We’ve answered the most frequently asked questions about RiskScore

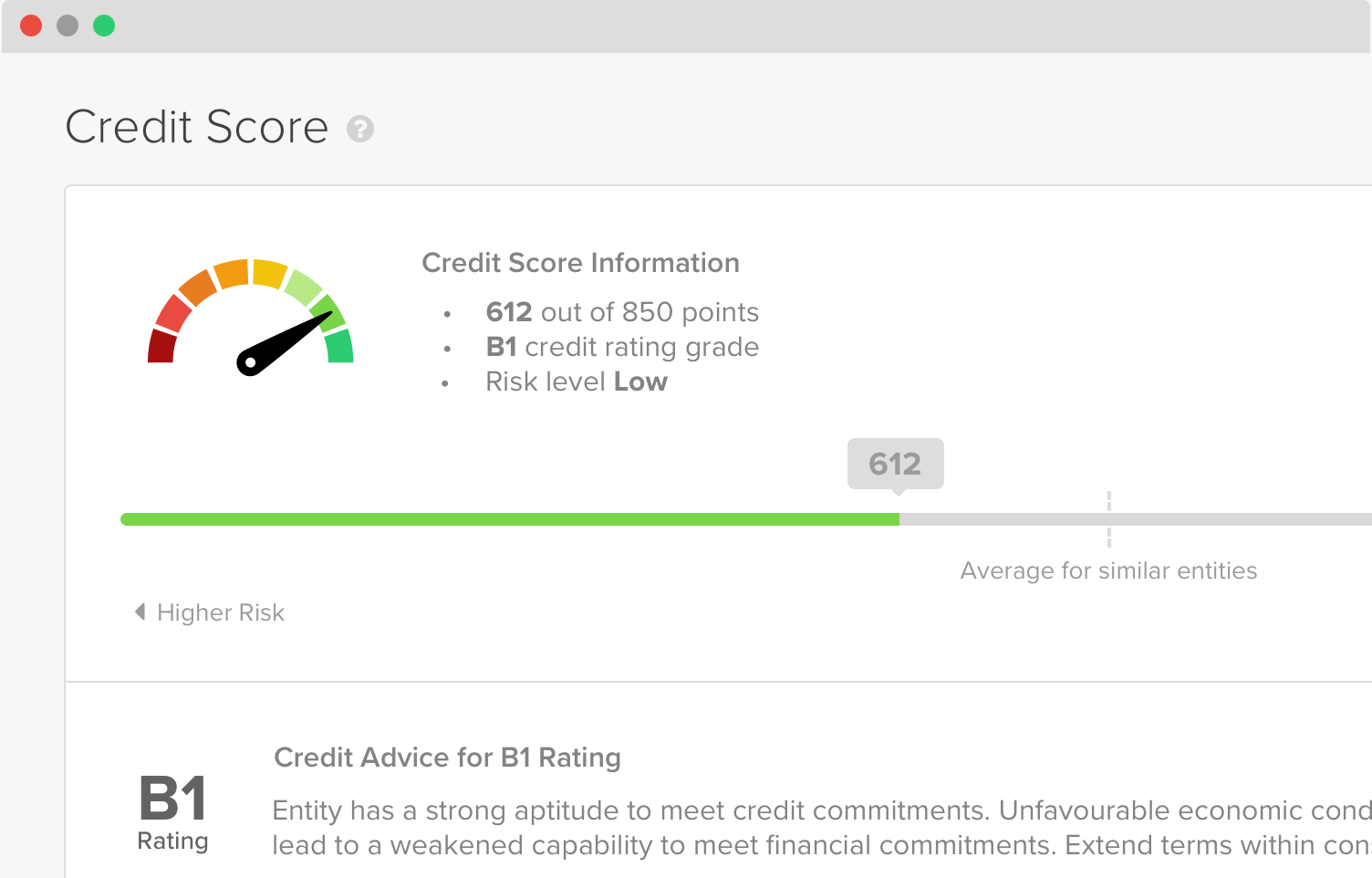

If you haven’t heard, RiskScore is the latest credit risk management solution to come out of CreditorWatch. We’re incredibly proud of RiskScore – the most predictive and accurate credit scoring and rating product in the market – and it’s been fantastic to hear our customers love it too.

Our CEO Patrick Coghlan and founder of Open Analytics James O’Donnell held a webinar to introduce Australia to RiskScore. If you missed it, you can watch the recording on-demand to understand how the new score is calculated and the role it plays in helping businesses assess creditworthiness.

Pat and James have answered some of the most frequently asked questions about RiskScore below. If you have any further questions, please don’t hesitate to get in contact with us at support@creditorwatch.com.au.

Q: How open and transparent is CreditorWatch about how RiskScore is built?

A: CreditorWatch projects a philosophy of transparency in everything we do. This also applies to sharing how RiskScore has been developed and the factors that contribute to the credit ratings.

RiskScore is a first for any commercial credit bureau in Australia. We believe that providing our customers with a clear understanding of what predictors are used to calculate RiskScore allows for the most effective use of the ratings and better integration into an organisation’s broader credit management processes.

If you are interested in learning more about the design and factors behind RiskScore, please speak to your account manager or email support@creditorwatch.com.au.

Q: A customer’s score has dropped significantly since RiskScore was introduced. How do I assess this new risk to our business?

A: Under the RiskScore rating system, the average score across all entities in Australia has reduced when compared to our previous credit scoring model. So on average, a drop in your customer’s credit score is not necessarily a cause for any concern.

The reason for the shift to lower scores under the new rating system is twofold:

- The new score is calibrated to a different scale. In simple terms the previous score cannot be directly compared to the new due to the different scores measuring different quantities.

- The new score has resulted in a shift from a ‘demerit-based’ scoring system, where the majority of businesses with clean behaviour are considered low risk, to a balanced ‘probability of default’ model, which produces a wider range of risk classifications. Under the new RiskScore, customers without significant adverse behaviour are spread across a range of risk categories based on additional demographic and transactional predictors.

To determine whether the new RiskScore has identified material risk in your customer base, we suggest you consider the proportion of your customers assigned a C3 rating or below. If a significant proportion of your customers fall into this category (e.g. more than 30%), then this would indicate a higher-than-average risk customer base. If you have 10-15% in this category, we would consider this a better-than-average risk profile.

Q: Does RiskScore take current court actions into account?

A: RiskScore does factor in court data, but it does depend on the individual court if we get access to writs as well as the judgment. We’re always in discussions with the courts to determine how frequently we can get this data.

RiskScore incorporates both the dollar value of court judgments along with the number of current court actions and court actions within the last 12 months as predictors.

Q: How frequently is the credit score updated?

A: RiskScore is a real-time scoring system that updates and provides our credit ratings based on live data. There are some slower-moving data sources such as geographic risk and industry risk that are updated less frequently, based on industry and market changes.

Q: What is the benchmark credit score for different entity types, like suppliers and subcontractors, trusts or public companies?

A: See the list below for the credit score and rating benchmarks for key segments, organised by entity type and tax status.

| Segment | Average Rating |

| Trusts (All) | A1 |

| Public Companies (All) | B3 |

| Private Companies and Partnerships, GST Registered | C1 |

| Sole Traders, GST Registered | C2 |

| Private Companies and Partnerships, Not GST Registered | C2 |

| Sole Traders, Not GST Registered | D2 |

These are relatively broad groupings across all Australian businesses and average risk can vary considerably based on other key demographics including company size, industry and location. Subcontractors, for example, can be a sole trader, private company or public company, and suppliers have significantly different risk profiles depending on their industry.

CreditorWatch can provide more granular benchmarking based on individual customer needs. If you are interested in more targeted benchmarking for a particular segment, please speak to your account manager or email support@creditorwatch.com.au.

Q: How is the RiskScore of a joint venture calculated?

A: RiskScore calculates the creditworthiness of joint ventures under the ‘Private Companies and Partnerships’ segment. The ratings assigned to joint ventures include data capturing any adverse cross-directorship information along with behaviours and demographic risk of the joint venture entity itself.

When assessing the risk of any joint venture, we recommend that the credit rating and credit reports for all companies or individuals involved in the partnership are also reviewed in conjunction with the risk assessment for the joint venture entity.

Q: Is it possible for the RiskScore algorithm to cross check a trust and a trustee?

A: There are no official data sources that link a trust with a trustee. Customers should always request a trust deed and deal with the trustee.

Q: I think my business’s credit rating should be higher than what it is. Who should I speak to?

A: If you have any questions about RiskScore and how it’s calculated, please speak to your account manager or email support@creditorwatch.com.au.