SYDNEY, Thursday 16 February 2023 – The January 2023 CreditorWatch Business Risk Index (BRI) reveals that business conditions are turning for Australian businesses, with a number of key metrics continuing to decline after a subdued end to 2022 as the RBA continued to tighten the screws on interest rates.

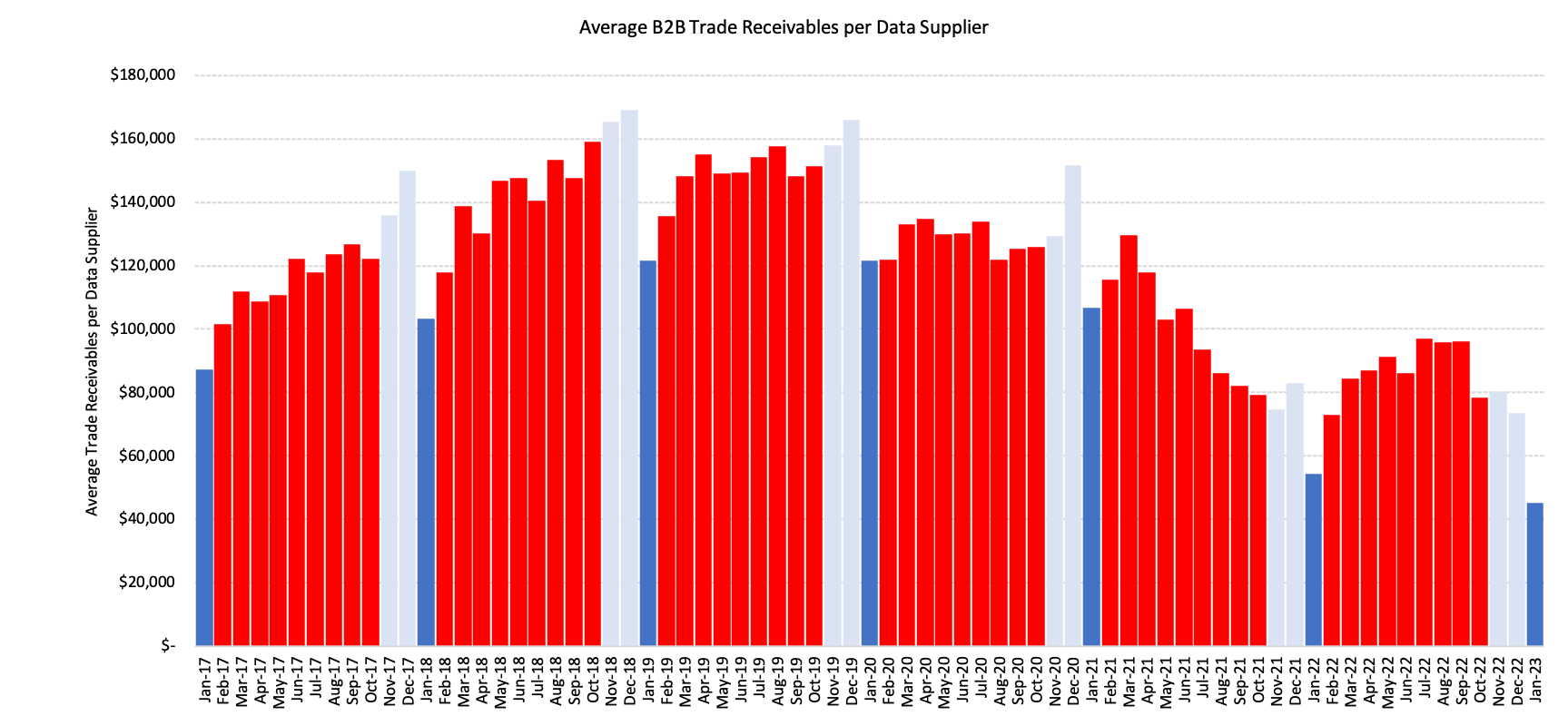

CreditorWatch’s key trade indicator, trade receivables (the average value of invoices), experienced a seasonal drop in January, down 39% from December, but have also been trending downward since July 2022. In fact, they are at their lowest point since CreditorWatch began collecting this data in January 2015.

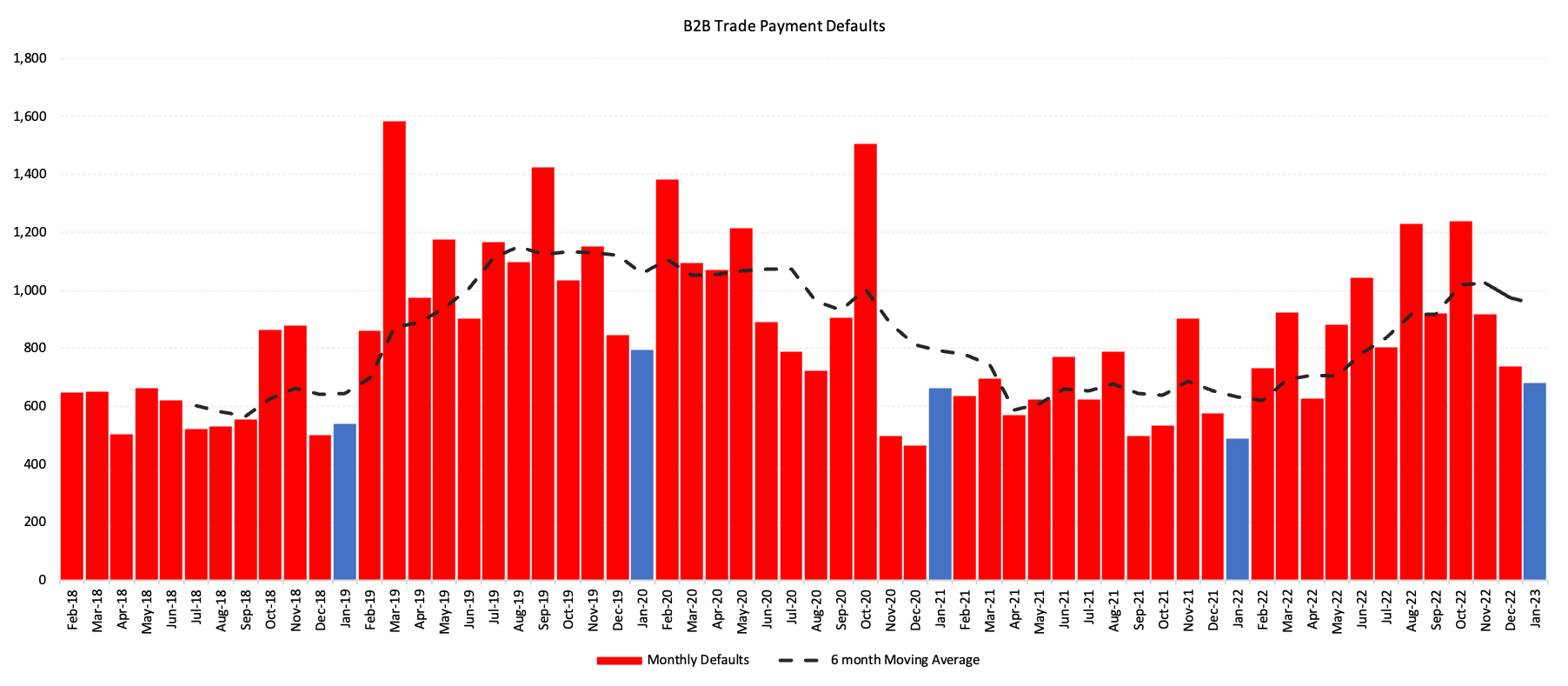

B2B trade payment defaults were down eight per cent from December to January but are still up 39% year-on-year and showed a clear upward trend before the seasonal decline in November last year (see chart below).

In terms of probability of default by industry, food and beverage services (hospitality) is ranked number one by a considerable margin due to the multiple challenges it currently faces: from labour shortages to price hikes to lower consumer demand.

Credit enquiries were up a massive 129% year-on-year in January, following an uptick that began in October – a likely consequence of the Optus and Medibank data breaches.

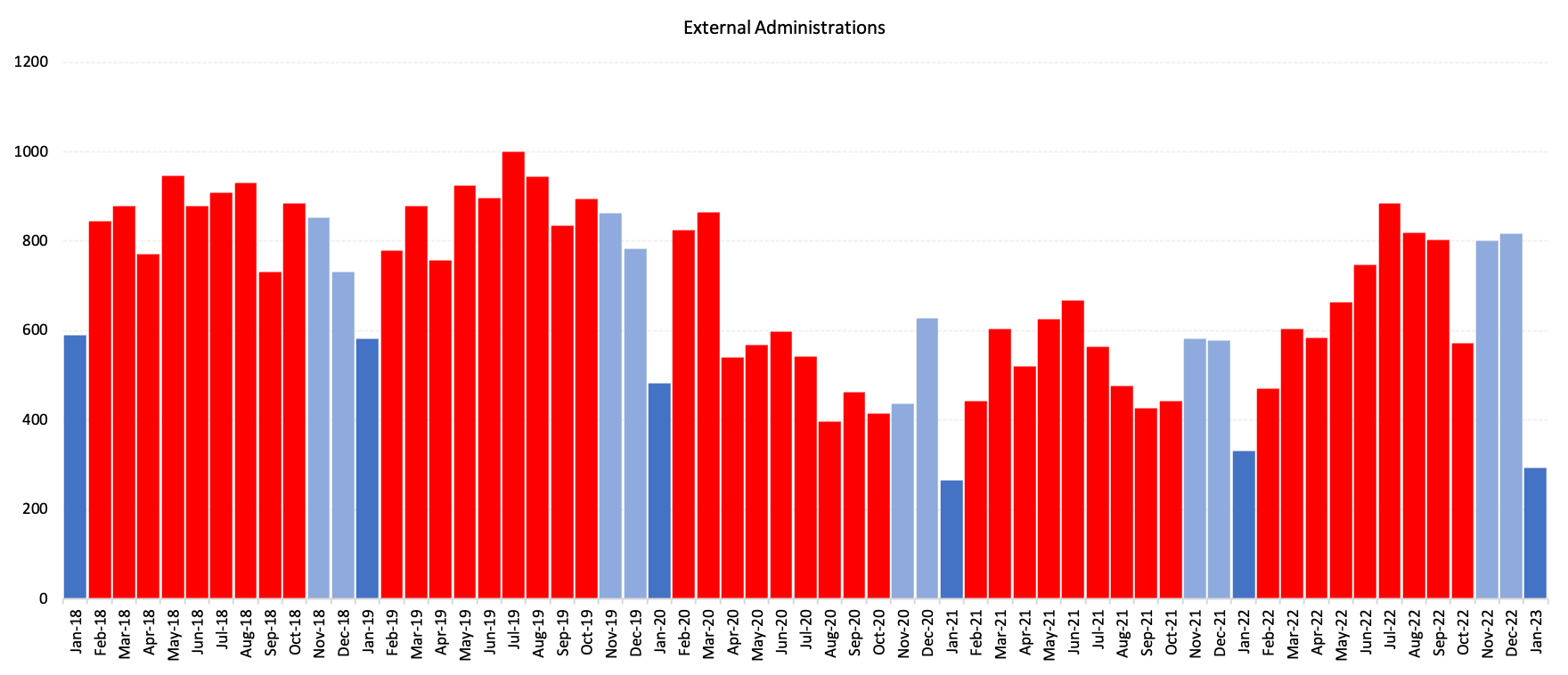

External administrations were trending upwards until their seasonal drop in January, however we expect the February Business Risk Index results to show a continuation of the upward trend.

Key Business Risk Index insights for January:

- B2B trade receivables are at their lowest point since CreditorWatch began collecting this data in January 2015.

- Trade payment defaults are up 39% year-on-year.

- Credit enquiries are up 129% year-on-year.

- External administrations are expected to continue trending upward this year.

- Court actions are at their highest point since September and are up 36% on January 2022.

- Yarra Ranges in Victoria is the region with the lowest insolvency risk (across regions with more than 5,000 businesses), followed by Cottesloe-Claremont in Western Australia.

- Gold Coast Hinterland in Queensland and Melton-Bacchus Marsh in Victoria are the regions at highest risk of default across Australia (for regions with more than 5,000 businesses). The Western Sydney regions of Merrylands–Guildford and Canterbury have improved but still hold positions nine and 10 respectively on the list of worst performing regions.

CreditorWatch CEO Patrick Coghlan says that the January Business Risk Index results clearly indicate a tough year ahead for Australian businesses.

“The upward trend in trade payment defaults, in particular, should definitely be of concern to business owners,” he says.

“The RBA’s tightening of monetary policy is beginning to bite, on top of other challenges like labour shortages and supply chain disruptions. We will hopefully see inflation peaking soon, followed by an improvement in business and consumer confidence. It is important to remember that the Australian economy is still in a much better position than most.”

CreditorWatch Chief Economist, Anneke Thompson, says trade receivables and trade default data provide a strong indication that we are now well past the peak of business conditions.

“This is in line with NAB’s latest Business Conditions survey, which also shows business conditions and confidence falling,” she says. “While 2023 will certainly be a tougher trading environment for businesses than 2022, we are coming off a period where many businesses were operating at or close to capacity, and the RBA is looking for a slowdown in activity to cool inflation.

“One of the likely results of this slowing of business activity is rising unemployment. Again, employment conditions have been extremely tight, so any rise in the unemployment rate will likely still see the rate at very low levels in overall terms. It will also dampen wage growth, something the RBA Is very keen to keep at moderate levels so as not to induce a wage-price spiral.

External administrations were slowly rising in trend terms over 2022, before falling In January due to seasonal impacts. It Is likely that external administrations continue to rise in trend terms over 2023, as falling demand hits businesses that were already struggling to cope with rising costs and interest payments, but may have been maintaining operations due to decent cash flow.

Probability of default by region

Projected default rates for the next 12 months for both best performing and worst performing regions are considerably higher than their defaults rates over the past 12 months.

The five regions* at least risk of default over the next 12 months are:

1. Yarra Ranges (VIC): 4.80% |

2. Cottesloe-Claremont (WA): 4.87% |

3. Adelaide City (SA): 4.89% |

4. Cairns – South (QLD): 4.96% |

5. Chatswood – Lane Cove (NSW): 5.02% |

The five regions* most at risk of default over the next 12 months are:

1. Gold Coast Hinterland (QLD): 7.02% |

2. Melton – Bacchus Marsh (VIC): 7.04% |

3. Kogarah – Rockdale (NSW): 7.09% |

4. Southport (QLD): 7.27% |

5. Bankstown (NSW): 7.30% |

* Regions with more than 5,000 registered businesses

Once again, areas with a high number of households with residential mortgages are the most likely areas to see business defaults. This is because many small business’s finances are closely aligned with Individual/household finances.

Probability of default by industry

The industries with the highest probability of default over the next 12 months are:

- Food and Beverage Services: 7.26%

- Transport, Postal and Warehousing: 4.64%

- Arts and Recreation Services: 4.63%

The industries with the lowest probability of default over the next 12 months are:

- Health Care and Social Assistance: 3.26%

- Agriculture, Forestry and Fishing: 3.50%

- Wholesale Trade: 3.59%

Source: CreditorWatch risk score credit rating average probability of default by industry

Outlook

The outlook for 2023 has worsened upon the most recent increase to the cash rate which, while expected, was coupled with a very downbeat tone by the RBA in its accompanying statement, and included an expectation of further Increases to the cash rate.

While many Individuals and businesses had priced in at least one further rise to the cash rate, two more will present real serviceability problems to small businesses, particularly those in areas and sectors where demand is likely to drop, or already dropping.

Get started with CreditorWatch today

Take your credit management to the next level with a 14-day free trial.