There are new changes to business restructuring and insolvency laws

From 1 January 2021 to 31 March 2021, the Australian government is offering temporary restructuring relief to eligible companies, as part of a host of business measures implemented during COVID-19.

A company director needs to declare its eligibility for temporary restructuring relief with ASIC and publish the notice on the Published Notices website. This notice is then published on the company’s CreditorWatch credit report, so all creditors are made aware of a business’s declaration.

Read below to find out more about the temporary restructuring relief, how to find out if a company has declared for the relief, and what it means for creditors.

What is temporary restructuring relief?

Temporary restructuring relief gives eligible companies access to the measures listed below:

- Increasing the amount that must be owed to a creditor from $2,000 to $20,000 before the creditor can issue a statutory demand for payment on the company;

- Increasing the time a company has to respond to a statutory demand from 21 days to 6 months; and

- Providing a director with a temporary safe harbour from personal liability for insolvent trading for debts incurred in the ordinary course of business before any appointment of an administrator or liquidator of the company during the period of safe harbour protection.

Who is eligible for temporary restructuring relief?

To be eligible, a director of a company needs to declare they intend to take advantage of the simplified debt restructuring process because they believe that:

- Their company is insolvent or likely to become insolvent

- They would be eligible for restructuring if a restructuring practitioner was appointed during the declaration period (three months from when the declaration was published)

- There is no external administrator already appointed to the company

Read the full list of eligibility guidelines here.

How can I find out if a company has declared their eligibility for temporary restructuring relief?

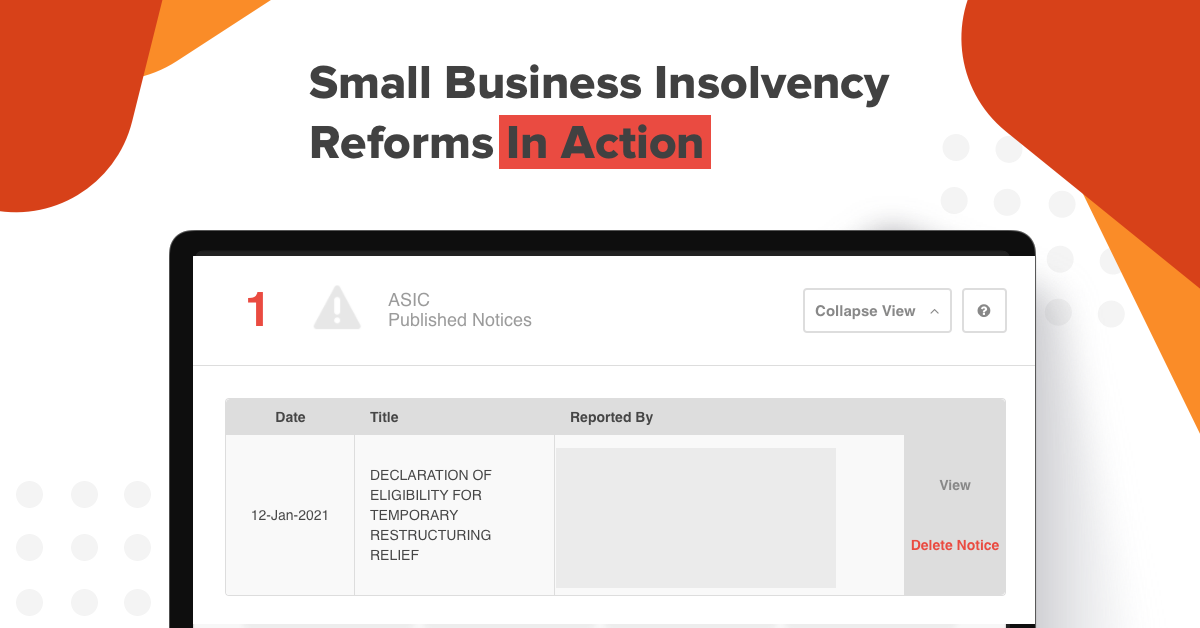

ASIC provides CreditorWatch with all notices that are published on the insolvency notices website, including declarations for temporary restructuring relief. You can find this notice in a company credit report on CreditorWatch. Just click on the ‘ASIC Published Notices’ widget at the top of a credit report to be directed to the right spot.

CreditorWatch customers will also be instantly alerted via email if one of their customers on their watchlist publishes this notice. This is delivered by our 24/7 monitoring and alerts tool that keeps you updated of all adverse changes to your customers’ credit reports. Think of us like a guardian angel that watches over your accounts, so you don’t have to. We’re the only Australian credit bureau to offer this tool.

How do I avoid businesses that are insolvent or about to become insolvent?

Prevention is always better than a cure, especially in the case of credit risk management. CreditorWatch helps you recognise the adverse risk of businesses through a range of tools, including credit reports, RiskScore and real-time monitoring.

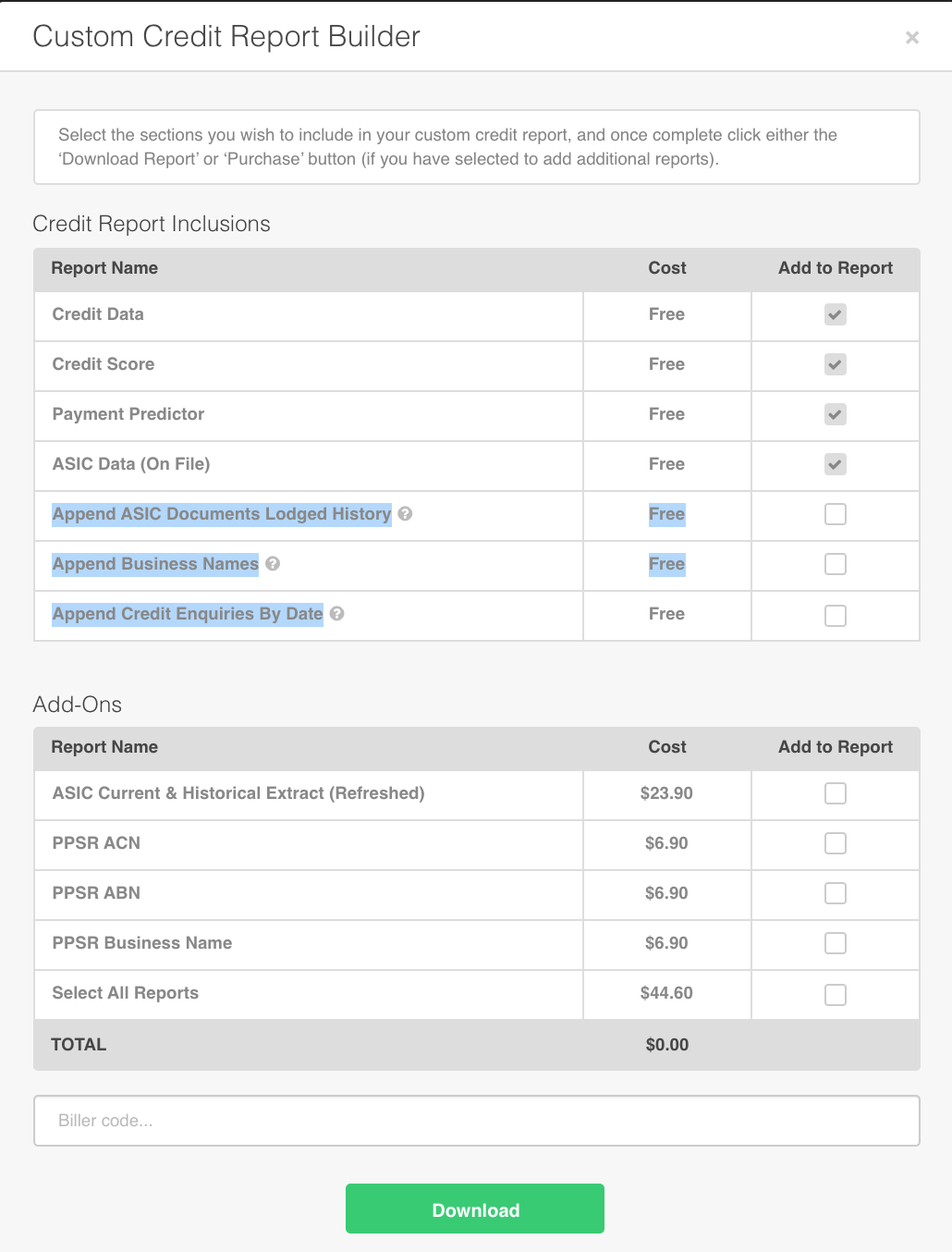

It’s also vital to become a secured creditor and protect yourself should things go pear-shaped. Register your security interests on the PPSR using our award-winning platform, PPSRLogic. This is one of the most effective ways to keep the threat of zombie companies at bay.

I’m a creditor and one of my customers has declared their eligibility for temporary restructuring relief. What should I do?

In the debt restructuring process, a company has 20 business days to put forward a plan to its creditors. Read this government fact sheet for information on what creditors can and can’t do during this process. CreditorWatch recommends you seek independent professional advice on what to do next.

For more information on temporary restructuring relief and other relief measures available for small businesses and directors, head to the ASIC website.

If you’d like help from CreditorWatch, we’d be more than happy to help you navigate the new legislation changes for businesses. Please chat with your account manager or contact us at support@creditorwatch.com.au.