After four consecutive months of increases to the cash rate target, and inflation continuing to rise, it is now clear that a slowdown in demand in many industries is inevitable. The retail sector will feel the brunt of the impact of a reduction in discretionary spending.

The big question is, when will consumers stop spending? Month-on-month retail sales growth rates have started to decline already. Between May and June, Australian retail sales grew by just 0.20 per cent, which is more in line with growth rates we were recording in 2019. Year-on-year growth is still in double digits, although not a very accurate reflection of conditions given that June 2021 was impacted by lockdowns and retail restrictions.

As the month-on-month retail sales chart shows, trade has been incredibly volatile throughout the past two years, for obvious reasons, and this has impacted the retail sector’s ability to forward plan things like inventory levels, staffing, and investment in bricks and mortar. The challenge going forward for retailers, is how to plan for a future where discretionary spending is likely to be well down.

Other factors at play that will also negatively impact the retail sector include still soft international tourist levels, more Australian tourists now holidaying overseas, low international student numbers and low overall permanent and temporary migration.

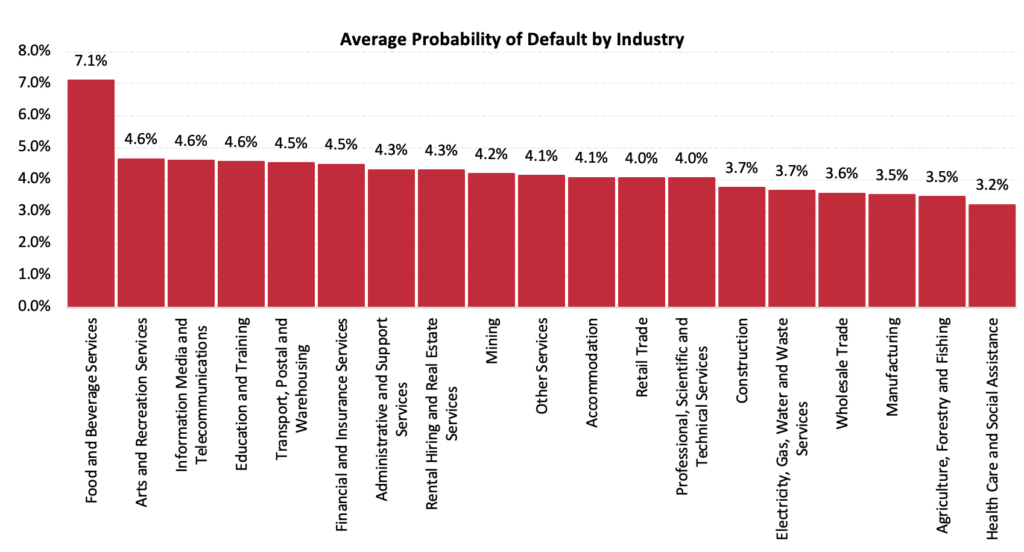

The retail trade sector thus far is not showing any increase in its probability of default (PoD). Our July 2022 BRI data indicates that 4.0 per cent of retail businesses are at risk of default. This sector, however, is impacted by having many large, safer operating businesses. Smaller, individually operated retail businesses will be at greater risk – probably similar to the food and beverage sector, which is dominated by smaller operators.

The same can be said for the construction sector, where the PoD is still sitting at 3.7 per cent. Again, smaller operators in this sector, that are quickly impacted by late payments and reduced demand, will be subject to higher probabilities.

Other industries that are likely to feel impacts of rising interest rates and falling demand are those businesses aligned to the property sector. Both residential and commercial property are huge industries in Australia, with agents, valuers, banks, mortgage brokers, conveyancers and a host of other job types directly impacted when turnover volumes fall.

The good news is that many of these businesses that have been established for some time should have very healthy balance sheets, after many years of excellent trading conditions. Nevertheless, we may start to see some impact to employment in these sectors, as businesses find they don’t need so many staff.

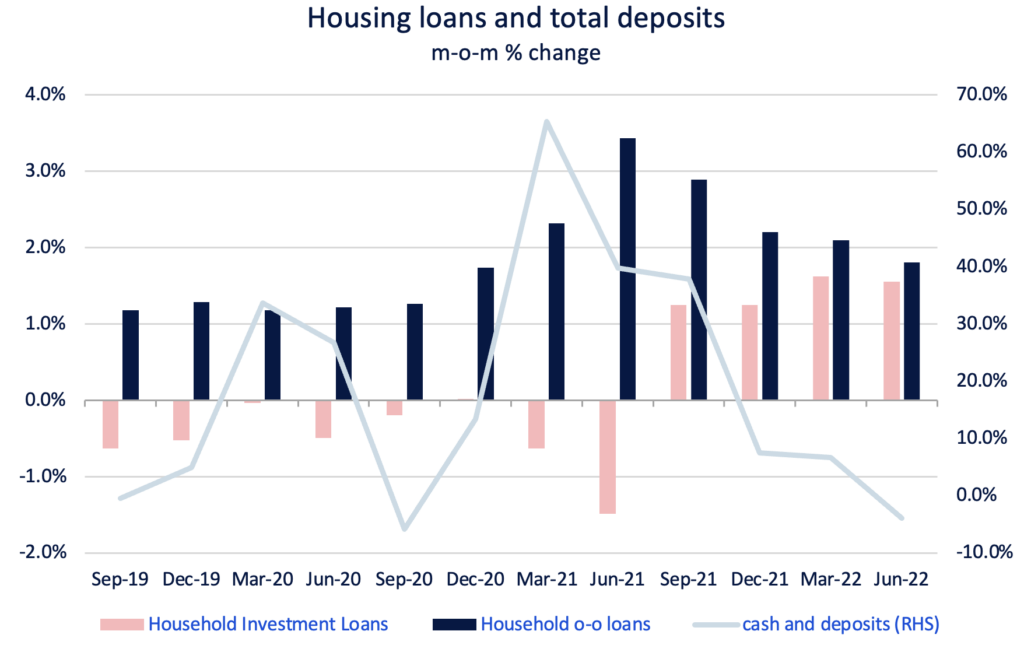

Initially, this will be somewhat of a relief, as hiring staff has been incredibly difficult. So, we are likely to see less jobs advertised before we see any major job cuts. The very strong rental market is also keeping investors in the market, despite rising interest rates. Housing loans for investment purposes continues to see an increase in month-on-month growth, while loans for owner occupiers have been slowing since September 2021.

Importantly, households are now starting to eat in to their savings, with total cash and deposits held by banks actually reducing between March and June 2022, after many months of exceptional growth while Australians could not spend freely. This shows that rising prices, as well as the removal of government stimulus, are leaving Australians poorer than they were during lockdowns.

Get started with CreditorWatch today

Take your credit management to the next level with a 14-day free trial.