2022

Looking at the past can help you determine trends of the future – but sometimes the past can come back to bite you. A company’s credit history can make or break its ability to secure credit and conduct business.

Jul 29, 2022

When you first start out, it can be a daunting task to try and pick out which customers have the best chance of working well with your business. Luckily, there’s a simple way to land your goal of building a base of reliable customers – check their credit scores!

Jul 29, 2022

The current economic climate is awash with change and uncertainty. These unstable trading conditions have highlighted the necessity for businesses, particularly small and medium enterprises (SMEs), to become more aware of who they are working with.

Jul 25, 2022

It takes a multitude of people to work end-to-end on a construction project. If you own or run a construction company of any kind, your employees or contractors need to be paid and you need to be paid by the client to pay these contractors.

Jul 25, 2022

Checking the credit of your customers and clients is a crucial part of running any business. Whether you're providing services, products, or financing, you need a way to ensure that you can trust your customers to make good on what they owe you.

Jul 21, 2022

The current trading environment for Australian business is presenting unique and unforeseen challenges to both ownership and their management teams. In light of this, diligent credit assessment of customers is as necessary as ever before.

Jul 19, 2022

In this episode of Business Insights, we take you through how to improve the strength of your ledger, with CreditorWatch’s Trade Consultant for DebtorLogic, Lucinda Judd. In these times of uncertainty for businesses, ensuring that your customers are reliable and able to pay on time is critically important for your cash flow.

Apr 06, 2022

Strong cash flow is crucial for business success and longevity. But chasing outstanding invoices can prove difficult. Late payments are a real problem, particularly for small businesses. This is where a best practice overdue invoice reminders workflow comes into play.

Mar 03, 2025

Don’t miss out on the latest news, webinars, podcasts and more! Our newsletter drops monthly with all the updates you need.