It has certainly been a year of highs and lows for the Australian business community, writes CreditorWatch Chief Economist Anneke Thompson.

Throughout 2022, Australian businesses in almost all industries have been dealing with very high levels of customer demand, both from an historical perspective and when compared to the lockdown-interrupted years of 2020 and 2021. Customers were finally allowed back into dining establishments on an unrestricted basis, and domestic and international travel resumed to pre-COVID operating conditions.

This has been very positive for the food and beverage, travel, tourism and retail trade sectors. However, businesses have faced extreme challenges in the form of labour shortages, supply chain issues, inflation and very high, and volatile, energy prices.

The best of 2022

- Employment – strong employment has been a major strength of the Australian economy throughout 2022. There are around 482,000 more people employed in Australia at the end of the year, versus the end of 2021. We also reached a near record low unemployment rate of 3.4% in October 2022. With more Australians employed than ever before, and workers feeling relatively secure in their jobs, retail spending has held up better than expected as interest rates have risen.

- Business conditions – businesses have been operating at near record capacity utilisation for most of the year, according to NAB’s Business Conditions Index. Capacity utilisation is a very good lead indicator of future employment rates. With this measure of business activity remaining very strong towards the end of the year, employment should remain relatively steady, at least in the first quarter of 2023.

- External administrations and court actions – while both of these measures of business insolvency have increased over 2022, they are still not as high as pre-COVID levels, according to CreditorWatch’s Business Risk Index. This is reflective of the high demand conditions that most businesses experienced over 2022, helping keep cash flow mostly constant.

The worst of 2022

- Inflation – rising prices across almost all categories throughout 2022 has caused a swift and brutal tightening of monetary policy. Inflation continues to be a problem globally, although there are early signs that inflation may have peaked, at least in Australia and the USA. Inflation results post the busy Christmas period will give us more certainty as to whether we have crested the inflation wave, and central banks can start to breathe a little easier

- Consumer confidence – this measure of economic activity plummeted as the RBA moved on the cash rate target at their May meeting. Consumer confidence has now only been lower in times of severe economic or social disruption – namely the GFC and COVID 19. Balanced with strong employment, the impact on retail trade has so far been negligible, however, we did record our first negative month on month retail trade figure in October 2022, suggesting consumers are starting to act with more caution

- B2B Trade Payment Defaults – this is CreditorWatch’s measure of businesses lodging a default against another business, and it has been rising steadily since February 2022. Trade payment defaults are now averaging around the levels they were at just prior to and during the first few months of the pandemic. Given trade payment defaults are a precursor to court actions and external administrations, we expect that these indices will rise throughout 2023.

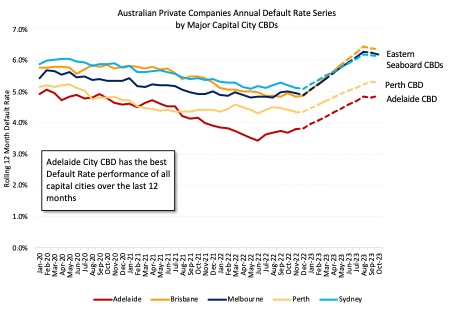

The capital city CBDs

Our capital city CBDs are still battling very different visitor behaviour, even as we have moved past lockdowns to contend with COVID-19. Eastern seaboard CBDs are recording far fewer office workers in their office buildings on most weekdays, while weekends are very busy. There was less disruption to offices in Adelaide and Perth, and this is reflected in changes in our Business Risk Index over 2022.

Adelaide and Perth now have a clear buffer in terms of probability of default to their eastern seaboard counterparts. The Melbourne and Sydney CBDs now have the highest probability of default, with Melbourne overtaking Brisbane. All CBDs are expected to deteriorate as we move into more challenging economic conditions in 2023.

The biggest movers

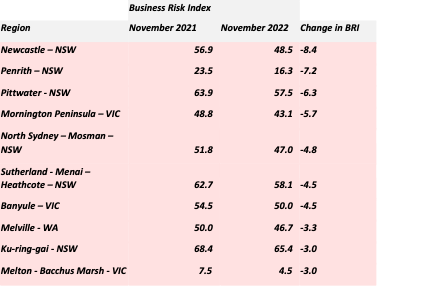

There was no clear pattern to note when looking at which regions moved up and down the BRI the most in terms of default rate. However, it is clear that the end of lockdowns in 2022 have caused greater volatility in NSW and Victoria, and SA3s in both states dominated our largest increase and decrease tables for 2022.

The largest BRI increase over 2022

The largest BRI decrease over 2022

Outlook for 2023

There is now no doubt that the operating environment for businesses is going to be much more challenging in 2023. Businesses now have to contend with much higher interest rates on their loans, higher wages, higher input costs and falling consumer demand. However, it is important to remember that a cooling of the economy is absolutely necessary to bring inflation down, and Australia is in a better position than most.

While GDP growth is expected to slow dramatically, it is still unlikely at this stage that Australia will move into recession. Also, strong employment is an important safety net for Australians, as by and large borrowers will be able to make repayments, even if they have to reduce their spending. Businesses may also start seeing some increased ‘slack’ in the labour force, helping them run their operations more efficiently and with less disruption.

Contacts

Mitchy Koper

GM Communications and Marketing, CreditorWatch

mitchy.koper@creditorwatch.com.au

0417 771 778

Michael Pollack

Head of Content

michael.pollack@creditorwatch.com.au

0422 513 258

ABOUT CREDITORWATCH

CreditorWatch is Australia’s top commercial credit reporting bureau with more than 55,000 customers, from sole traders through to ASX-listed companies.

Our innovative credit management solutions help you strengthen due diligence, mitigate risks, and secure your cash flow. We provide exclusive credit risk insights, helping you make smarter decisions to protect your business in this complex economy.

CreditorWatch’s publishes the monthly Business Risk Index, a predictive economic indicator to help guide businesses when making future growth plans and inform public policy. Subscribe to the Business Risk Index to be the first to receive our monthly updates.

Subscribe to our newsletter

You’ll never miss our latest news, webinars, podcasts, etc. Our newsletter is sent out regularly, so don’t miss out.