CreditorWatch and trade credit insurance both protect businesses from the damaging impacts of bad debt. But what are their respective roles and how exactly do they work together? This article answers commonly asked questions and explains how CreditorWatch provides businesses with tools and data to strengthen their insurance decisions.

How do CreditorWatch and trade credit insurance work together to reduce the harmful effects of bad debt?

Credit insurance covers losses if your debtor defaults on payment or becomes insolvent. It provides revenue protection and recovery after your debtor defaults or becomes insolvent.

CreditorWatch helps you to perform due diligence on your debtors so you can mitigate credit risk. It enables you to take preventative measures before your debtor defaults or becomes insolvent. It can also in most circumstances be used to satisfy your discretionary limit for your insurance policy.

Both support each other in protecting your business from bad debt – CreditorWatch helps with prevention, while credit insurance helps with recovery of losses.

If a company is already using trade credit insurance, does it still need CreditorWatch?

Credit insurance is not a replacement for proper due diligence. Ongoing debtor management is essential and plays a crucial role in reducing mistakes and minimising insurance claims.

Insurance is the net that catches you when you fall, while CreditorWatch helps you avoid the fall in the first place. It is important to be proactive and take precautions instead of solely relying on a safety net.

Trade credit insurance will typically pay you 80-90% of a claim, so not incurring a loss is still financially the best outcome.

The key is to take a holistic approach by combining prevention and recovery measures.

How can credit monitoring help to reduce insurance claims

It’s important to identify the early warning signs of potential high-risk clients so you can start mitigating risk as soon as possible. These include: payment defaults, insolvency notices, court actions, poor payment performance, potential phoenix activity and director changes.

CreditorWatch allows you to monitor your entire ledger for adverse information via live alerts and helps you understand your debtors’ likelihood of default. This awareness enables you to make better business decisions and reduce the need to make claims.

The ultimate goal is to make as few claims as possible. The more claims you make leads to a likely increased premium in the future. Not to mention the lost revenue from a percentage of the claim being paid.

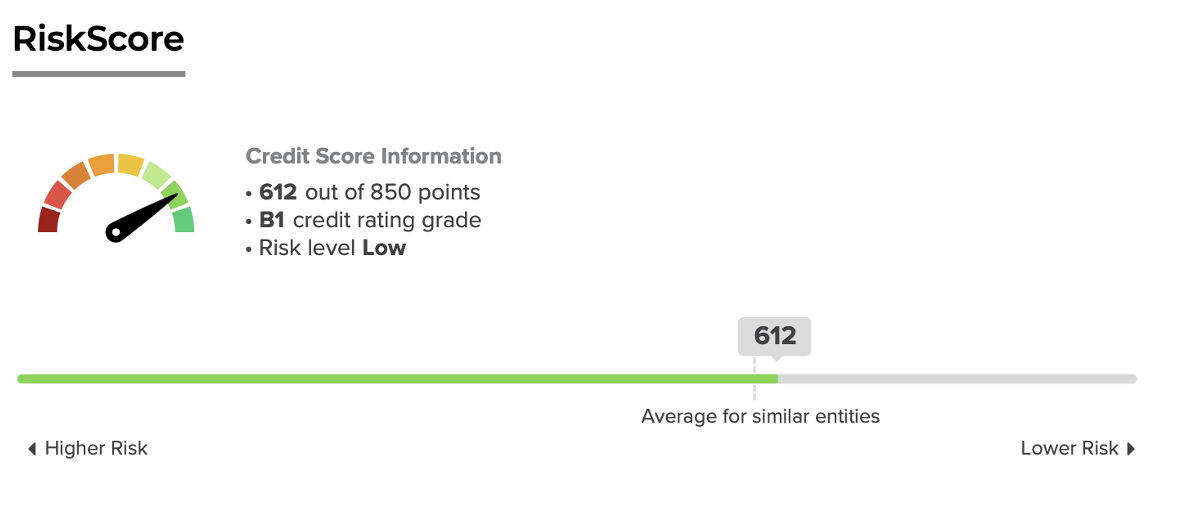

RiskScore helps to assess a business’s creditworthiness and predict their likelihood of default within the next 12 months.

What about the accounts that aren’t insured?

As insurance can be expensive, a lot of companies choose to only insure a portion of their ledger. For example, some policies don’t insure accounts under $5,000.

This leaves companies exposed to those remaining debtors…although these accounts are only small, as bad debts they can add up. CreditorWatch plays a crucial role in filling these gaps and protecting your entire ledger.

Reports that satisfy discretionary limits

The ones you do insure will be covered up to a discretionary limit, which is the maximum amount of business you can do with a customer without formal approval. It requires you to undergo proper credit management processes internally. All major insurers use and will accept CreditorWatch reports here, especially given the strength of data available on Australian entities.

The CW system allows you to customise your own reports, including a credit score, payment predictor, ASIC extract (if ASIC data is not up to data) and PPSR searches. When a credit report loads, these elements are available to view in real time, and ensures you order a report that satisfies your discretionary limit policy requirements.

By using both CreditorWatch and credit insurance together, businesses gain holistic coverage to prevent and recover from bad debt. Ultimately, a business is better off if it can avoid payment defaults in the first place. CreditorWatch gives you the tools to keep your finger on the pulse of your customers and make the best decisions for your business. If you’d like to learn more, get in touch with Grace who will be able to assist and direct your questions to the right person.

Grace Kulbe

Senior Consultant

Grace is one of our Melbourne-based Senior Consultant. In her role, Grace teams up with credit managers and finance professionals from a variety of businesses to help improve their credit risk processes.

Grace has a background in fintech, so she loves communicating the benefits of CreditorWatch’s market-leading technology to her clients and showing how it can make a positive impact to their business.

Outside of work, you’ll find Grace playing basketball, reading the latest fantasy fiction or enjoying a wine over dinner with friends. Connect with Grace on LinkedIn.

E: grace.kulbe@creditorwatch.com.au

M: 0437 087 664