Business Risk Review July 2020

Despite the uncertainty of 2020, there are signs of green shoots appearing in the Australian economy. According to CreditorWatch‘s Business Risk Review data, the number of businesses defaulting on payments fell by 13.2 percent in July, compared to June 2020, and the average days to payment decreased by 7.6 percent across all industries.

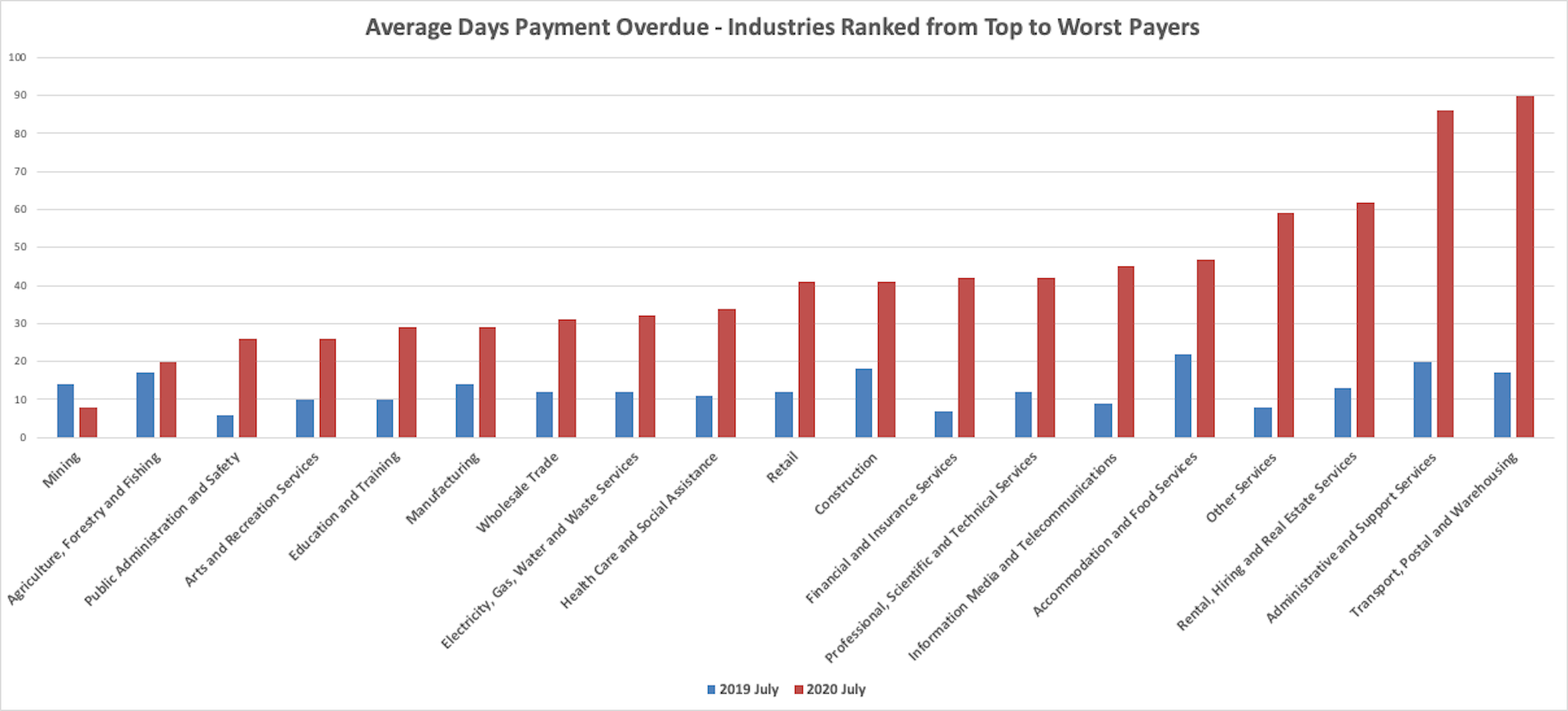

Who are the best and worst paying industries?

Industries have been struggling with cash flow well before COVID-19: payment times are 224 percent higher than they were in July 2019. However, some sectors have made small improvements since June 2020:

- Arts and Recreation fell to 26 days overdue in July 2020 – down 34 days from June

- Healthcare and Social Assistance fell to 24 days overdue in July 2020 – down 18 days from June

- Finance and Insurance fell to 42 days overdue in July 2020 – down 33 days from June

The pandemic has wrecked havoc on other key industries who are struggling to pay businesses within 40 days of receiving an invoice. Collecting late payments can be time-consuming and fruitless, but having a game plan will boost your chances of success.

The industries to watch

Industry |

Days overdue in July 2020 |

Change vs July 2019 |

Change vs June 2020 |

| Transport, Postal and Warehousing | 90 | 429.4% | 0 days |

| Administrative and Support Services | 86 | 330.0% | -2 days |

| Rental, Hiring and Real Estate Services | 62 | 376.9% | -8 days |

| Accommodation and Food Services | 47 | 113.6% | -5 days |

| Information Media and Telecommunications | 45 | 400.0% | +1 day |

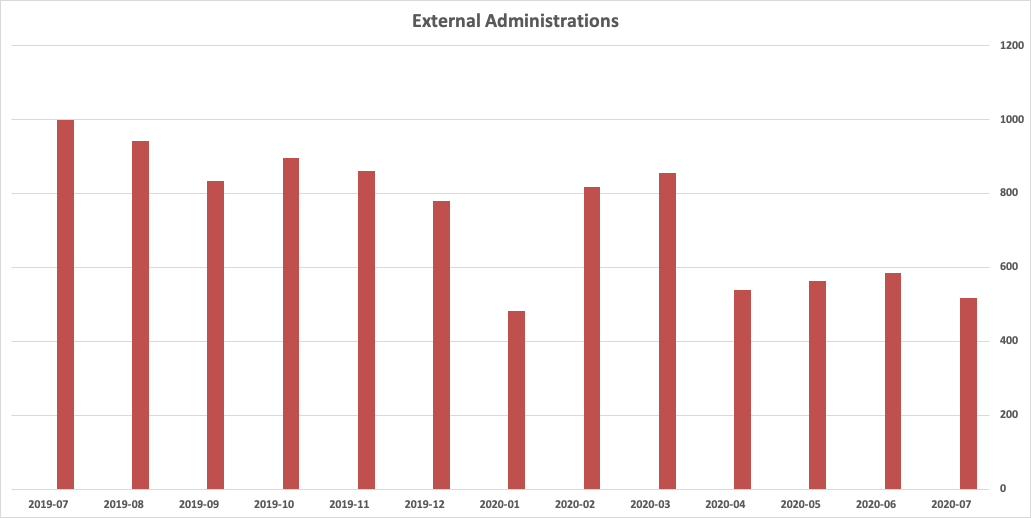

External administrations continue to be put on hold

Government stimulus continues to be a life raft for cash-poor businesses. External administrations haven’t been this low since January, a notoriously quiet month after the Christmas rush. There has been a further 11.6 percent drop in administrations in July compared to June 2020. The 518 external administrations reported in July 2020 pales in comparison to the 998 reported during July 2019.

This has been a frequent topic of discussion in recent months for good reason: the economy will be feeling the effects of the temporary insolvency laws for years to come.

ASIC commissioner Sean Hughes echoed this sentiment in a response to Labor MP Anne Aly, quoted in The Sydney Morning Herald on August 6:

“We are certainly looking out beyond the pandemic, and in particular to where the waves of potential insolvencies in small business sectors may emerge into 2021 and 2022.”

“We’re very mindful of the impact not only families and small business, but also the impact on the insolvency profession and the volume of work that is going to be flowing in that direction. But it’s certainly something we will be keeping a very close eye on over the coming months and it’s fair to say years.”

CreditorWatch CEO Patrick Coghlan says:

“Until now, the priority has been to keep as many businesses as possible above water. The extension of JobKeeper measures to March 2021 and the mooted extension of Safe Harbour measures, including high limits on the amount of debt that SMEs can incur whilst still trading, will keep SMEs afloat.”

“However, the number of ‘zombie companies’ – those being kept out of administration artificially – continues to grow and policy makers need to consider the gradual easing of measures to ensure good money is not being thrown away on bad companies.”

Creditors need to protect their cash flow and security interests

As hundreds of businesses escape insolvency each month and continue trading as normal, it’s increasingly difficult for creditors to protect themselves from hidden risks.

“Just as investors are watching listed companies closely during the reporting season to ensure they are not hiding behind government payments, creditors need to be keeping close tabs on SME market confidence and work with debtors to build sustainable cash flow,” says Patrick Coghlan.

Our advice is the same for any economic climate: equip yourself with credit risk technology that can detect your riskiest debtors and help you make more informed decisions. CreditorWatch’s product suite is designed to act as your business’ guardian angel. Protect yourself by using:

PPSRLogic: This award-winning platform makes it faster and easier to register on the PPSR. It’s essential for any business leasing goods on credit terms.

DebtorLogic: Take the guesswork out of analysing your ATB. DebtorLogic is a fully-interactive program that identifies payment trends so you know who to collect from first.

Business credit monitoring: Get alerted to adverse customer activity in real time with CreditorWatch’s monitoring and alerts feature. It’s the only way to watch all your debtors at once and act promptly when a customer shows signs of trouble.

All data accurate as of 7th August 2020. ASIC data is subject to change.